Form 990 T, Exempt Organization Business Income Tax Return

What is the Form 990 T, Exempt Organization Business Income Tax Return

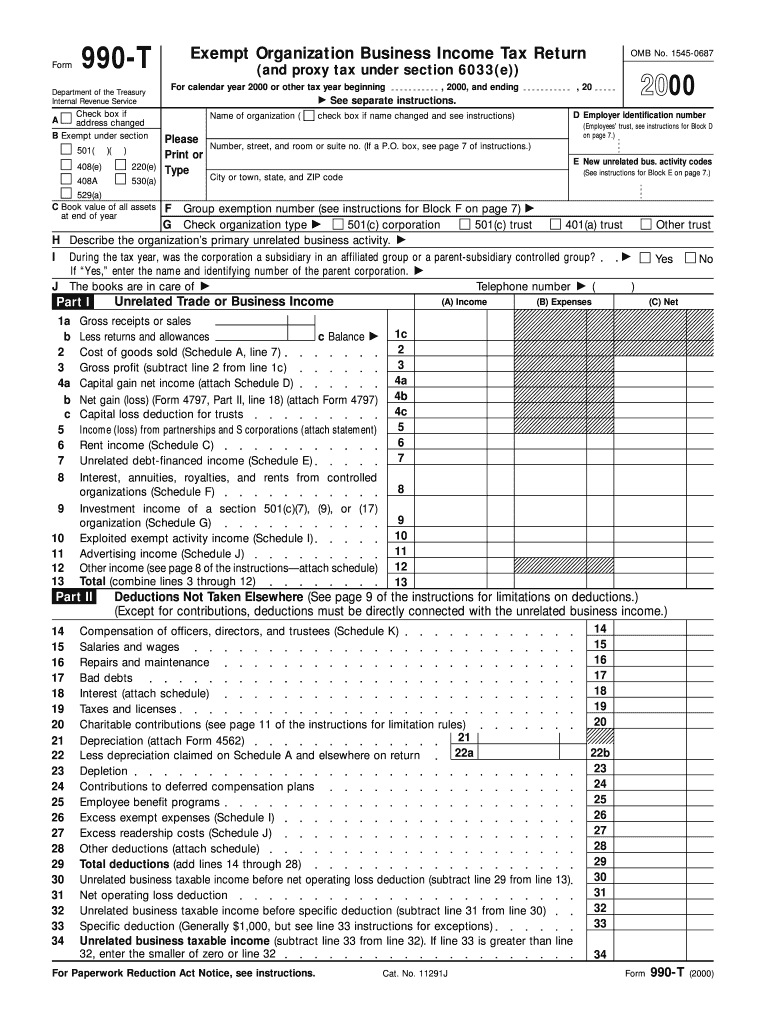

The Form 990 T, officially known as the Exempt Organization Business Income Tax Return, is a tax form used by tax-exempt organizations to report income generated from activities that are not substantially related to their exempt purposes. This form is essential for organizations that engage in business activities, as it helps determine the amount of unrelated business income tax (UBIT) owed to the Internal Revenue Service (IRS).

Organizations required to file this form include charities, educational institutions, and other exempt entities that earn income from sources like advertising, sponsorships, or unrelated business ventures. Understanding the nuances of this form is crucial for maintaining compliance with federal tax regulations.

How to use the Form 990 T, Exempt Organization Business Income Tax Return

Using the Form 990 T involves accurately reporting all unrelated business income and expenses. Organizations must first gather relevant financial data, including income from business activities and any allowable deductions. This information will be used to calculate the taxable income.

Once the data is compiled, organizations fill out the form, detailing their income sources and expenses. It is important to ensure that all information is complete and accurate to avoid potential penalties. After completing the form, organizations must submit it to the IRS by the designated deadline, typically the fifteenth day of the fifth month after the end of the organization's tax year.

Steps to complete the Form 990 T, Exempt Organization Business Income Tax Return

Completing the Form 990 T involves several key steps:

- Gather Financial Information: Collect all relevant income and expense records related to unrelated business activities.

- Determine Unrelated Business Income: Identify income that is not substantially related to the organization's exempt purpose.

- Calculate Allowable Deductions: Identify and calculate expenses that can be deducted from the unrelated business income.

- Complete the Form: Fill out the Form 990 T, ensuring all sections are accurately completed.

- Review for Accuracy: Double-check all entries for accuracy and completeness to prevent errors.

- Submit the Form: File the completed form with the IRS by the required deadline.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Form 990 T to ensure compliance. The standard due date for filing is the fifteenth day of the fifth month following the end of the organization's tax year. For organizations operating on a calendar year, this typically means the form is due by May 15.

If the organization requires additional time, it may file for an extension using Form 8868, which grants an automatic six-month extension. However, it is important to note that this extension applies only to the filing deadline and not to the payment of any taxes owed.

Penalties for Non-Compliance

Failure to file the Form 990 T or filing it inaccurately can result in significant penalties. The IRS imposes a penalty for late filing, which can amount to a percentage of the unpaid tax for each month the return is late. Additionally, if the form is not filed at all, the organization may face a penalty based on the gross receipts of the unrelated business income.

To avoid these penalties, organizations should maintain accurate records and ensure timely filing of the form. Regular reviews of compliance with IRS regulations can also help mitigate risks associated with non-compliance.

Required Documents

To complete the Form 990 T accurately, organizations need to gather several key documents:

- Financial statements detailing income and expenses from unrelated business activities.

- Records of any allowable deductions related to the business income.

- Previous tax returns, if applicable, to ensure consistency and accuracy.

- Documentation supporting the organization's exempt status.

Having these documents readily available will streamline the process of completing the form and help ensure compliance with IRS requirements.

Quick guide on how to complete form 990 t exempt organization business income tax return

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among enterprises and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely archive it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important parts of your documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or by downloading it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require new copies of documents. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Alter and eSign [SKS] and establish exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 990 T, Exempt Organization Business Income Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form 990 t exempt organization business income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 990 T, Exempt Organization Business Income Tax Return?

Form 990 T, Exempt Organization Business Income Tax Return, is a tax form that certain tax-exempt organizations must file to report unrelated business income. This form ensures that these organizations pay tax on income generated from activities not substantially related to their exempt purpose. Understanding this form is crucial for compliance and maintaining tax-exempt status.

-

Why do I need to file Form 990 T, Exempt Organization Business Income Tax Return?

You need to file Form 990 T, Exempt Organization Business Income Tax Return if your exempt organization earns $1,000 or more in unrelated business income. Filing helps you report this income accurately and ensures compliance with IRS regulations. Failure to file can result in penalties and jeopardize your organization’s tax-exempt status.

-

What features does airSlate SignNow offer for handling Form 990 T?

airSlate SignNow offers features that simplify the process of completing and filing Form 990 T, Exempt Organization Business Income Tax Return. Our platform allows for easy document management, electronic signatures, and collaboration among team members. These features streamline workflow and ensure accuracy in your tax reporting.

-

How can airSlate SignNow help improve efficiency when filing Form 990 T?

Using airSlate SignNow to manage Form 990 T, Exempt Organization Business Income Tax Return can greatly enhance your organization's efficiency. Our solution automates tasks, reduces paperwork, and facilitates eSigning, which saves time and minimizes errors in filing. This efficiency allows you to focus more on your core mission rather than administrative burdens.

-

What is the pricing structure for using airSlate SignNow to file Form 990 T?

airSlate SignNow offers flexible pricing plans tailored to meet varying organizational needs when filing Form 990 T, Exempt Organization Business Income Tax Return. We provide cost-effective solutions that are competitive in the market, ensuring you receive value without compromising quality. Contact us for detailed pricing information based on your requirements.

-

Is airSlate SignNow secure for filing sensitive documents like Form 990 T?

Yes, airSlate SignNow is highly secure for filing sensitive documents such as Form 990 T, Exempt Organization Business Income Tax Return. Our platform utilizes advanced encryption and security measures to protect your data. You can trust that your financial information remains confidential and safe while using our solution.

-

Can airSlate SignNow integrate with accounting software for Form 990 T?

Absolutely! airSlate SignNow easily integrates with various accounting software, which assists in the preparation and filing of Form 990 T, Exempt Organization Business Income Tax Return. This integration enables seamless data transfer and reduces the likelihood of errors, making your filing process more efficient and streamlined.

Get more for Form 990 T, Exempt Organization Business Income Tax Return

- Riddle page area of irregular figures form

- Letter of recommendation2 de la salle university form

- Workplace professionalism rubric grading sheet acctc schoolfusion form

- Cleaning audit checklist form

- Photoelectric effect gizmo answers form

- Blue cross of illinois claim form fillable

- Ivq in health care form

- Medical billing sign up and welcome packet form

Find out other Form 990 T, Exempt Organization Business Income Tax Return

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast