Form 943 X Rev February IRS Irs

What is the Form 943 X Rev February IRS Irs

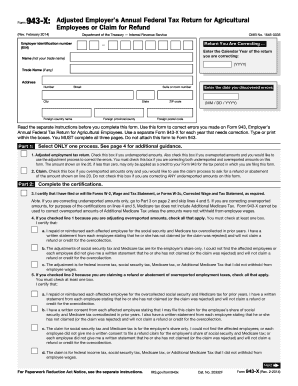

The Form 943 X Rev February is an amended version of the IRS Form 943, which is used by employers to report and pay federal income tax withholding and the employer's share of social security and Medicare taxes for agricultural employees. This form allows employers to correct errors made on previously filed Form 943 submissions. It is specifically designed for agricultural businesses, ensuring compliance with tax obligations related to farm workers.

How to use the Form 943 X Rev February IRS Irs

To use the Form 943 X Rev February, employers must first identify the errors in their original Form 943 submission. The amended form requires detailed information about the corrections being made, including the specific line items that need adjustment. Employers should carefully follow the instructions provided by the IRS to ensure that all necessary information is accurately reported. It is important to submit the amended form to the IRS in a timely manner to avoid potential penalties.

Steps to complete the Form 943 X Rev February IRS Irs

Completing the Form 943 X Rev February involves several key steps:

- Review the original Form 943 to identify errors that need correction.

- Obtain the Form 943 X Rev February from the IRS website or through tax professionals.

- Fill out the form, providing accurate details about the corrections, including the original amounts and the corrected amounts.

- Attach any supporting documentation that may be required to substantiate the changes.

- Submit the completed form to the IRS, ensuring it is sent to the correct address based on the employer's location.

Filing Deadlines / Important Dates

Filing deadlines for the Form 943 X Rev February are crucial for compliance. Employers must submit the amended form within three years from the date the original Form 943 was filed or within two years from the date the tax was paid, whichever is later. It is essential to keep track of these deadlines to avoid penalties and ensure that corrections are processed in a timely manner.

Penalties for Non-Compliance

Failure to file the Form 943 X Rev February or to correct errors in a timely manner can result in significant penalties. The IRS may impose fines for late filings, and interest may accrue on any unpaid taxes. Employers should be aware of these potential consequences and take proactive steps to ensure compliance with all tax reporting requirements.

Digital vs. Paper Version

The Form 943 X Rev February can be completed and submitted in both digital and paper formats. Using digital tools can streamline the process, allowing for easier corrections and faster submission. However, employers must ensure that they are using the latest version of the form and follow IRS guidelines for electronic submissions. Paper submissions are still accepted but may take longer to process.

Quick guide on how to complete form 943 x rev february irs irs

Effortlessly Prepare Form 943 X Rev February IRS Irs on Any Device

The management of online documents has become increasingly favored by companies and individuals alike. It offers an excellent environmentally-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to generate, modify, and eSign your documents promptly without any delays. Manage Form 943 X Rev February IRS Irs on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Method to Modify and eSign Form 943 X Rev February IRS Irs with Ease

- Find Form 943 X Rev February IRS Irs and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, laborious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your preference. Modify and eSign Form 943 X Rev February IRS Irs and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 943 x rev february irs irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 943 X Rev February IRS Irs used for?

Form 943 X Rev February IRS Irs is used for correcting errors on the previously filed Form 943. This form specifically addresses issues related to agricultural employers' federal tax withholding and payment obligations. By using this form, businesses can ensure compliance with IRS regulations and avoid potential penalties.

-

How does airSlate SignNow assist with Form 943 X Rev February IRS Irs?

airSlate SignNow simplifies the process of completing and submitting your Form 943 X Rev February IRS Irs. Our platform allows you to eSign documents securely and track the status of your submissions, ensuring that you stay organized and compliant. With an intuitive interface, users can quickly fill out and send important forms like the 943 X Rev.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. By choosing the right plan, users can access advanced features that enhance their ability to manage forms, including the Form 943 X Rev February IRS Irs. For detailed pricing information, visit our website or contact our sales team.

-

Can I integrate airSlate SignNow with other software for my Form 943 X Rev February IRS Irs?

Yes, airSlate SignNow provides seamless integrations with a variety of popular software tools. This feature allows users to streamline their workflow by linking applications such as CRMs and document management systems directly with their Form 943 X Rev February IRS Irs processes. Check our integrations page for a complete list of supported applications.

-

What are the benefits of using airSlate SignNow for eSigning documents?

Using airSlate SignNow for eSigning documents offers numerous benefits, including increased efficiency and enhanced security. The platform makes it easy to complete and send essential forms like Form 943 X Rev February IRS Irs, reducing the time spent on paperwork. Additionally, eSignatures comply with legal standards, ensuring your documents are legally binding.

-

Is airSlate SignNow secure for submitting Form 943 X Rev February IRS Irs?

Absolutely, airSlate SignNow takes security seriously, employing advanced encryption protocols to protect your data. When submitting your Form 943 X Rev February IRS Irs through our platform, you can trust that your information is secure and confidential. We also offer user authentication features to further safeguard your documents.

-

How does airSlate SignNow ensure compliance when dealing with Form 943 X Rev February IRS Irs?

airSlate SignNow is designed to facilitate compliance by providing users with up-to-date templates and guidance for completing forms like Form 943 X Rev February IRS Irs. Our platform also enables businesses to maintain accurate records of submissions and communications, which is crucial for audits. Regular updates and support ensure that you stay compliant with IRS regulations.

Get more for Form 943 X Rev February IRS Irs

- Ut corporation 497427326 form

- Pre incorporation form

- Bylaws 497427328 form

- Corporate records maintenance package for existing corporations utah form

- Ut llc form

- Limited liability company llc operating agreement utah form

- Single member limited liability company llc operating agreement utah form

- Utah formation

Find out other Form 943 X Rev February IRS Irs

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation