Streamlined Sales and Use Tax Agreement Certificate of Exemption Streamlinedsalestax Form

Understanding the Streamlined Sales and Use Tax Agreement Certificate of Exemption

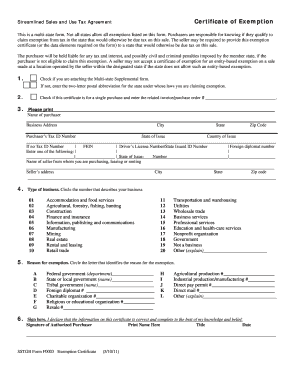

The Streamlined Sales and Use Tax Agreement Certificate of Exemption is a crucial document for businesses operating in Arkansas and other participating states. This certificate allows qualified purchasers to make tax-exempt purchases of goods and services. It simplifies the sales tax process by providing a uniform method for claiming exemptions, which is beneficial for both buyers and sellers. The agreement aims to reduce the complexity of sales tax compliance and promote economic efficiency across state lines.

Steps to Complete the Streamlined Sales and Use Tax Agreement Certificate of Exemption

Completing the Streamlined Sales and Use Tax Agreement Certificate of Exemption involves several key steps:

- Gather necessary information, including your business name, address, and tax identification number.

- Identify the specific goods or services for which you are claiming an exemption.

- Fill out the certificate accurately, ensuring all required fields are completed.

- Sign and date the certificate to validate your claim.

- Provide the completed certificate to the seller from whom you are purchasing goods or services.

Legal Use of the Streamlined Sales and Use Tax Agreement Certificate of Exemption

The legal use of the Streamlined Sales and Use Tax Agreement Certificate of Exemption is governed by specific regulations. It is essential that the certificate is used solely for qualifying purchases. Misuse of the certificate can lead to penalties, including back taxes owed and potential fines. Businesses must ensure they are compliant with both state and federal laws when utilizing this exemption to avoid legal repercussions.

State-Specific Rules for the Streamlined Sales and Use Tax Agreement Certificate of Exemption

Each state participating in the Streamlined Sales and Use Tax Agreement may have its own specific rules regarding the use of the certificate. In Arkansas, for example, businesses must be aware of the types of exemptions allowed and the documentation required. It is advisable to consult state tax authorities or legal advisors to ensure compliance with local regulations and to understand any updates to the rules that may affect the use of the certificate.

How to Obtain the Streamlined Sales and Use Tax Agreement Certificate of Exemption

Obtaining the Streamlined Sales and Use Tax Agreement Certificate of Exemption is a straightforward process. Businesses can typically download the certificate from the official state revenue department website or request it directly from local tax offices. It is important to ensure that you are using the most current version of the certificate, as outdated forms may not be accepted. Additionally, businesses should verify their eligibility before applying for the exemption.

Examples of Using the Streamlined Sales and Use Tax Agreement Certificate of Exemption

There are various scenarios in which businesses might utilize the Streamlined Sales and Use Tax Agreement Certificate of Exemption. For instance, a manufacturing company purchasing raw materials for production may present the certificate to avoid paying sales tax on those materials. Similarly, a nonprofit organization may use the certificate to acquire supplies for charitable events without incurring tax. These examples illustrate the practical applications of the certificate in everyday business transactions.

Quick guide on how to complete streamlined sales and use tax agreement certificate of exemption streamlinedsalestax

Complete Streamlined Sales And Use Tax Agreement Certificate Of Exemption Streamlinedsalestax effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal green alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without any hold-ups. Manage Streamlined Sales And Use Tax Agreement Certificate Of Exemption Streamlinedsalestax on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to revise and eSign Streamlined Sales And Use Tax Agreement Certificate Of Exemption Streamlinedsalestax with ease

- Find Streamlined Sales And Use Tax Agreement Certificate Of Exemption Streamlinedsalestax and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you would like to share your form, through email, text message (SMS), an invite link, or by downloading it to your computer.

Eliminate worries about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Streamlined Sales And Use Tax Agreement Certificate Of Exemption Streamlinedsalestax and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the streamlined sales and use tax agreement certificate of exemption streamlinedsalestax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the streamlined sales and use tax agreement Arkansas?

The streamlined sales and use tax agreement Arkansas is a legislative framework that simplifies the sales and use tax process for businesses operating in the state. It helps businesses comply with tax regulations more efficiently while minimizing the administrative burden associated with sales tax collection and remittance.

-

How can airSlate SignNow assist with the streamlined sales and use tax agreement Arkansas?

airSlate SignNow provides a digital solution that allows businesses to easily create, send, and eSign documents related to the streamlined sales and use tax agreement Arkansas. This capability ensures timely and accurate submissions, helping businesses stay compliant with state tax laws.

-

What are the pricing options for airSlate SignNow services related to the streamlined sales and use tax agreement Arkansas?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Whether you are a small business or a larger enterprise, our solutions for managing the streamlined sales and use tax agreement Arkansas are designed to be cost-effective and provide excellent value.

-

What features does airSlate SignNow offer for handling tax agreements?

With airSlate SignNow, businesses can take advantage of features such as customizable templates, bulk sending, and automatic reminders to streamline the process of managing the streamlined sales and use tax agreement Arkansas. These features enhance efficiency and ensure that documents are processed in a timely manner.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for the streamlined sales and use tax agreement Arkansas allows businesses to save time and reduce paperwork. The user-friendly interface makes it easy to navigate, ensuring users can focus on their business instead of tedious paperwork and compliance issues.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax management software to facilitate the handling of the streamlined sales and use tax agreement Arkansas. These integrations enable data synchronization and improve the overall accuracy of tax-related documentation.

-

Is airSlate SignNow suitable for small businesses managing tax agreements?

Absolutely! airSlate SignNow is designed to accommodate businesses of all sizes, making it an ideal solution for small businesses managing the streamlined sales and use tax agreement Arkansas. Our platform is easy to use, thus enabling small businesses to handle their tax documentation without extensive training.

Get more for Streamlined Sales And Use Tax Agreement Certificate Of Exemption Streamlinedsalestax

- Quitclaim deed louisiana pdf form

- Sampark lisbon form

- Chevy blazer repair manual download form

- Nypd affidavit of co habitant form

- Koordinierung der systeme der sozialen sicherheit a1 form

- Org library volunteer application form name date address telephone home telephone cell e elpl

- 12000 gallon tank chart 320302651 form

- Form i 983 answers for section 1 student information ucmo

Find out other Streamlined Sales And Use Tax Agreement Certificate Of Exemption Streamlinedsalestax

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast