Learn How to Track Your Delaware State Tax Refund Status Form

Understanding the Delaware State Tax Refund Status

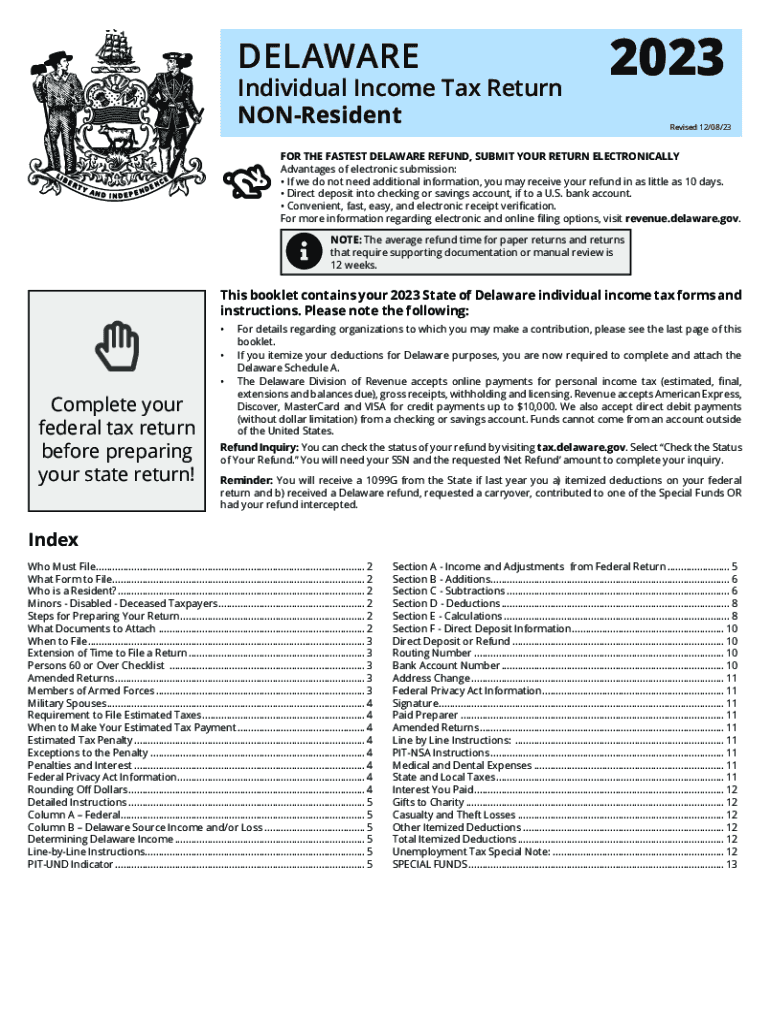

The Delaware State Tax Refund Status refers to the process by which taxpayers can check the current status of their tax refund after filing their state income tax return. This system allows individuals to monitor their refund progress, ensuring they are informed about when to expect their funds. Tracking your refund status is essential for effective financial planning and can alleviate concerns regarding the processing of your tax return.

How to Track Your Delaware State Tax Refund Status

To track your Delaware State Tax Refund Status, you can visit the Delaware Division of Revenue website. Here, you will find a dedicated section for checking refund statuses. You will need to provide specific information, including your Social Security number, the amount of your expected refund, and your filing status. This information helps the system accurately locate your tax return and provide you with the latest updates.

Required Information for Tracking Your Refund

When checking your Delaware State Tax Refund Status, ensure you have the following information ready:

- Your Social Security number

- Your filing status (single, married filing jointly, etc.)

- The exact amount of your expected refund

Having this information on hand will streamline the process and allow you to receive accurate updates regarding your refund.

Steps to Check Your Refund Status

Follow these steps to check your Delaware State Tax Refund Status:

- Visit the Delaware Division of Revenue website.

- Navigate to the section for checking tax refund statuses.

- Enter your Social Security number, filing status, and expected refund amount.

- Submit the information to view your refund status.

This straightforward process enables you to stay informed about your tax refund and manage your finances effectively.

Common Reasons for Delay in Tax Refunds

There are several reasons why your Delaware State Tax Refund may be delayed. Common issues include:

- Errors in your tax return, such as incorrect Social Security numbers or mismatched names.

- Incomplete information submitted with your tax return.

- Fraud prevention checks that may require additional verification.

- Changes in tax laws or processing delays due to high volume during peak filing seasons.

Understanding these factors can help you anticipate potential delays and take appropriate action if necessary.

Contacting the Delaware Division of Revenue

If you encounter issues or have questions about your Delaware State Tax Refund Status, you can contact the Delaware Division of Revenue directly. They provide assistance through various channels, including phone support and email inquiries. Having your tax information ready when you reach out can help expedite the resolution process.

Quick guide on how to complete learn how to track your delaware state tax refund status

Effortlessly Prepare Learn How To Track Your Delaware State Tax Refund Status on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without interruptions. Manage Learn How To Track Your Delaware State Tax Refund Status on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Learn How To Track Your Delaware State Tax Refund Status with Ease

- Find Learn How To Track Your Delaware State Tax Refund Status and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Select important sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Review the details and click the Done button to preserve your modifications.

- Specify how you would like to send your form, either by email, text message (SMS), or invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Learn How To Track Your Delaware State Tax Refund Status and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the learn how to track your delaware state tax refund status

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the first step to learn how to track your Delaware State tax refund status?

To learn how to track your Delaware State tax refund status, begin by visiting the Delaware Division of Revenue's official website. Here, you will find resources and tools that guide you through the tracking process. Additionally, setting up an account for updates can streamline your experience.

-

Is there a fee to track my Delaware State tax refund status?

No, there is no fee to learn how to track your Delaware State tax refund status. The service provided by the Delaware Division of Revenue is free of charge, making it accessible for all taxpayers. Just ensure you have your personal information and filing details ready.

-

Can I track my Delaware State tax refund status using mobile devices?

Yes, you can easily learn how to track your Delaware State tax refund status using mobile devices. The Delaware Division of Revenue’s website is optimized for mobile access, allowing you to check your status conveniently from anywhere. Ensure your device has internet access for a smooth experience.

-

What information do I need to track my Delaware State tax refund status?

To learn how to track your Delaware State tax refund status, you'll need your Social Security number, the exact amount of your refund, and your filing status. This information is essential to access your refund status accurately. Keep your tax documents handy for this purpose.

-

How long does it take to refund Delaware State tax after tracking begins?

Once you learn how to track your Delaware State tax refund status, you can expect to receive your refund within 10-12 weeks during the peak season. The refund timeline may vary based on factors like the accuracy of your filing and the volume of requests. Stay informed by checking your status regularly.

-

Can I check my refund status if I filed an amendment?

Yes, you can still learn how to track your Delaware State tax refund status even if you filed an amendment. However, it may take additional time for your amended return to process. Ensure you keep an eye on your status as it can vary depending on the complexity of your amendment.

-

Are there any features that can enhance my tracking experience?

To enhance your experience while you learn how to track your Delaware State tax refund status, consider utilizing notifications or alerts provided by the Delaware Division of Revenue. These features can keep you updated on any changes to your refund status. Additionally, keeping tracking details saved in your account can save time.

Get more for Learn How To Track Your Delaware State Tax Refund Status

- Bill of sale for watercraft or boat washington form

- Bill of sale of automobile and odometer statement for as is sale washington form

- Construction contract cost plus or fixed fee washington form

- Painting contract for contractor washington form

- Trim carpenter contract for contractor washington form

- Fencing contract for contractor washington form

- Hvac contract for contractor washington form

- Landscape contract for contractor washington form

Find out other Learn How To Track Your Delaware State Tax Refund Status

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself