Credit ApplicationRevised2 DOC Form

What is the Credit ApplicationRevised2 doc

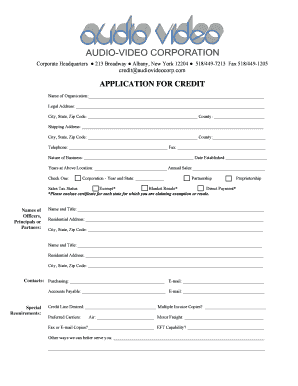

The Credit ApplicationRevised2 doc is a formal document used by individuals or businesses to apply for credit. It typically includes essential information such as personal identification details, financial history, and the amount of credit requested. This document serves as a tool for lenders to assess the creditworthiness of applicants and make informed decisions regarding credit approvals. Understanding the components of this document is crucial for anyone seeking credit, as it can significantly impact the approval process.

Steps to complete the Credit ApplicationRevised2 doc

Completing the Credit ApplicationRevised2 doc involves several key steps to ensure accuracy and completeness. Begin by gathering all necessary personal and financial information, including your Social Security number, employment details, and income sources. Next, fill out the application form carefully, ensuring that all fields are completed. Double-check for any errors or omissions, as inaccuracies can delay the approval process. Finally, review the application for clarity before submitting it to the lender.

Key elements of the Credit ApplicationRevised2 doc

The Credit ApplicationRevised2 doc contains several key elements that are critical for evaluating an applicant's creditworthiness. These elements typically include:

- Personal Information: Name, address, date of birth, and Social Security number.

- Employment Details: Current employer, job title, and length of employment.

- Financial Information: Monthly income, existing debts, and assets.

- Credit Request: The amount of credit being requested and the purpose of the loan.

Providing accurate and comprehensive information in these sections can enhance the likelihood of approval.

How to use the Credit ApplicationRevised2 doc

Using the Credit ApplicationRevised2 doc effectively involves understanding its purpose and how to present your information clearly. Start by carefully reading the instructions provided with the form. Fill out each section with accurate data, ensuring that your financial information reflects your current situation. Once completed, submit the document to the appropriate lender through the specified method, whether online, by mail, or in person. Following these guidelines can streamline the application process and improve your chances of receiving credit.

Eligibility Criteria

Eligibility for credit through the Credit ApplicationRevised2 doc generally depends on several factors. Lenders typically assess the applicant’s credit history, income level, and existing debt obligations. Additionally, applicants may need to meet minimum age requirements and provide proof of residency. Understanding these criteria can help applicants prepare their documentation and improve their chances of approval.

Form Submission Methods

The Credit ApplicationRevised2 doc can be submitted through various methods, depending on the lender’s preferences. Common submission methods include:

- Online Submission: Many lenders offer an online portal for electronic submission, allowing for quicker processing.

- Mail: Applicants can print the completed form and send it via traditional mail to the lender's address.

- In-Person Submission: Some applicants may prefer to deliver the application directly to a bank or credit institution.

Choosing the right submission method can impact the speed and efficiency of the application review process.

Quick guide on how to complete credit applicationrevised2 doc

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained signNow traction among companies and individuals alike. It serves as an excellent sustainable substitute for conventional printed and signed documents, allowing you to obtain the necessary template and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents promptly and without delays. Handle [SKS] on any device with the airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

How to Modify and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to initiate the process.

- Use the tools we offer to complete your document.

- Mark important sections of the documents or black out confidential information using specialized tools provided by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invite link, or download it directly to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure outstanding communication throughout every stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Credit ApplicationRevised2 doc

Create this form in 5 minutes!

How to create an eSignature for the credit applicationrevised2 doc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Credit ApplicationRevised2 doc and how does it work?

The Credit ApplicationRevised2 doc is a streamlined template designed for businesses to efficiently manage their credit applications. It allows users to fill out, eSign, and send documents securely, simplifying the application process. With airSlate SignNow, the Credit ApplicationRevised2 doc enhances compliance and reduces paperwork.

-

What features does the Credit ApplicationRevised2 doc offer?

The Credit ApplicationRevised2 doc offers features such as customizable fields, electronic signatures, and automated workflows. These features help businesses reduce processing times and improve accuracy in credit application submissions. Additionally, you can track the status of your documents in real-time.

-

How does airSlate SignNow ensure the security of the Credit ApplicationRevised2 doc?

airSlate SignNow prioritizes security by utilizing encryption protocols and secure cloud storage for the Credit ApplicationRevised2 doc. All documents are securely transmitted and stored, ensuring that sensitive information remains protected. Compliance with regulations like GDPR and HIPAA further enhances user trust.

-

Is there a free trial available for the Credit ApplicationRevised2 doc?

Yes, airSlate SignNow offers a free trial for the Credit ApplicationRevised2 doc, allowing prospective customers to experience its features before committing. This trial enables users to evaluate how the document fits their business needs without any upfront cost. Sign up today to access the benefits firsthand.

-

Can the Credit ApplicationRevised2 doc be integrated with other software?

Certainly! The Credit ApplicationRevised2 doc can be seamlessly integrated with popular software solutions like Salesforce, Google Drive, and Dropbox. These integrations streamline workflows and enhance productivity, allowing for a cohesive experience across platforms.

-

What benefits can businesses expect from using the Credit ApplicationRevised2 doc?

By utilizing the Credit ApplicationRevised2 doc, businesses can expect increased efficiency, reduced processing times, and improved customer satisfaction. This solution simplifies the credit application process, allowing for quick approvals and smoother communication. Overall, it helps in better management of credit transactions.

-

What are the pricing options for the Credit ApplicationRevised2 doc?

AirSlate SignNow provides flexible pricing plans tailored to different business needs for the Credit ApplicationRevised2 doc. Options range from basic packages for small businesses to comprehensive solutions for enterprises. Contact our sales team for a detailed pricing structure and to find the best fit for your organization.

Get more for Credit ApplicationRevised2 doc

- Pepperdine isd form

- 2010 tuscreia lease rental agreementdoc form

- Deferred benefits claim form aw8p nhs business services

- Girl scout bronze award final report girl scouts of eastern girlscoutseasternmass form

- Blower door test form

- Form sl 1925 a delawareamp39s insurance delawareinsurance

- Single case agreement template form

- Transcript request form stoneman douglas high school

Find out other Credit ApplicationRevised2 doc

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF