NC 4 EZ Employee S Withholding Allowance Certific 2024

What is the NC 4 EZ Employee’s Withholding Allowance Certificate?

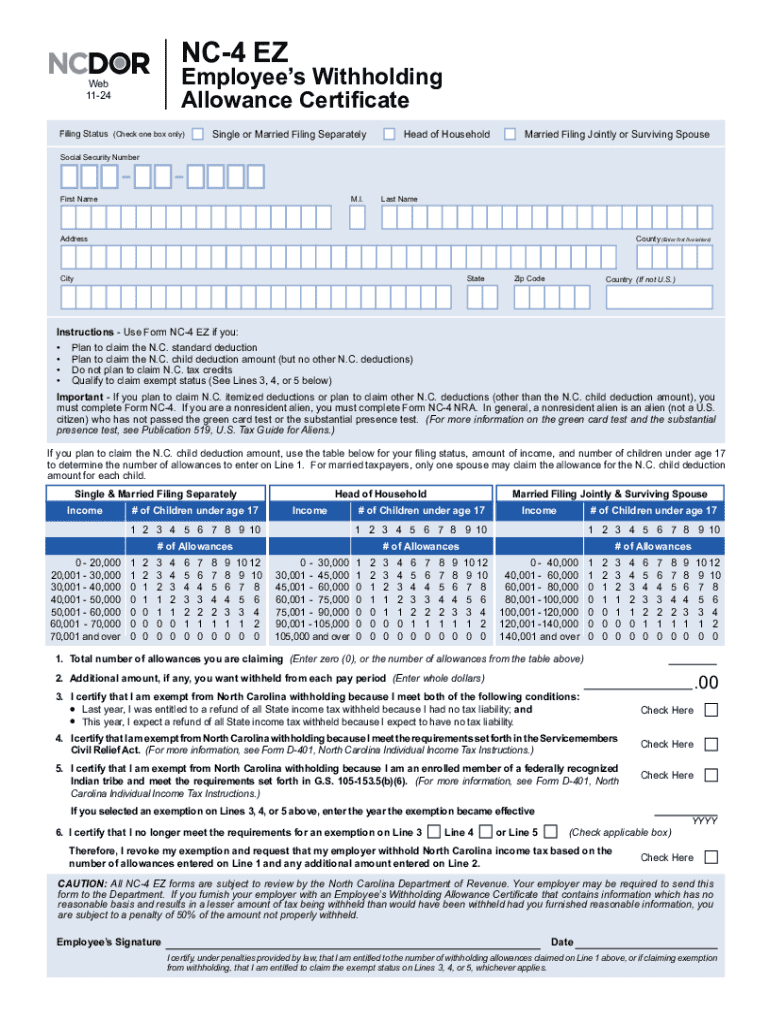

The NC 4 EZ form is a simplified version of the Employee’s Withholding Allowance Certificate used in North Carolina. It is designed for employees to indicate their withholding allowances for state income tax purposes. This form helps employers determine the correct amount of state income tax to withhold from an employee's paycheck. By filling out the NC 4 EZ, employees can ensure that their tax withholdings align with their financial situations, potentially reducing the amount owed at tax time or increasing their take-home pay.

Steps to Complete the NC 4 EZ Employee’s Withholding Allowance Certificate

Completing the NC 4 EZ form involves a few straightforward steps:

- Personal Information: Begin by entering your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, such as single, married, or head of household.

- Allowances: Calculate the number of allowances you are claiming based on your personal and financial situation. This may include considerations for dependents.

- Additional Withholding: If desired, you can specify an additional amount to be withheld from each paycheck.

- Signature: Finally, sign and date the form to certify that the information provided is accurate.

Legal Use of the NC 4 EZ Employee’s Withholding Allowance Certificate

The NC 4 EZ form is legally recognized in North Carolina for state income tax withholding purposes. Employees must complete this form accurately to comply with state tax laws. Employers are required to keep this form on file for each employee, ensuring that the correct amount of state income tax is withheld. Failure to submit a valid NC 4 EZ may result in incorrect withholding, leading to potential tax liabilities for both the employee and employer.

Key Elements of the NC 4 EZ Employee’s Withholding Allowance Certificate

Several key elements are essential to understand when filling out the NC 4 EZ form:

- Personal Information: Accurate personal details are crucial for proper identification.

- Allowances Claimed: The number of allowances directly affects the withholding amount.

- Filing Status: Your filing status can influence the calculation of allowances.

- Additional Withholding: This option allows for more tax to be withheld if you anticipate owing taxes.

Examples of Using the NC 4 EZ Employee’s Withholding Allowance Certificate

Consider the following scenarios where the NC 4 EZ form is applicable:

- An employee who is single with no dependents may claim one allowance to minimize withholding.

- A married couple with children may claim multiple allowances to maximize their take-home pay.

- A new employee may fill out the NC 4 EZ to ensure proper withholding from their first paycheck.

Form Submission Methods

The NC 4 EZ form can be submitted through various methods:

- Online: Many employers offer electronic submission options through payroll systems.

- Mail: Employees may also print the form and send it directly to their employer's payroll department.

- In-Person: Submitting the form in person allows for immediate confirmation of receipt.

Handy tips for filling out NC 4 EZ Employee s Withholding Allowance Certific online

Quick steps to complete and e-sign NC 4 EZ Employee s Withholding Allowance Certific online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Get access to a GDPR and HIPAA compliant solution for maximum efficiency. Use signNow to electronically sign and send NC 4 EZ Employee s Withholding Allowance Certific for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct nc 4 ez employees withholding allowance certific

Create this form in 5 minutes!

How to create an eSignature for the nc 4 ez employees withholding allowance certific

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nc 4 form and why is it important?

The nc 4 form is a crucial document used for tax withholding in North Carolina. It allows employers to determine the correct amount of state income tax to withhold from employees' paychecks. Understanding the nc 4 form is essential for compliance and accurate payroll processing.

-

How can airSlate SignNow help with the nc 4 form?

airSlate SignNow simplifies the process of sending and eSigning the nc 4 form. With our platform, you can easily create, share, and securely sign the form online, ensuring that all necessary parties can complete it efficiently. This streamlines your workflow and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the nc 4 form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, providing you with the tools necessary to manage documents like the nc 4 form without breaking the bank. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the nc 4 form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for the nc 4 form. These tools enhance your document management process, making it easier to collect signatures and ensure compliance. Additionally, our platform is user-friendly, allowing anyone to navigate it with ease.

-

Can I integrate airSlate SignNow with other software for the nc 4 form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the nc 4 form. Whether you use CRM systems, accounting software, or other tools, our platform can connect seamlessly to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the nc 4 form?

Using airSlate SignNow for the nc 4 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored securely and can be accessed anytime, anywhere. This not only saves time but also helps maintain compliance with state regulations.

-

How secure is airSlate SignNow when handling the nc 4 form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage solutions to protect your nc 4 form and other sensitive documents. Our platform complies with industry standards to ensure that your data remains safe and confidential throughout the signing process.

Get more for NC 4 EZ Employee s Withholding Allowance Certific

- Application for the assessment of qualifications leading to registration as a teacher postprimary under regulation four of the form

- Ec20 application to be issued with a full practising certificate form

- Schedule a 2017 2018 2019 form

- Form 5074 2018 2019

- 990 ez instructions form 2018 2019

- Purpose in order to withdraw terminatecancel the registration form

- Vehiclevessel owner name update affidavit for dolwagov dol wa form

- On date i signed a written power of attorney form

Find out other NC 4 EZ Employee s Withholding Allowance Certific

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will