Q4 PBS Forms PBS Tax & Bookkeeping Service

What is the Q4 PBS Forms PBS Tax & Bookkeeping Service

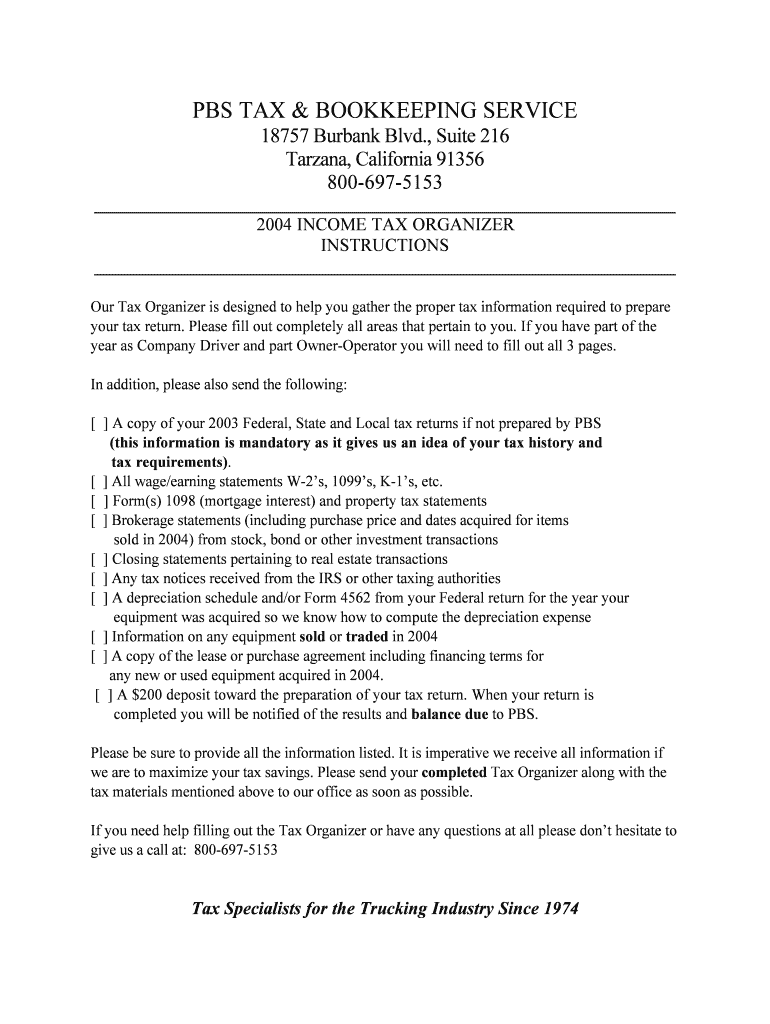

The Q4 PBS Forms PBS Tax & Bookkeeping Service is a specialized set of documents designed to assist businesses in the United States with their quarterly tax reporting and bookkeeping needs. These forms help ensure compliance with IRS regulations while providing a structured approach to tracking income, expenses, and tax obligations. Utilizing these forms can streamline the bookkeeping process, making it easier for businesses to maintain accurate financial records and meet their tax responsibilities.

Steps to complete the Q4 PBS Forms PBS Tax & Bookkeeping Service

Completing the Q4 PBS Forms involves several key steps that help ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense receipts, and any relevant tax documents. Next, fill out each section of the form carefully, ensuring that all figures are accurate and reflect the correct reporting period. After completing the forms, review them for any errors or omissions before submitting. Finally, keep a copy of the completed forms for your records, as they may be needed for future reference or audits.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the Q4 PBS Forms. Typically, these forms must be submitted by the end of the first month following the close of the quarter, which means they are due by January 31 for Q4. Missing these deadlines can result in penalties and interest, so keeping track of these important dates is essential for maintaining compliance and avoiding unnecessary costs.

Required Documents

To accurately complete the Q4 PBS Forms, certain documents are required. These include financial statements that detail income and expenses for the quarter, receipts for any deductible expenses, and prior tax returns for reference. Having these documents readily available will facilitate a smoother completion process and help ensure that all necessary information is included in the forms.

Legal use of the Q4 PBS Forms PBS Tax & Bookkeeping Service

The Q4 PBS Forms are legally recognized documents that businesses must use to report their financial activities to the IRS. Proper use of these forms ensures compliance with federal tax laws and regulations. It is important for businesses to understand the legal implications of these forms, including the requirement to provide truthful and accurate information, as any discrepancies can lead to audits or penalties.

Examples of using the Q4 PBS Forms PBS Tax & Bookkeeping Service

Businesses can utilize the Q4 PBS Forms in various scenarios. For example, a small business owner may use these forms to report quarterly earnings and expenses, ensuring they pay the correct amount of estimated taxes. Similarly, freelancers can leverage these forms to track income from multiple clients, simplifying their tax reporting process. These examples illustrate the versatility and importance of the Q4 PBS Forms in maintaining accurate financial records.

Quick guide on how to complete q4 pbs forms pbs tax amp bookkeeping service

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign [SKS] without stress

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information carefully and click on the Done button to save your changes.

- Choose how you would like to send your document, via email, text message (SMS), or invite link, or download it to your computer.

Forget about missing or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the q4 pbs forms pbs tax amp bookkeeping service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Q4 PBS Forms in PBS Tax & Bookkeeping Service?

Q4 PBS Forms are essential tax documents provided by PBS Tax & Bookkeeping Service that summarize your financial activities for the fourth quarter. These forms are crucial for accurate year-end reporting and ensure compliance with tax regulations. Utilizing airSlate SignNow to manage Q4 PBS Forms helps streamline your processes, making eSignature easy and efficient.

-

How can airSlate SignNow benefit my Q4 PBS Forms process?

airSlate SignNow simplifies the management of Q4 PBS Forms by allowing you to send, sign, and store documents electronically. This increases efficiency, reduces paper usage, and ensures that your forms are secure and easily accessible. By incorporating airSlate SignNow into your Q4 PBS Forms workflow, you can save time and reduce errors in your tax documentation.

-

What pricing options are available for PBS Tax & Bookkeeping Service?

PBS Tax & Bookkeeping Service offers flexible pricing plans tailored to various business needs. Whether you need basic services or comprehensive financial support, there’s a package that fits your requirements. Consult with our team to identify the best solution for your Q4 PBS Forms preparation and filing at a competitive rate.

-

Can I integrate airSlate SignNow with other accounting software for my Q4 PBS Forms?

Yes, airSlate SignNow integrates seamlessly with a variety of accounting software, enhancing your overall workflow for Q4 PBS Forms. This integration ensures that your financial data is synchronized and accessible, making eSigning and document management more efficient. Leverage these integrations to improve productivity in your PBS Tax & Bookkeeping Service operations.

-

What features does airSlate SignNow offer for managing Q4 PBS Forms?

airSlate SignNow provides numerous features for effective management of Q4 PBS Forms, including secure eSigning, document storage, and real-time tracking. With an intuitive interface, you can easily customize forms and automate workflows, which helps in organizing your Q4 PBS Forms efficiently. These features are designed to enhance user experience within the PBS Tax & Bookkeeping Service environment.

-

How secure is airSlate SignNow for handling Q4 PBS Forms?

Security is paramount in airSlate SignNow, which employs advanced encryption protocols to protect your Q4 PBS Forms. Your sensitive data is safeguarded during transmission and at rest, ensuring compliance with industry standards. When you choose airSlate SignNow for PBS Tax & Bookkeeping Service, you can trust that your information remains confidential and secure.

-

What are the key benefits of using PBS Tax & Bookkeeping Service for my Q4 PBS Forms?

Using PBS Tax & Bookkeeping Service offers several benefits for your Q4 PBS Forms, such as expert guidance and accurate preparation of tax documents. Our experienced team ensures that you remain compliant with regulatory changes, while also maximizing deductions. This expert support, combined with airSlate SignNow's efficiency, can signNowly enhance your tax filing experience.

Get more for Q4 PBS Forms PBS Tax & Bookkeeping Service

- Certified export specialist form

- West virginia tax exempt form

- Lpde form

- Rrc p 13 form rrc state tx

- Fgasa level 1 exam questions form

- Fee status questionnaire royal holloway form

- Streamlined sales and use tax agreement certificate of exemption streamlinedsalestax form

- Nevada department of insurance lh100 form

Find out other Q4 PBS Forms PBS Tax & Bookkeeping Service

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple