ST 137 11 10 Indd Form

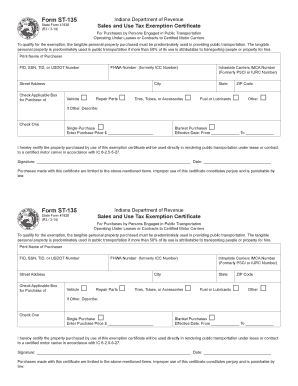

What is the ST 135?

The ST 135 is a specific form used in the United States for sales tax exemption purposes. This form allows eligible purchasers to claim exemption from sales tax on qualifying purchases. It is primarily utilized by organizations that are exempt from sales tax, such as non-profits, government agencies, and certain educational institutions. Understanding the ST 135 is essential for both buyers and sellers to ensure compliance with state tax regulations.

How to use the ST 135

To properly use the ST 135, purchasers must complete the form by providing necessary information, including their name, address, and the reason for the exemption. Once filled out, the form should be presented to the seller at the time of purchase. Sellers are responsible for retaining the ST 135 for their records to substantiate the tax-exempt sale during audits. It is important to ensure that the form is filled out accurately to avoid any issues with tax compliance.

Steps to complete the ST 135

Completing the ST 135 involves several straightforward steps:

- Obtain the ST 135 form from a reliable source or the relevant state tax authority.

- Fill in the required fields, including your organization’s name, address, and tax-exempt status.

- Provide a detailed explanation of the purpose of the purchase.

- Sign and date the form to certify its accuracy.

- Present the completed form to the seller during the transaction.

Legal use of the ST 135

The ST 135 must be used in accordance with state laws governing sales tax exemptions. Only eligible organizations can utilize this form to claim tax-exempt status. Misuse of the ST 135, such as using it for ineligible purchases, can result in penalties, including fines and back taxes owed. It is crucial for both buyers and sellers to understand the legal implications of using this form to ensure compliance with tax regulations.

Required Documents

When completing the ST 135, certain documents may be required to support the exemption claim. These documents typically include:

- A copy of the organization’s tax-exempt certificate.

- Proof of the organization’s status, such as IRS determination letters.

- Any additional documentation that verifies the nature of the purchase and its eligibility for tax exemption.

Form Submission Methods

The ST 135 does not require formal submission to a tax authority; however, it should be retained by the seller for record-keeping. Sellers must keep the completed forms on file to demonstrate compliance during audits. It is advisable to store these documents securely, whether in digital or physical format, to ensure easy access when needed.

Quick guide on how to complete st 137 11 10 indd

Complete ST 137 11 10 indd seamlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers a superior eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle ST 137 11 10 indd on any device with the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign ST 137 11 10 indd effortlessly

- Locate ST 137 11 10 indd and click Get Form to begin.

- Utilize the tools we provide to fill in your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your PC.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign ST 137 11 10 indd and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 137 11 10 indd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 135 feature in airSlate SignNow?

The st 135 feature in airSlate SignNow refers to a specific document type that can be easily prepared, sent, and signed electronically. This functionality allows users to streamline their document workflows while ensuring compliance and security. With st 135, organizations can enhance productivity by simplify the signing process, making it accessible to all stakeholders.

-

How much does airSlate SignNow cost for using the st 135 feature?

Pricing for airSlate SignNow starts competitively, with plans designed to accommodate various business needs. The st 135 feature is included in all subscription tiers, ensuring that businesses of any size can benefit from electronic signatures without breaking the bank. For specific pricing details tailored to your enterprise, we recommend contacting our sales team.

-

What are the key benefits of using airSlate SignNow for st 135 documents?

Using airSlate SignNow for st 135 documents provides numerous benefits, including faster turnaround times and improved document tracking. Our platform ensures that all eSignatures meet legal standards, which enhances document security and integrity. Additionally, businesses can experience reduced operational costs through increased efficiency and reduced paper usage.

-

Can I integrate airSlate SignNow with other software for managing st 135 documents?

Absolutely! airSlate SignNow offers robust integrations with popular software applications, enabling seamless management of st 135 documents. You can connect with tools like Salesforce, Google Drive, and Dropbox, which enhances your document workflow. These integrations make it easier to work on and send st 135 paperwork directly from your existing applications.

-

Is it secure to send st 135 documents via airSlate SignNow?

Yes, sending st 135 documents via airSlate SignNow is very secure. Our platform uses high-level encryption and complies with industry standards to protect sensitive information. We prioritize data security to ensure that your eSignatures and documents are safe from unauthorized access.

-

What types of documents can I send as st 135 using airSlate SignNow?

You can send a variety of document types as st 135 using airSlate SignNow, including contracts, agreements, and forms that require signatures. This flexibility allows businesses to use the platform for nearly all their documentation needs. Our system is designed to accommodate diverse document types while ensuring compliance and legality.

-

How do I get started with airSlate SignNow for my st 135 documents?

Getting started with airSlate SignNow for your st 135 documents is easy. Simply sign up for an account on our website, choose a suitable plan, and begin uploading your documents. Our user-friendly interface makes it simple to create, send, and manage your st 135 paperwork in just a few clicks.

Get more for ST 137 11 10 indd

- Concrete mason contract for contractor new jersey form

- Sample demolition contract form

- Framing contract for contractor new jersey form

- New jersey contract form

- Insulation contract for contractor new jersey form

- Paving contract for contractor new jersey form

- Site work contract for contractor new jersey form

- Siding contract for contractor new jersey form

Find out other ST 137 11 10 indd

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT