Form 706 GS D 1 Rev October Internal Revenue Service

What is the Form 706 GS D 1 Rev October Internal Revenue Service

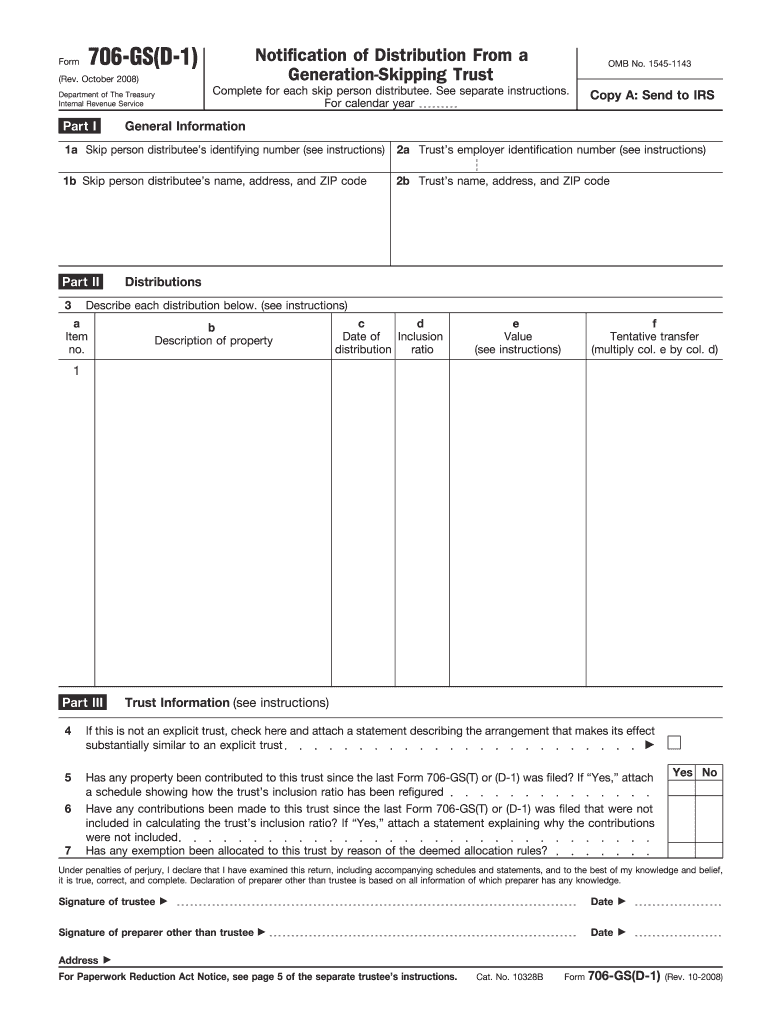

The Form 706 GS D 1 Rev October is a tax form issued by the Internal Revenue Service (IRS) that is used to report the estate of a decedent who was a resident of the United States. This form is specifically designed for the purpose of calculating the federal estate tax owed by the estate. It includes detailed information about the decedent's assets, liabilities, and any deductions that may apply. Understanding this form is crucial for executors and administrators managing the estate, as it ensures compliance with federal tax laws.

How to use the Form 706 GS D 1 Rev October Internal Revenue Service

Using the Form 706 GS D 1 Rev October involves several steps to ensure accurate reporting of the estate's financial information. Executors must gather all necessary documentation regarding the decedent's assets, debts, and any applicable deductions. This includes property valuations, bank statements, and records of any outstanding liabilities. Once the required information is collected, the form can be filled out, detailing the financial status of the estate. It is essential to review the completed form for accuracy before submission to avoid potential penalties.

Steps to complete the Form 706 GS D 1 Rev October Internal Revenue Service

Completing the Form 706 GS D 1 Rev October requires careful attention to detail. The following steps outline the process:

- Gather necessary documents: Collect all relevant financial records, including asset valuations and debt statements.

- Fill out the form: Enter the decedent's information, including name, date of birth, and date of death.

- Report assets: List all assets owned by the decedent at the time of death, including real estate, investments, and personal property.

- Calculate deductions: Include any applicable deductions, such as funeral expenses and debts owed by the decedent.

- Review for accuracy: Double-check all entries for correctness and completeness.

- Submit the form: File the completed form with the IRS by the specified deadline.

Filing Deadlines / Important Dates

The filing deadline for the Form 706 GS D 1 Rev October is typically nine months after the date of the decedent's death. It is important to adhere to this timeline to avoid penalties and interest on any taxes owed. If additional time is needed, executors may file for an extension using Form 4768, which can provide an additional six months for filing the estate tax return. However, any tax owed must still be paid by the original deadline to avoid penalties.

Required Documents

To accurately complete the Form 706 GS D 1 Rev October, certain documents are essential. These include:

- Death certificate of the decedent.

- Valuation reports for all assets, such as real estate appraisals and stock valuations.

- Records of debts and liabilities, including mortgages and loans.

- Documentation of any prior gifts made by the decedent that may affect the estate tax calculations.

- Receipts for funeral expenses and other deductible costs.

Penalties for Non-Compliance

Failure to file the Form 706 GS D 1 Rev October on time or inaccuracies in the form can result in significant penalties. The IRS may impose a failure-to-file penalty, which is typically five percent of the unpaid tax for each month the return is late, up to a maximum of twenty-five percent. Additionally, if the IRS determines that the underpayment of tax was due to negligence or intentional disregard of the rules, further penalties may apply. It is crucial to ensure compliance to avoid these financial repercussions.

Quick guide on how to complete form 706 gs d 1 rev october internal revenue service

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can acquire the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, update, and eSign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign [SKS] without difficulty

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive data with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 706 GS D 1 Rev October Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the form 706 gs d 1 rev october internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 706 GS D 1 Rev October from the Internal Revenue Service?

Form 706 GS D 1 Rev October is a United States federal tax form used to report the estate tax and is specifically used for certain non-resident entities. This form must be filed by the executor of an estate with gross values exceeding specific thresholds. Understanding how to complete Form 706 GS D 1 Rev October is crucial for compliance with the Internal Revenue Service.

-

How can airSlate SignNow assist in filling out Form 706 GS D 1 Rev October?

airSlate SignNow simplifies the process of filling out Form 706 GS D 1 Rev October by allowing users to create, edit, and eSign the document digitally. Our platform provides templates that can help streamline the preparation process, reducing errors and saving time. With airSlate SignNow, you can ensure that your Form 706 GS D 1 Rev October is completed efficiently and accurately.

-

Is there a cost associated with using airSlate SignNow for Form 706 GS D 1 Rev October?

Yes, airSlate SignNow operates on a subscription model that provides various pricing tiers depending on your business needs. These plans offer features tailored to facilitate the completion and signing of documents like Form 706 GS D 1 Rev October. Our cost-effective solution enables you to manage your documents without overspending.

-

What features does airSlate SignNow offer for managing Form 706 GS D 1 Rev October?

airSlate SignNow offers a variety of features for managing Form 706 GS D 1 Rev October, including customizable templates, secure eSigning, and document sharing capabilities. Additionally, our platform supports storing documents in the cloud, which allows for easy retrieval and management. Features like audit trails and integrations ensure that your filing process is both comprehensive and secure.

-

Can I use airSlate SignNow to collaborate with others on Form 706 GS D 1 Rev October?

Absolutely! airSlate SignNow facilitates collaboration by allowing multiple users to work on Form 706 GS D 1 Rev October simultaneously. You can share documents with clients or colleagues, get their input, and collect necessary signatures quickly. This collaborative approach streamlines the process and enhances communication.

-

What integrations does airSlate SignNow support for handling Form 706 GS D 1 Rev October?

airSlate SignNow integrates seamlessly with a range of popular applications, including cloud storage solutions, CRMs, and productivity tools. This capability allows you to manage Form 706 GS D 1 Rev October alongside your existing workflows. These integrations help facilitate easier access to important documents and ensure that your processes remain efficient.

-

How secure is airSlate SignNow when handling sensitive documents like Form 706 GS D 1 Rev October?

Security is a top priority at airSlate SignNow. Our platform employs advanced security measures, including encryption and two-factor authentication, to protect sensitive documents like Form 706 GS D 1 Rev October. We adhere to numerous compliance standards to ensure that your information is safe and secure.

Get more for Form 706 GS D 1 Rev October Internal Revenue Service

- Cdph 283 form

- Hemodialysis technician renewal form

- Bayview secondary school grade 9 pre ib candidate form

- Aao transfer form patient in active treatment to bb

- Bryant transcript form

- Notification of postsquadron commanders amp adjutants txlegion form

- Hltaid003 provide first aid 1 day pre course review pack form

- Form lease condominium 2014 2019

Find out other Form 706 GS D 1 Rev October Internal Revenue Service

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement