Form MET 2 ADJ Comptroller of Maryland 2014

What is the Form MET 2 ADJ Comptroller Of Maryland

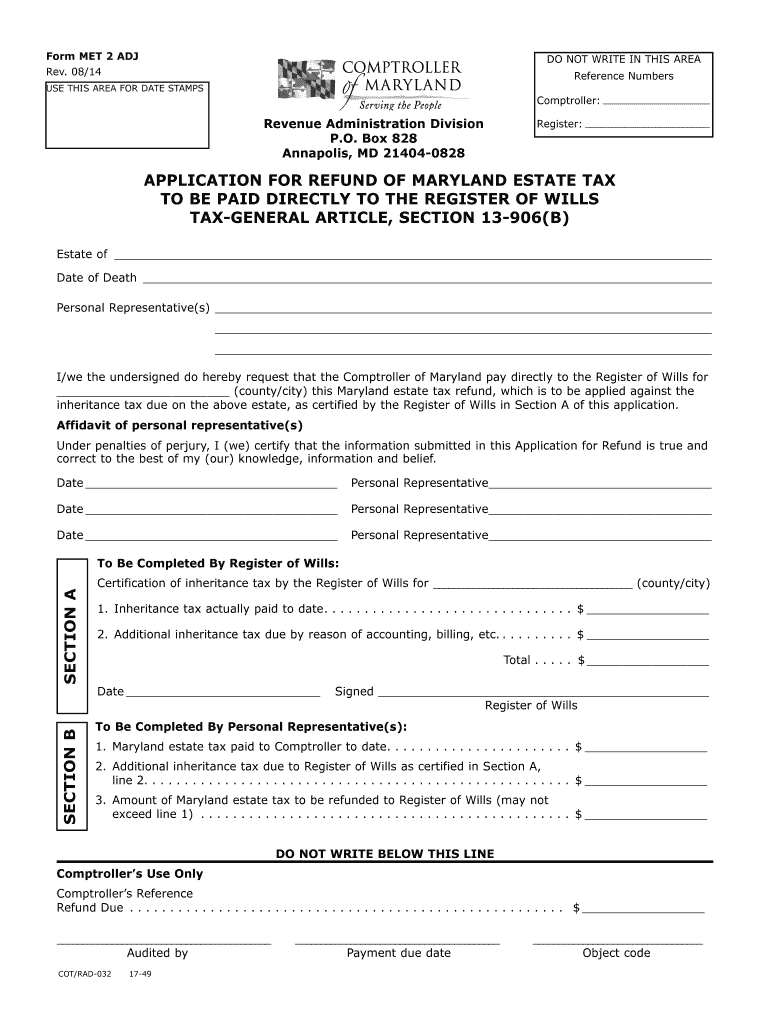

The Form MET 2 ADJ Comptroller Of Maryland is a specific document used for tax purposes in the state of Maryland. It is designed to facilitate adjustments to tax liabilities, ensuring that taxpayers can accurately report their financial information. This form is particularly relevant for individuals and businesses seeking to amend previously filed tax returns or correct any discrepancies in their tax records. Understanding the purpose and requirements of this form is essential for compliance with state tax regulations.

How to use the Form MET 2 ADJ Comptroller Of Maryland

Using the Form MET 2 ADJ Comptroller Of Maryland involves several steps. First, ensure that you have the correct version of the form, which can be obtained from the Maryland Comptroller's website or other official state resources. Next, gather all necessary financial documents, including previous tax returns and any supporting documentation for the adjustments you intend to make. Carefully fill out the form, ensuring that all information is accurate and complete. Once completed, the form can be submitted electronically or via mail, depending on your preference and the specific requirements outlined by the Comptroller's office.

Steps to complete the Form MET 2 ADJ Comptroller Of Maryland

Completing the Form MET 2 ADJ Comptroller Of Maryland requires a systematic approach:

- Obtain the latest version of the form.

- Review the instructions provided with the form to understand the requirements.

- Gather all relevant documentation, including prior tax returns and any receipts or records that support your adjustments.

- Fill in your personal and financial information accurately in the designated fields.

- Double-check all entries for accuracy to avoid delays in processing.

- Sign and date the form where required.

- Submit the completed form according to the guidelines provided, either online or by mail.

Legal use of the Form MET 2 ADJ Comptroller Of Maryland

The legal use of the Form MET 2 ADJ Comptroller Of Maryland is governed by Maryland state tax laws. It is crucial for taxpayers to ensure that they are using the form in accordance with these regulations. This includes adhering to deadlines for submission and ensuring that all information provided is truthful and accurate. Misuse of the form or providing false information can result in penalties, including fines or other legal consequences. Therefore, understanding the legal framework surrounding this form is vital for compliance and protection against potential issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form MET 2 ADJ Comptroller Of Maryland are critical for taxpayers to observe. Typically, the form must be submitted within a specific timeframe following the original tax return filing. It is advisable to check the Maryland Comptroller's website for the most current deadlines, as these can vary based on the tax year and any changes in state regulations. Missing a deadline can result in penalties or delays in processing your adjustments, so keeping track of these important dates is essential.

Form Submission Methods (Online / Mail / In-Person)

The Form MET 2 ADJ Comptroller Of Maryland can be submitted through various methods, providing flexibility for taxpayers. Options typically include:

- Online Submission: Many taxpayers prefer to submit the form electronically through the Maryland Comptroller's online portal, which can expedite processing.

- Mail: The completed form can also be printed and mailed to the appropriate address specified by the Comptroller's office.

- In-Person: For those who prefer face-to-face interaction, submitting the form in person at a local Comptroller office is an option.

Choosing the right submission method depends on personal preference and the urgency of the adjustments being made.

Quick guide on how to complete form met 2 adj comptroller of maryland 432680047

Your assistance manual on how to formulate your Form MET 2 ADJ Comptroller Of Maryland

If you're unsure about how to generate and transmit your Form MET 2 ADJ Comptroller Of Maryland, here are a few brief instructions on simplifying your tax submission process.

To begin, simply register your airSlate SignNow account to transform your approach to handling documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to modify, draft, and finalize your tax paperwork effortlessly. With its editor, you can navigate between text, check boxes, and eSignatures and return to amend details as necessary. Optimize your tax management with enhanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to finalize your Form MET 2 ADJ Comptroller Of Maryland in no time:

- Establish your account and start editing PDFs within moments.

- Utilize our directory to obtain any IRS tax form; explore differing versions and schedules.

- Select Get form to access your Form MET 2 ADJ Comptroller Of Maryland in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and rectify any mistakes.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please keep in mind that filing on paper may lead to return mistakes and cause delays in refunds. Naturally, before e-filing your taxes, consult the IRS website for filing regulations in your location.

Create this form in 5 minutes or less

Find and fill out the correct form met 2 adj comptroller of maryland 432680047

FAQs

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the form met 2 adj comptroller of maryland 432680047

How to create an eSignature for the Form Met 2 Adj Comptroller Of Maryland 432680047 in the online mode

How to make an electronic signature for your Form Met 2 Adj Comptroller Of Maryland 432680047 in Chrome

How to create an electronic signature for signing the Form Met 2 Adj Comptroller Of Maryland 432680047 in Gmail

How to make an electronic signature for the Form Met 2 Adj Comptroller Of Maryland 432680047 from your smartphone

How to make an electronic signature for the Form Met 2 Adj Comptroller Of Maryland 432680047 on iOS

How to create an eSignature for the Form Met 2 Adj Comptroller Of Maryland 432680047 on Android devices

People also ask

-

What is the Form MET 2 ADJ Comptroller Of Maryland, and why is it important?

The Form MET 2 ADJ Comptroller Of Maryland is a crucial document used for personal property tax assessments. It allows individuals and businesses to appeal assessments they believe are incorrect, ensuring they are fairly represented in tax matters. Proper completion of this form is vital to prevent overpaying taxes and to protect your rights.

-

How can airSlate SignNow assist with filling out the Form MET 2 ADJ Comptroller Of Maryland?

airSlate SignNow simplifies the process of filling out the Form MET 2 ADJ Comptroller Of Maryland by offering a user-friendly interface. Users can easily input their information, save and share the completed form, and ensure that all necessary details are accurately captured. This facilitates a smoother submission process to the Comptroller's office.

-

What are the costs associated with using airSlate SignNow for the Form MET 2 ADJ Comptroller Of Maryland?

airSlate SignNow provides a cost-effective solution for handling the Form MET 2 ADJ Comptroller Of Maryland, with various pricing plans tailored to different business needs. Users can choose from free trials to affordable monthly subscriptions, allowing businesses of all sizes to access essential eSigning and document management features without breaking the bank.

-

Are there integrations available for airSlate SignNow when working with the Form MET 2 ADJ Comptroller Of Maryland?

Yes, airSlate SignNow offers various integrations with popular applications like Google Drive, Salesforce, and Dropbox, making it easy to manage documents related to the Form MET 2 ADJ Comptroller Of Maryland. These integrations streamline workflows, allowing users to access and manage their documents from one centralized location.

-

What features does airSlate SignNow provide for handling the Form MET 2 ADJ Comptroller Of Maryland?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for documents like the Form MET 2 ADJ Comptroller Of Maryland. Users can collaborate in real-time, ensuring that all necessary stakeholders are involved in the process, leading to quicker resolution times.

-

How does airSlate SignNow enhance the security of the Form MET 2 ADJ Comptroller Of Maryland?

airSlate SignNow prioritizes security by employing industry-standard encryption protocols to protect sensitive information on forms like the Form MET 2 ADJ Comptroller Of Maryland. Additionally, features like password protection and audit trails ensure that only authorized users have access to the documents.

-

Can I use airSlate SignNow to track the status of my Form MET 2 ADJ Comptroller Of Maryland?

Absolutely! airSlate SignNow offers real-time tracking, allowing users to monitor the status of their Form MET 2 ADJ Comptroller Of Maryland throughout the submission and review process. Notifications keep you informed, so you know when your document has been opened, signed, or needs your attention.

Get more for Form MET 2 ADJ Comptroller Of Maryland

- Metlife attending physician statement form

- Delta dental enrollment change form 3400 ca

- Endofild formhouse medicin

- Daily schedule form oklahoma homeschool

- Troop meeting permission slip publicity permission form capitalwestcc

- Omb no 1845 0110 412807257 form

- Neola 5330 f1 form

- Healthcare claim processing why medical billing claims healthcare claim processing why medical billing claims 10 common medical form

Find out other Form MET 2 ADJ Comptroller Of Maryland

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document