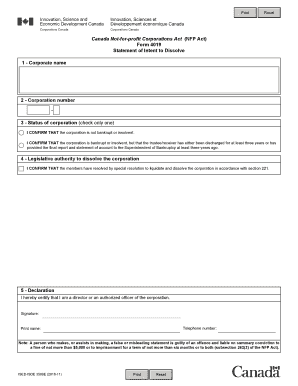

Form 4019

What is the Form 4019

The Form 4019 is a specific document used in various administrative processes, primarily related to tax and compliance in the United States. It serves as a means for individuals or entities to report certain financial information to the relevant authorities. Understanding the purpose of this form is essential for accurate reporting and compliance with federal regulations.

How to use the Form 4019

Using the Form 4019 involves several straightforward steps. First, ensure you have the correct version of the form, as updates may occur periodically. Fill out the required fields accurately, providing all necessary information as specified. Once completed, the form must be submitted to the appropriate agency, either electronically or via mail, depending on the guidelines provided for that specific form.

Steps to complete the Form 4019

Completing the Form 4019 requires careful attention to detail. Follow these steps for proper completion:

- Gather all necessary documentation that supports the information you will provide.

- Carefully read the instructions accompanying the form to understand what information is required.

- Fill in personal or business information as requested, ensuring accuracy.

- Review the completed form for any errors or omissions before submission.

Legal use of the Form 4019

The legal use of the Form 4019 is crucial for compliance with U.S. laws. This form must be used in accordance with the regulations set forth by the issuing authority. Misuse or incorrect filing can lead to penalties, so it is important to understand the legal implications of submitting this form accurately and on time.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4019 can vary based on the specific context in which it is used. It is vital to be aware of these dates to avoid late submissions, which can result in penalties. Check the relevant guidelines for the specific deadlines associated with your filing requirements.

Required Documents

When preparing to complete the Form 4019, certain documents may be required. These can include identification information, financial statements, or other supporting documentation that verifies the information being reported. Ensuring you have all necessary documents ready can facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

The Form 4019 can typically be submitted through various methods, which may include online submission, mailing the completed form, or delivering it in person to the designated office. Each method has its own set of guidelines and requirements, so it is important to choose the one that best suits your needs and complies with the regulations.

Quick guide on how to complete form 4019

Complete Form 4019 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form 4019 across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 4019 with ease

- Find Form 4019 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark relevant sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs within a few clicks from any device of your preference. Modify and eSign Form 4019 and ensure clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4019

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 4019 and how is it used?

Form 4019 is a critical document for many organizations that helps streamline data collection and processing. By using airSlate SignNow, you can easily create, send, and eSign your form 4019, ensuring accuracy and efficiency in your workflows.

-

How much does it cost to use airSlate SignNow for form 4019?

airSlate SignNow offers flexible pricing plans tailored to fit different business needs, including features to manage your form 4019 efficiently. The cost depends on the specific plan selected, but it remains an affordable choice for organizations looking to optimize their document processes.

-

What features does airSlate SignNow offer for form 4019?

With airSlate SignNow, you can enjoy features such as electronic signatures, custom templates, and real-time tracking for your form 4019. These tools boost collaboration and enhance the document signing experience, making it easier to complete your workflows.

-

Can I integrate airSlate SignNow with other applications when working with form 4019?

Yes, airSlate SignNow supports integration with numerous applications, which simplifies handling your form 4019 across various platforms. This interoperability helps keep all your data in sync and bolsters overall productivity.

-

What are the benefits of using airSlate SignNow for form 4019?

Using airSlate SignNow for your form 4019 provides numerous benefits, including improved turnaround time for document processing and enhanced security features. These advantages not only save time but also ensure that your data remains secure and complies with regulations.

-

Is airSlate SignNow user-friendly for managing form 4019?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy to manage your form 4019 even for those with minimal technical expertise. The intuitive interface allows quick navigation, ensuring a smooth experience from document creation to eSigning.

-

How can I track the status of my form 4019 in airSlate SignNow?

airSlate SignNow provides real-time tracking features that allow you to monitor the status of your form 4019. You'll receive notifications for each stage of the process, ensuring you're always updated on who has signed and who still needs to complete their part.

Get more for Form 4019

Find out other Form 4019

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure