R 540ins Louisiana Form 2017

What is the R 540ins Louisiana Form

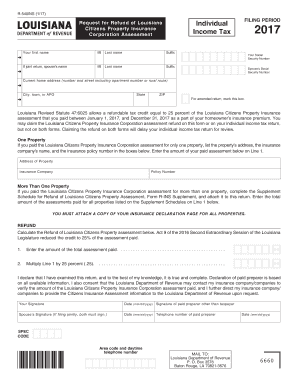

The R 540ins Louisiana Form is a state-specific tax document used by residents of Louisiana to report their individual income tax. This form is essential for taxpayers to accurately declare their income, deductions, and credits to the Louisiana Department of Revenue. It is designed to ensure compliance with state tax laws and facilitate the calculation of tax liabilities. Understanding this form is crucial for anyone who wishes to fulfill their tax obligations in Louisiana effectively.

How to use the R 540ins Louisiana Form

Using the R 540ins Louisiana Form involves several steps to ensure accurate completion. Taxpayers should start by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, individuals can fill out the form either online or on paper, ensuring they provide all required information, such as personal details, income sources, and applicable deductions. After completing the form, it is essential to review it for accuracy before submitting it to the state tax authority.

Steps to complete the R 540ins Louisiana Form

Completing the R 540ins Louisiana Form requires careful attention to detail. Here are the key steps:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Access the R 540ins Louisiana Form either through the Louisiana Department of Revenue website or by requesting a paper copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, including wages, interest, and dividends.

- Claim any eligible deductions and credits to reduce your taxable income.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail, following the guidelines provided by the Louisiana Department of Revenue.

Key elements of the R 540ins Louisiana Form

The R 540ins Louisiana Form contains several key elements that taxpayers must understand. These include:

- Personal Information: Taxpayers must provide their name, address, and Social Security number.

- Income Reporting: All income sources must be reported, including wages, rental income, and investment earnings.

- Deductions and Credits: Taxpayers can claim various deductions and credits, which can significantly reduce their tax liability.

- Signature: A valid signature is required to certify the accuracy of the information provided.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the R 540ins Louisiana Form. Typically, the deadline for filing individual income tax returns in Louisiana aligns with the federal tax deadline, which is usually April 15. However, taxpayers should check for any specific extensions or changes announced by the Louisiana Department of Revenue, especially in light of any special circumstances or emergencies.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the R 540ins Louisiana Form. The form can be filed electronically through the Louisiana Department of Revenue's online portal, which is a convenient and efficient method. Alternatively, individuals may choose to print the completed form and mail it to the appropriate tax office. In-person submissions may also be possible at designated tax offices, providing additional flexibility for those who prefer face-to-face assistance.

Quick guide on how to complete r 540ins louisiana 2017 form

Your assistance manual on how to prepare your R 540ins Louisiana Form

If you’re wondering how to finalize and submit your R 540ins Louisiana Form, here are a few straightforward guidelines to simplify tax declaration.

To begin, simply create your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to edit, draft, and finalize your tax documents with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to modify answers as necessary. Optimize your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your R 540ins Louisiana Form in no time:

- Set up your account and start working on PDFs within a few minutes.

- Utilize our catalog to locate any IRS tax form; explore various versions and schedules.

- Click Get form to access your R 540ins Louisiana Form in our editor.

- Populate the necessary fillable fields with your information (text content, numbers, check marks).

- Use the Sign Tool to incorporate your legally-binding eSignature (if required).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that paper filing may lead to increased return errors and delayed refunds. It goes without saying, before e-filing your taxes, check the IRS website for declaration guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct r 540ins louisiana 2017 form

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

Create this form in 5 minutes!

How to create an eSignature for the r 540ins louisiana 2017 form

How to make an electronic signature for your R 540ins Louisiana 2017 Form in the online mode

How to make an electronic signature for the R 540ins Louisiana 2017 Form in Chrome

How to generate an electronic signature for putting it on the R 540ins Louisiana 2017 Form in Gmail

How to create an eSignature for the R 540ins Louisiana 2017 Form straight from your smart phone

How to generate an eSignature for the R 540ins Louisiana 2017 Form on iOS

How to make an electronic signature for the R 540ins Louisiana 2017 Form on Android OS

People also ask

-

What is the R 540ins Louisiana Form, and why is it important?

The R 540ins Louisiana Form is a tax document specifically designed for Louisiana residents to report income and calculate tax liabilities. It plays a crucial role in ensuring compliance with state tax laws, making it essential for individuals and businesses alike to file accurately.

-

How can airSlate SignNow help me with the R 540ins Louisiana Form?

airSlate SignNow offers an efficient solution to electronically sign and submit your R 540ins Louisiana Form seamlessly. With its user-friendly interface, you can ensure that your documents are signed, stored, and sent quickly, saving time and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for the R 540ins Louisiana Form?

Yes, while airSlate SignNow provides a cost-effective solution for electronic signatures and document management, pricing varies based on the plan selected. Evaluate the features offered in different packages to choose the best options for managing the R 540ins Louisiana Form.

-

What features does airSlate SignNow offer for the R 540ins Louisiana Form?

airSlate SignNow provides features such as eSignature, document templates, and real-time tracking that streamline the process of managing the R 540ins Louisiana Form. Additionally, you can customize notifications and reminders to ensure timely submission.

-

Can I integrate airSlate SignNow with other applications when working with the R 540ins Louisiana Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems, allowing for efficient management of the R 540ins Louisiana Form. This enhances collaboration and ensures your documents are always accessible.

-

How secure is airSlate SignNow for handling the R 540ins Louisiana Form?

airSlate SignNow prioritizes security by employing advanced encryption methods and compliance with industry standards, making it a safe choice for handling the R 540ins Louisiana Form. Rest assured, your sensitive information is protected throughout the signing process.

-

Can I access my R 540ins Louisiana Form on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully compatible with mobile devices, allowing you to manage your R 540ins Louisiana Form from anywhere, at any time. This mobile functionality ensures you can complete and sign documents on the go without any hassle.

Get more for R 540ins Louisiana Form

Find out other R 540ins Louisiana Form

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple