Form 1040A Irs

What is the Form 1040A Irs

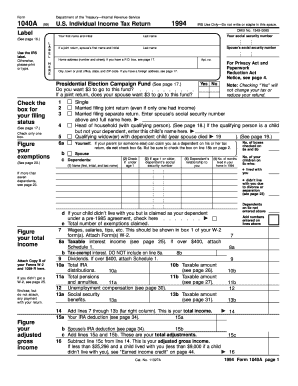

The Form 1040A is a simplified version of the standard IRS Form 1040, designed for individual taxpayers with straightforward financial situations. This form allows taxpayers to report their income, claim certain tax credits, and determine their tax liability. It is suitable for those who do not have complex tax situations, such as self-employment income or significant itemized deductions. The Form 1040A can be used by taxpayers who earn wages, salaries, or pensions, and those who qualify for specific tax credits, such as the Earned Income Tax Credit (EITC).

How to obtain the Form 1040A Irs

Taxpayers can obtain the Form 1040A from several sources. The most common method is to download it directly from the IRS website, where the latest version is always available. Additionally, taxpayers can request a physical copy by calling the IRS or visiting a local IRS office. Many tax preparation services also provide the form as part of their software offerings, making it accessible for those who prefer to file electronically.

Steps to complete the Form 1040A Irs

Completing the Form 1040A involves several key steps:

- Gather all necessary documents, including W-2 forms, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income in the designated sections, ensuring accuracy to avoid potential issues.

- Claim any applicable tax credits and adjustments, such as the EITC or education credits.

- Calculate your total tax liability and determine if you owe additional taxes or are due a refund.

- Sign and date the form before submitting it to the IRS.

Key elements of the Form 1040A Irs

The Form 1040A includes several important sections that taxpayers must complete:

- Personal Information: This section requires basic details about the taxpayer and their dependents.

- Income: Taxpayers report various sources of income, including wages, interest, and dividends.

- Adjustments to Income: Certain deductions can be claimed here, such as educator expenses and student loan interest.

- Tax and Credits: This section allows taxpayers to apply for credits that may reduce their overall tax liability.

- Payments: Taxpayers report any tax payments made throughout the year, including withholding and estimated payments.

Filing Deadlines / Important Dates

The deadline for filing the Form 1040A typically aligns with the general tax filing deadline of April 15 each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also be aware of any extensions available, which can provide additional time to file, although any taxes owed must still be paid by the original deadline to avoid penalties.

Eligibility Criteria

To use the Form 1040A, taxpayers must meet specific eligibility criteria. This form is intended for individuals with a taxable income of less than one hundred thousand dollars. Additionally, taxpayers should not have income from self-employment, capital gains, or certain types of income that require more detailed reporting. The form is designed for those who can claim the standard deduction and do not itemize their deductions.

Quick guide on how to complete form 1040a irs

Effortlessly Set Up [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline your document-based tasks today.

The Easiest Method to Alter and Electronically Sign [SKS] Seamlessly

- Obtain [SKS] and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to finalize your changes.

- Select your preferred method to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1040A Irs

Create this form in 5 minutes!

How to create an eSignature for the form 1040a irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1040A Irs and how is it different from other forms?

Form 1040A Irs is a simplified version of the standard tax form used by individuals to file their federal income tax returns. Unlike the longer Form 1040, the 1040A allows taxpayers to report income from wages, salaries, and pensions, as well as claim certain credits and deductions. This makes it an ideal choice for those with simpler tax situations.

-

How does airSlate SignNow facilitate the signing of Form 1040A Irs?

airSlate SignNow provides a user-friendly platform for electronically signing and managing your Form 1040A Irs. Our secure eSignature feature allows you to quickly send the document for signatures without the hassle of printing and mailing. This efficiency speeds up the filing process, ensuring you meet deadlines.

-

Is there a cost associated with using airSlate SignNow for Form 1040A Irs?

Yes, airSlate SignNow offers affordable pricing plans suitable for businesses of all sizes. Our pricing allows users to access powerful features for managing and signing documents, including Form 1040A Irs, without breaking the bank. We also provide a free trial, so you can experience our services before committing.

-

Can I integrate airSlate SignNow with other software for managing Form 1040A Irs?

Absolutely! airSlate SignNow seamlessly integrates with a variety of popular applications such as Google Drive, Microsoft Office, and CRM systems. This means you can easily streamline your workflow and manage your Form 1040A Irs alongside your other business documents without any disruptions.

-

What are the benefits of using airSlate SignNow for my Form 1040A Irs?

Using airSlate SignNow for your Form 1040A Irs offers numerous benefits, including increased efficiency and enhanced security. Our platform ensures that your documents are securely stored and easily accessible, while the eSigning capability allows you to expedite your tax filing process. This means more time focused on your business and less stress during tax season.

-

How does airSlate SignNow ensure the security of my Form 1040A Irs?

Security is a top priority at airSlate SignNow. We comply with the highest industry standards, including encryption, secure storage, and authentication processes, to safeguard your Form 1040A Irs and other sensitive documents. You can trust that your information is safe while using our services.

-

Can I access my completed Form 1040A Irs from any device?

Yes, airSlate SignNow is designed to be accessible from any device with an internet connection. Whether you're using a smartphone, tablet, or desktop, you can conveniently access your completed Form 1040A Irs anytime, anywhere. This flexibility is ideal for busy individuals and professionals alike.

Get more for Form 1040A Irs

Find out other Form 1040A Irs

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple