MET 2 ADJ the Comptroller of Maryland 2011

What is the MET 2 ADJ The Comptroller Of Maryland

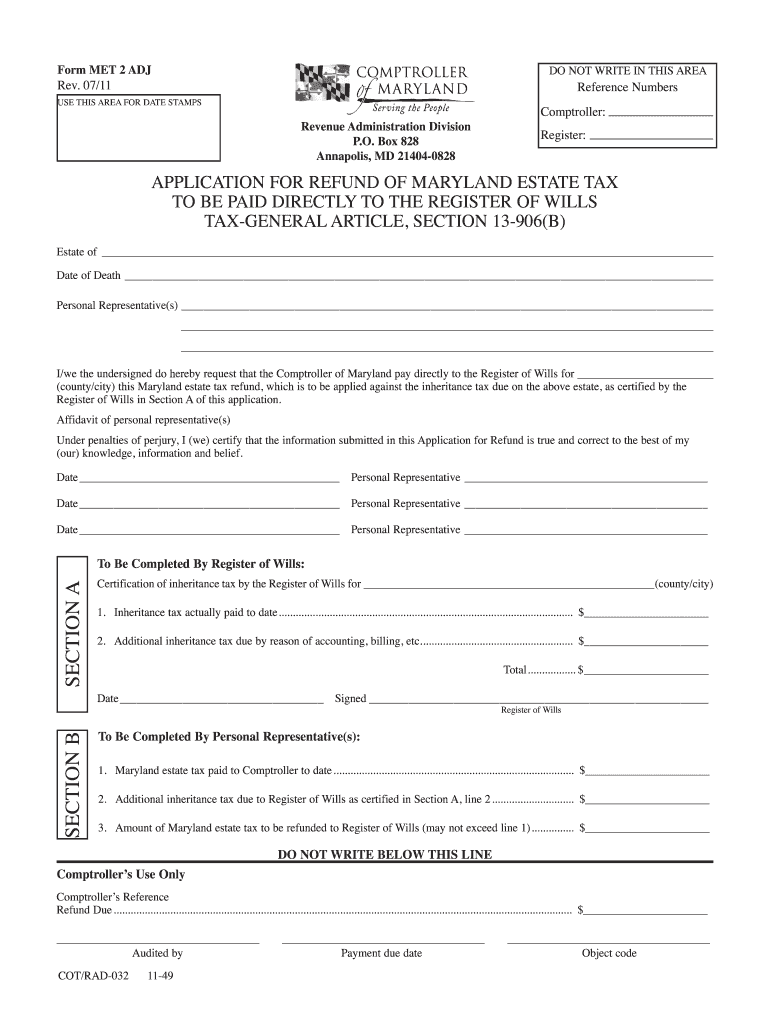

The MET 2 ADJ The Comptroller Of Maryland form is a specific document used for tax reporting purposes within the state of Maryland. This form is essential for individuals and businesses that need to report adjustments to their tax filings. It provides a structured way to communicate changes or corrections to previously submitted tax documents, ensuring compliance with state regulations. Understanding the purpose and requirements of this form is crucial for accurate tax reporting and to avoid potential penalties.

Steps to complete the MET 2 ADJ The Comptroller Of Maryland

Completing the MET 2 ADJ The Comptroller Of Maryland form involves several important steps:

- Gather necessary information, including your previous tax filings and any supporting documentation related to the adjustments.

- Access the form online through the official Maryland Comptroller's website or other authorized platforms.

- Fill in the required fields accurately, ensuring that all adjustments are clearly detailed.

- Review the completed form for accuracy and completeness before submission.

- Sign the form electronically or by hand, as appropriate, to validate your submission.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the MET 2 ADJ The Comptroller Of Maryland

The MET 2 ADJ The Comptroller Of Maryland form is legally recognized for making adjustments to tax filings. It is important that users adhere to the guidelines set forth by the Maryland Comptroller’s office to ensure that the form is used correctly. This includes understanding the legal implications of the adjustments being reported and ensuring that all information provided is truthful and accurate. Failure to comply with these legal requirements may result in penalties or further legal action.

Filing Deadlines / Important Dates

Filing deadlines for the MET 2 ADJ The Comptroller Of Maryland form are critical for compliance. Typically, adjustments must be submitted within a specific timeframe following the original filing date. It is advisable to check the Maryland Comptroller’s website for the most current deadlines, as they may vary based on the type of tax being adjusted or other factors. Missing these deadlines can lead to complications in the tax reporting process.

Form Submission Methods (Online / Mail / In-Person)

There are several methods available for submitting the MET 2 ADJ The Comptroller Of Maryland form:

- Online: Users can submit the form electronically through the Maryland Comptroller's online portal, which is often the fastest method.

- Mail: The completed form can be printed and sent via postal mail to the appropriate address provided by the Comptroller’s office.

- In-Person: Individuals may also choose to deliver the form in person at designated Comptroller offices for immediate processing.

Key elements of the MET 2 ADJ The Comptroller Of Maryland

Understanding the key elements of the MET 2 ADJ The Comptroller Of Maryland form is vital for effective completion. These elements typically include:

- Taxpayer Identification: Information about the individual or business filing the form.

- Adjustment Details: A clear explanation of the nature of the adjustments being made.

- Supporting Documentation: Any necessary attachments that substantiate the adjustments claimed.

- Signature: An affirmation that the information provided is accurate and complete.

Examples of using the MET 2 ADJ The Comptroller Of Maryland

Examples of situations where the MET 2 ADJ The Comptroller Of Maryland form may be utilized include:

- Correcting a misreported income amount from a previous tax year.

- Adjusting deductions that were inadvertently omitted in the original filing.

- Updating personal information, such as name or address changes, that affect tax filings.

Quick guide on how to complete met 2 adj the comptroller of maryland

Your assistance manual on how to prepare your MET 2 ADJ The Comptroller Of Maryland

If you are wondering how to create and submit your MET 2 ADJ The Comptroller Of Maryland, here are some brief recommendations to simplify your tax submission process.

Firstly, you simply need to set up your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is a user-friendly and powerful document solution that enables you to edit, draft, and finalize your tax paperwork with ease. Utilizing its editor, you can alternate between text, check boxes, and eSignatures and return to modify answers when necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing options.

Follow the instructions below to finalize your MET 2 ADJ The Comptroller Of Maryland within minutes:

- Create your account and start working on PDFs in no time.

- Access our library to find any IRS tax form; browse different versions and schedules.

- Hit Get form to open your MET 2 ADJ The Comptroller Of Maryland in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and amend any inaccuracies.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that filing on paper can lead to increased return mistakes and delayed refunds. Certainly, before electronically filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct met 2 adj the comptroller of maryland

FAQs

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

Can I fill out the form for the JEE Main 2 still? How?

No! You cannot fill the form now.The official authorities allowed candidates to fill the JEE Main application forms till 1st January 2018 and submit their fees till 2nd January 2018.Now, as the last date is over, you won’t be allowed to fill the form. As you would not like to waster your whole year, you must try other Engineering Exams such as BITSAT, VITEE etc.Go for it! Good Luck!

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the met 2 adj the comptroller of maryland

How to generate an electronic signature for your Met 2 Adj The Comptroller Of Maryland online

How to create an electronic signature for your Met 2 Adj The Comptroller Of Maryland in Chrome

How to make an electronic signature for putting it on the Met 2 Adj The Comptroller Of Maryland in Gmail

How to make an electronic signature for the Met 2 Adj The Comptroller Of Maryland right from your smart phone

How to create an electronic signature for the Met 2 Adj The Comptroller Of Maryland on iOS

How to create an electronic signature for the Met 2 Adj The Comptroller Of Maryland on Android devices

People also ask

-

What is MET 2 ADJ The Comptroller Of Maryland and how does it work?

MET 2 ADJ The Comptroller Of Maryland is a streamlined process for submitting and adjusting tax forms electronically. Using airSlate SignNow, businesses can easily eSign and send required documents to the Comptroller's office, ensuring compliance and efficiency in handling tax adjustments.

-

How can I integrate MET 2 ADJ The Comptroller Of Maryland with my existing systems?

airSlate SignNow offers seamless integrations with various business tools, allowing you to incorporate MET 2 ADJ The Comptroller Of Maryland into your existing workflows. You can connect with CRM systems, document management platforms, and other software to enhance your document handling and eSignature processes.

-

What are the benefits of using airSlate SignNow for MET 2 ADJ The Comptroller Of Maryland?

Using airSlate SignNow for MET 2 ADJ The Comptroller Of Maryland provides businesses with a cost-effective solution for managing documents. It automates the eSigning process, reduces turnaround time, and ensures that all documents are securely stored and easily accessible.

-

Is there a free trial available for MET 2 ADJ The Comptroller Of Maryland on airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows users to experience the benefits of MET 2 ADJ The Comptroller Of Maryland without any initial commitment. This trial period lets you explore the features and capabilities of our eSigning solution.

-

What pricing options are available for MET 2 ADJ The Comptroller Of Maryland users?

airSlate SignNow provides flexible pricing plans tailored to different business needs. Whether you are a small business or a large enterprise, you can choose a plan that best fits your requirements for using MET 2 ADJ The Comptroller Of Maryland.

-

How secure is the airSlate SignNow platform for MET 2 ADJ The Comptroller Of Maryland?

Security is a top priority for airSlate SignNow, especially for processes like MET 2 ADJ The Comptroller Of Maryland. Our platform employs advanced encryption and security protocols to protect your documents and data throughout the eSigning process.

-

Can I track the status of my MET 2 ADJ The Comptroller Of Maryland submissions?

Absolutely! With airSlate SignNow, you can easily track the status of your MET 2 ADJ The Comptroller Of Maryland submissions in real-time. You will receive notifications on document views and completions, ensuring you stay informed throughout the process.

Get more for MET 2 ADJ The Comptroller Of Maryland

- Packet f response to dissolution with missoula county kansasjudicialcouncil form

- 102 informaci n para abuelos sus derechos y responsabilidades kansasjudicialcouncil

- Juvenile court local rules of procedure butler county ohio kansasjudicialcouncil form

- 5113 1 332 in the district court of county kansas in kansasjudicialcouncil form

- Rev 072016 ksjc 1 373 in the district court of kansasjudicialcouncil form

- 5113 1 394 in the district court of county kansas in kansasjudicialcouncil form

- Kansas temporary order form

- Request and service instruction form kansas judicial council kansasjudicialcouncil

Find out other MET 2 ADJ The Comptroller Of Maryland

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate