Do Not Staple 6969 OMB No Irs Form

What is the Do Not Staple 6969 OMB No Irs

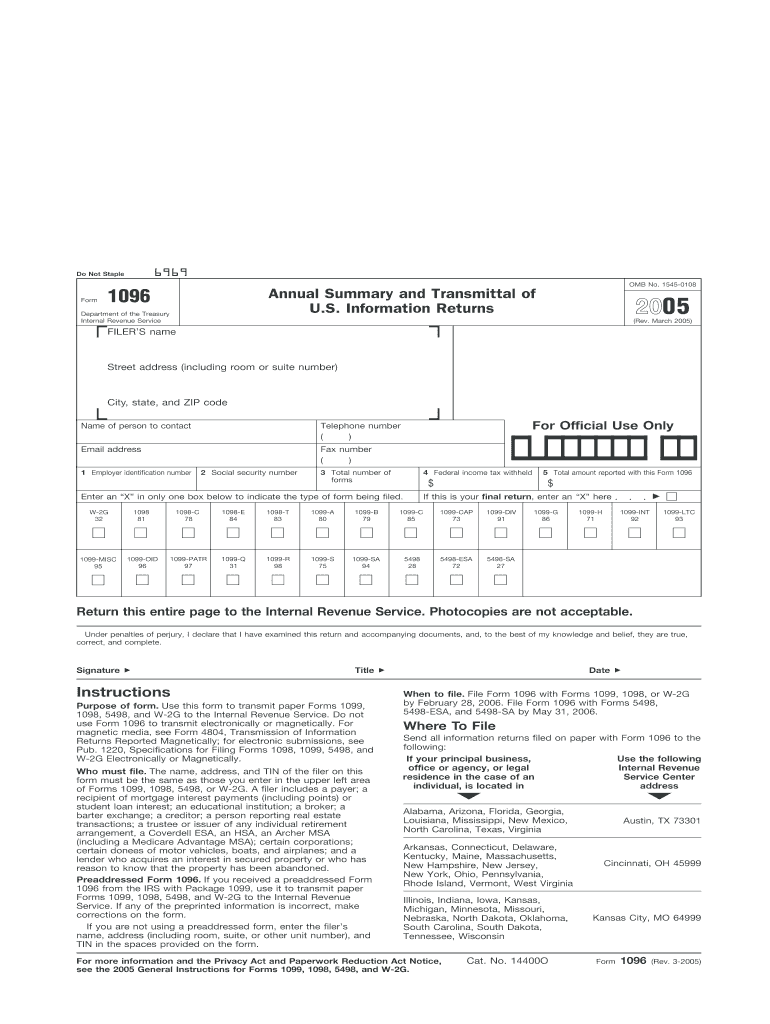

The "Do Not Staple 6969 OMB No Irs" refers to a specific instruction related to certain IRS forms. This instruction is crucial for ensuring that documents are processed correctly by the IRS. When filling out forms that include this directive, it is essential to follow the guidelines to avoid delays or issues in processing. The instruction indicates that staples should not be used when submitting the form, as they can interfere with scanning and data entry processes.

How to use the Do Not Staple 6969 OMB No Irs

To properly use the "Do Not Staple 6969 OMB No Irs," individuals must ensure that all pages of the form are submitted flat and unstapled. Instead of using staples, it is advisable to use paper clips or binder clips if necessary. This practice helps maintain the integrity of the document and facilitates easier handling by IRS personnel. Always double-check that all required information is accurately filled out before submission.

Steps to complete the Do Not Staple 6969 OMB No Irs

Completing the "Do Not Staple 6969 OMB No Irs" involves several key steps:

- Gather all necessary information and documents required for the form.

- Fill out the form completely, ensuring that all fields are accurate and legible.

- Review the form for any errors or omissions before finalizing it.

- Do not staple the pages together; instead, use paper clips if needed.

- Submit the form according to the specified submission methods, whether online, by mail, or in person.

IRS Guidelines

The IRS provides specific guidelines regarding the "Do Not Staple 6969 OMB No Irs." These guidelines emphasize the importance of submitting forms without staples to ensure efficient processing. It is recommended to consult the IRS website or official publications for the most current instructions and requirements related to this form. Adhering to these guidelines can help prevent processing delays and ensure compliance with IRS regulations.

Filing Deadlines / Important Dates

Filing deadlines for forms associated with the "Do Not Staple 6969 OMB No Irs" can vary based on the specific form and the taxpayer's situation. It is crucial to be aware of these deadlines to avoid penalties. Generally, forms must be submitted by the tax filing deadline, which is typically April fifteenth for most individual taxpayers. For businesses and other entities, deadlines may differ, so checking the IRS calendar is advisable.

Required Documents

When completing the "Do Not Staple 6969 OMB No Irs," certain documents may be required for submission. These can include:

- Supporting schedules or additional forms that relate to the primary form.

- Documentation that verifies income, deductions, or credits claimed.

- Any other relevant paperwork that the IRS specifies for the particular form.

Ensuring that all necessary documents are included will help facilitate a smooth processing experience.

Quick guide on how to complete do not staple 6969 omb no irs

Prepare [SKS] effortlessly on any gadget

Digital document management has increased in popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the needed form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to alter and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Make use of the tools available to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere moments and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, and errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device of your preference. Modify and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Do Not Staple 6969 OMB No Irs

Create this form in 5 minutes!

How to create an eSignature for the do not staple 6969 omb no irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the 'Do Not Staple 6969 OMB No Irs' instruction?

The 'Do Not Staple 6969 OMB No Irs' instruction is crucial for maintaining the integrity of IRS documents. Staples can interfere with the scanning process, potentially leading to delays or errors. By following this guideline, you ensure your documents are processed smoothly and efficiently.

-

How can airSlate SignNow help me comply with the 'Do Not Staple 6969 OMB No Irs' requirement?

airSlate SignNow provides a digital solution that eliminates the need to physically staple documents. By using our eSignature solution, you can ensure that documents remain intact and compliant with the 'Do Not Staple 6969 OMB No Irs' requirement, while also speeding up the signing process.

-

What are the pricing plans offered by airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored for various business needs. Our packages are designed to be cost-effective while providing extensive features, ensuring compliance with guidelines like 'Do Not Staple 6969 OMB No Irs'. You can choose a plan that suits your document management requirements best.

-

What features does airSlate SignNow offer to improve document management?

airSlate SignNow includes features like e-signatures, document templates, and secure storage that enhance your document management process. These features help businesses efficiently handle their paperwork while adhering to directives such as 'Do Not Staple 6969 OMB No Irs', making compliance easier.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow seamlessly integrates with popular software solutions to enhance your workflow. This integration ensures that your documents conform to important guidelines like 'Do Not Staple 6969 OMB No Irs', allowing for a streamlined signing and document management experience.

-

Is airSlate SignNow user-friendly for beginners?

Absolutely! airSlate SignNow is designed with user experience in mind, making it accessible even for those new to e-signatures. The intuitive interface allows users to create and manage documents adhering to instructions like 'Do Not Staple 6969 OMB No Irs' without prior technical knowledge.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security with advanced encryption and compliance with industry standards. This ensures that your documents are secure and that you can confidently follow requirements like 'Do Not Staple 6969 OMB No Irs' while managing your sensitive information.

Get more for Do Not Staple 6969 OMB No Irs

- Dr 501t pasco county property appraiser pascogovcom form

- Post observation conference form

- Print tax forms 1040

- United healthcare community plan nj prior authorization form

- Eesti kennelliit results form

- Pre employment health declaration form nsw

- Aimsweb number identification benchmark assessment 1 kindergarten fall form

- Lic 700 8 08 confidential form

Find out other Do Not Staple 6969 OMB No Irs

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast