State of New Jersey Division of Taxation CLAIM for 2023-2026

What is the State Of New Jersey Division Of Taxation CLAIM FOR

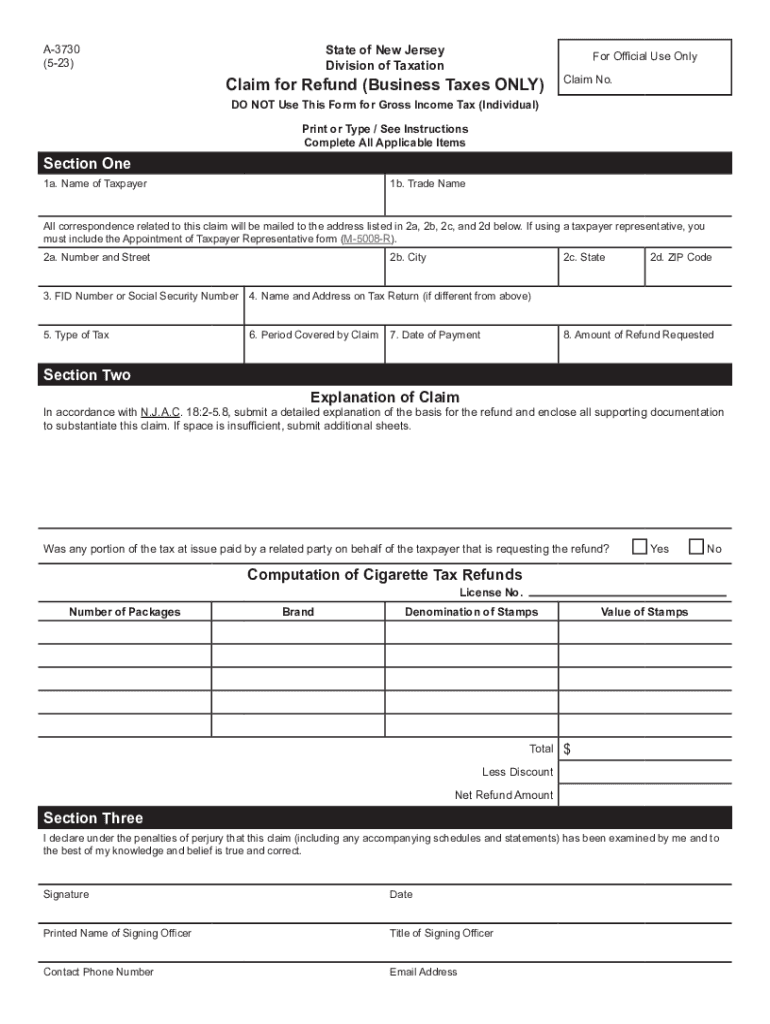

The NJ A 3730 form is a claim for a refund of overpaid taxes administered by the State of New Jersey Division of Taxation. This form is typically used by individuals and businesses to request a refund for taxes that were paid in excess or in error. It is important to understand the specific circumstances under which this form can be filed, as it is designed to ensure taxpayers can reclaim funds they are entitled to. The form serves as an official request to the state, detailing the reasons for the refund and providing necessary financial information.

Steps to complete the State Of New Jersey Division Of Taxation CLAIM FOR

Completing the NJ A 3730 form involves several key steps to ensure accurate submission. First, gather all relevant documentation, including proof of payment and any supporting documents that justify the refund request. Next, accurately fill out the form, ensuring that all required fields are completed. It is crucial to double-check the information for accuracy, as errors can delay processing. After completing the form, sign and date it where indicated. Finally, submit the form according to the provided instructions, either online or by mail, depending on your preference.

Required Documents

When filing the NJ A 3730 form, certain documents are necessary to support your claim. These typically include:

- Proof of tax payment, such as receipts or bank statements.

- Any relevant tax returns that pertain to the period in question.

- Documentation that substantiates the reason for the refund request, such as corrected tax forms or correspondence with the Division of Taxation.

Having these documents ready can expedite the processing of your claim and help clarify any questions that may arise during review.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the NJ A 3730 form is essential to ensure your claim is submitted in a timely manner. Typically, claims for refunds must be filed within four years from the date the tax was paid. It is advisable to check the specific deadlines for the tax year in question, as these can vary based on changes in tax legislation or state regulations. Keeping track of these dates can prevent potential loss of eligibility for a refund.

Eligibility Criteria

To qualify for a refund using the NJ A 3730 form, taxpayers must meet specific eligibility criteria. Generally, the claim must pertain to taxes that were overpaid or incorrectly assessed. This can include situations such as errors in tax calculations, changes in tax law that affect liability, or adjustments made after an audit. Taxpayers should also ensure that they have filed all required tax returns for the years in question, as failure to do so may disqualify them from receiving a refund.

Form Submission Methods (Online / Mail / In-Person)

The NJ A 3730 form can be submitted through various methods to accommodate taxpayer preferences. Options typically include:

- Online submission via the New Jersey Division of Taxation's website, which may offer a more streamlined process.

- Mailing the completed form to the appropriate address provided in the instructions, ensuring it is sent via a secure method.

- In-person submission at designated state offices, which may be beneficial for those needing immediate assistance or clarification.

Choosing the right submission method can help ensure that your claim is processed efficiently.

Key elements of the State Of New Jersey Division Of Taxation CLAIM FOR

The NJ A 3730 form includes several key elements that are crucial for a successful claim. These elements typically consist of:

- Taxpayer identification information, including name, address, and Social Security number or taxpayer identification number.

- Details of the tax year for which the refund is being claimed.

- A clear explanation of the reason for the refund request, supported by relevant documentation.

- Signature and date to validate the claim.

Ensuring that all these elements are accurately completed is vital for the processing of your claim.

Quick guide on how to complete state of new jersey division of taxation claim for

Complete State Of New Jersey Division Of Taxation CLAIM FOR seamlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any holdups. Oversee State Of New Jersey Division Of Taxation CLAIM FOR on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign State Of New Jersey Division Of Taxation CLAIM FOR without effort

- Find State Of New Jersey Division Of Taxation CLAIM FOR and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to distribute your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Revise and eSign State Of New Jersey Division Of Taxation CLAIM FOR while ensuring excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of new jersey division of taxation claim for

Create this form in 5 minutes!

How to create an eSignature for the state of new jersey division of taxation claim for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nj a 3730 form?

The nj a 3730 form is a specific document utilized for various administrative purposes in New Jersey. It is crucial for businesses and individuals to understand its requirements and correct usage to ensure compliance with state laws. Familiarizing yourself with the nj a 3730 form is essential for accurate and efficient processing.

-

How can airSlate SignNow help with the nj a 3730 form?

airSlate SignNow provides a simple and efficient solution for electronically signing and sending the nj a 3730 form. Our platform ensures that your form remains legally binding, secure, and easily accessible. By using airSlate SignNow, you can streamline the process and reduce the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for the nj a 3730 form?

Yes, there are pricing plans available for using airSlate SignNow for the nj a 3730 form. We offer different tiers to suit various business needs, making it a cost-effective solution. You can choose a plan that fits your requirements and budget while enjoying all the features we offer.

-

Are there any specific features for handling the nj a 3730 form with airSlate SignNow?

airSlate SignNow includes features specifically designed to make handling the nj a 3730 form easy. These include customizable templates, bulk sending options, and real-time tracking of document status. Such functionalities enhance the efficiency of your document management process.

-

Can I integrate airSlate SignNow with other applications for managing the nj a 3730 form?

Absolutely! airSlate SignNow offers numerous integrations with popular applications to help manage the nj a 3730 form. You can connect our platform with tools like CRM systems, cloud storage services, and other business applications to streamline your workflow.

-

What types of businesses benefit from using airSlate SignNow for the nj a 3730 form?

Businesses of all sizes can benefit from using airSlate SignNow for the nj a 3730 form. Whether you are a small business owner, a corporate entity, or a nonprofit organization, our platform simplifies document management and enhances productivity. It caters to diverse industries needing efficient eSignature solutions.

-

How secure is the nj a 3730 form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use our platform for the nj a 3730 form, your documents are protected with encryption and comply with industry standards. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for State Of New Jersey Division Of Taxation CLAIM FOR

Find out other State Of New Jersey Division Of Taxation CLAIM FOR

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF