Individual Retirement Account Required Minimum Distribution Form

What is the Individual Retirement Account Required Minimum Distribution Form

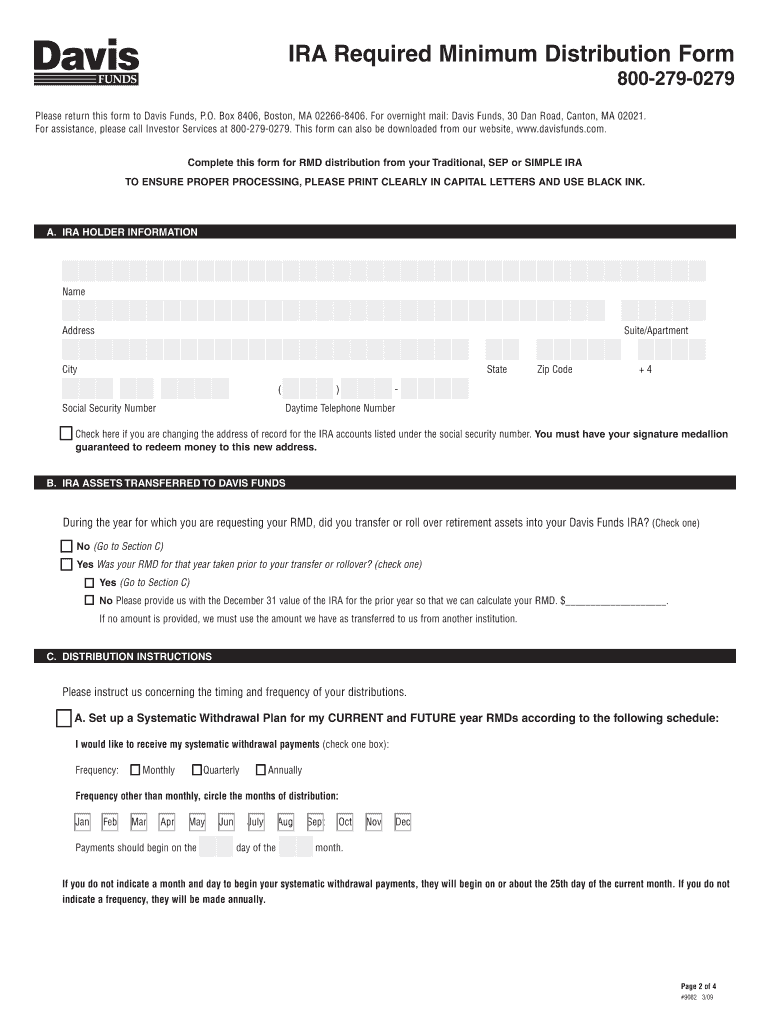

The Individual Retirement Account Required Minimum Distribution Form is a document that individuals must complete to withdraw the minimum required amount from their Individual Retirement Accounts (IRAs) once they reach a certain age. According to IRS regulations, account holders must begin taking distributions from their traditional IRAs by April first of the year following the year they turn seventy-two. This form helps ensure compliance with these regulations and assists in calculating the required distribution amount.

How to use the Individual Retirement Account Required Minimum Distribution Form

Using the Individual Retirement Account Required Minimum Distribution Form involves several key steps. First, gather all necessary personal and account information, including your Social Security number and account details. Next, accurately calculate the minimum distribution amount based on your life expectancy and account balance. Complete the form by providing the required information and sign it to validate your request. Finally, submit the form to your IRA custodian, who will process your request and facilitate the distribution.

Steps to complete the Individual Retirement Account Required Minimum Distribution Form

Completing the Individual Retirement Account Required Minimum Distribution Form requires careful attention to detail. Follow these steps:

- Gather necessary information, including your personal details and IRA account information.

- Calculate your required minimum distribution using IRS life expectancy tables or consult a financial advisor.

- Fill out the form with accurate details, ensuring all sections are completed.

- Review the form for any errors or omissions before signing.

- Submit the completed form to your IRA custodian through the preferred submission method.

Key elements of the Individual Retirement Account Required Minimum Distribution Form

The Individual Retirement Account Required Minimum Distribution Form includes several essential elements that must be completed for it to be valid. Key components include:

- Account Holder Information: Personal details such as name, address, and Social Security number.

- Account Information: Details about the IRA, including the account number and type.

- Distribution Amount: The calculated minimum distribution amount based on IRS guidelines.

- Signature: The account holder's signature to authorize the distribution.

IRS Guidelines

The IRS provides specific guidelines regarding the Required Minimum Distribution (RMD) for IRAs. According to these guidelines, individuals must begin taking distributions by the age of seventy-two. The amount is calculated based on the account balance and the account holder's life expectancy. Failing to take the required distribution can result in significant penalties, making it crucial for individuals to understand and comply with these regulations.

Penalties for Non-Compliance

Non-compliance with the Required Minimum Distribution rules can lead to severe financial consequences. If an individual fails to withdraw the minimum required amount, the IRS imposes a penalty of fifty percent of the amount that should have been withdrawn. This penalty underscores the importance of timely and accurate completion of the Individual Retirement Account Required Minimum Distribution Form to avoid unnecessary financial burdens.

Quick guide on how to complete individual retirement account required minimum distribution form

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can locate the correct form and securely store it online. airSlate SignNow provides all the features necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign [SKS] with minimal effort

- Find [SKS] and click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Adjust and eSign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Individual Retirement Account Required Minimum Distribution Form

Create this form in 5 minutes!

How to create an eSignature for the individual retirement account required minimum distribution form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Individual Retirement Account Required Minimum Distribution Form?

The Individual Retirement Account Required Minimum Distribution Form is essential for investors who need to take distributions from their IRAs. This form helps ensure that you comply with IRS regulations regarding mandatory withdrawals, typically starting at age 72. By using this form, you can avoid penalties associated with missing required distributions.

-

How can I obtain the Individual Retirement Account Required Minimum Distribution Form?

You can easily obtain the Individual Retirement Account Required Minimum Distribution Form through your financial institution or by visiting the IRS website. Many online platforms also offer these forms for download. Ensure you have the correct form that matches your specific IRA to avoid any processing delays.

-

Is there a fee associated with processing the Individual Retirement Account Required Minimum Distribution Form?

Fees for processing the Individual Retirement Account Required Minimum Distribution Form can vary by institution. Some banks or financial services may charge for processing or advising on the form. It's best to confirm with your IRA provider regarding any associated costs before submitting your form.

-

What features does airSlate SignNow offer for managing the Individual Retirement Account Required Minimum Distribution Form?

airSlate SignNow provides a user-friendly platform to easily fill out and eSign the Individual Retirement Account Required Minimum Distribution Form. With features like document templates, secure storage, and real-time tracking, you can efficiently manage your IRA distributions without hassle. This ensures that all paperwork is completed promptly and accurately.

-

Can I integrate airSlate SignNow with other financial management tools for the Individual Retirement Account Required Minimum Distribution Form?

Yes, airSlate SignNow offers integrations with various financial management tools which can simplify the process of submitting the Individual Retirement Account Required Minimum Distribution Form. Integrating these tools allows for seamless data transfer and enhances your overall financial workflow. Check the available integrations on the airSlate SignNow platform for compatibility.

-

What are the benefits of using airSlate SignNow for the Individual Retirement Account Required Minimum Distribution Form?

Using airSlate SignNow for the Individual Retirement Account Required Minimum Distribution Form streamlines the eSignature process, saving you time and effort. The platform ensures compliance and helps reduce the risk of errors, making retirement planning more efficient. Moreover, it provides a secure way to manage sensitive information related to your IRA.

-

How does airSlate SignNow ensure the security of my Individual Retirement Account Required Minimum Distribution Form?

airSlate SignNow prioritizes security by implementing advanced encryption protocols and secure access controls for your Individual Retirement Account Required Minimum Distribution Form. This protects your sensitive financial information from unauthorized access and ensures compliance with privacy regulations. Rest assured, your documents are safe when using our platform.

Get more for Individual Retirement Account Required Minimum Distribution Form

Find out other Individual Retirement Account Required Minimum Distribution Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors