Film Tax CreditMonthly ReportingForm08 FFORM Qxd Film

What is the Film Tax Credit Monthly Reporting Form 08 FFORM qxd Film

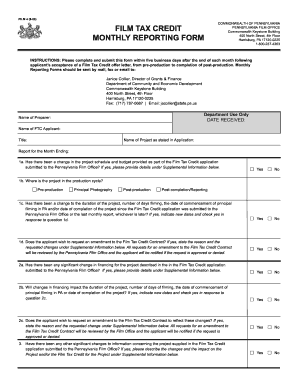

The Film Tax Credit Monthly Reporting Form 08 FFORM qxd Film is a specialized document used by production companies to report expenses and activities related to film production. This form is essential for claiming tax credits available for eligible film projects. It provides a structured way to present financial information, ensuring compliance with state regulations. The form typically includes sections for detailing production costs, crew wages, and other expenditures that qualify for tax incentives.

How to use the Film Tax Credit Monthly Reporting Form 08 FFORM qxd Film

Using the Film Tax Credit Monthly Reporting Form 08 FFORM qxd Film involves several steps. First, gather all necessary financial documentation related to the film production. This includes invoices, payroll records, and receipts. Next, fill out the form accurately, ensuring that all figures reflect the actual expenses incurred. After completing the form, it should be submitted to the appropriate state agency for review. It is crucial to keep copies of the submitted form and all supporting documents for future reference.

Steps to complete the Film Tax Credit Monthly Reporting Form 08 FFORM qxd Film

Completing the Film Tax Credit Monthly Reporting Form involves a systematic approach:

- Collect all relevant financial documents, including receipts and payroll records.

- Fill in the production company details at the top of the form.

- Detail the eligible expenses in the designated sections, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate state agency by the specified deadline.

Eligibility Criteria

To qualify for the Film Tax Credit, productions must meet specific eligibility criteria. Generally, these criteria include:

- The production must be filmed in the state offering the tax credit.

- At least a minimum percentage of the budget must be spent within the state.

- Production companies must provide proof of all expenses claimed on the form.

- Compliance with local labor laws and regulations is required.

Filing Deadlines / Important Dates

Filing deadlines for the Film Tax Credit Monthly Reporting Form are crucial for maintaining eligibility. Typically, forms must be submitted monthly or quarterly, depending on state regulations. It is essential to check the specific deadlines for the state in which the production is taking place. Missing a deadline can result in the loss of potential tax credits.

Required Documents

When submitting the Film Tax Credit Monthly Reporting Form, several supporting documents are necessary to validate the claims made. These documents may include:

- Invoices for all production-related expenses.

- Payroll records showing wages paid to crew members.

- Contracts with vendors and service providers.

- Any other documentation that supports the expenses reported on the form.

Quick guide on how to complete film tax creditmonthly reportingform08 fform qxd film

Prepare [SKS] seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and electronically sign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Film Tax CreditMonthly ReportingForm08 FFORM qxd Film

Create this form in 5 minutes!

How to create an eSignature for the film tax creditmonthly reportingform08 fform qxd film

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Film Tax Credit Monthly Reporting Form 08 FFORM qxd Film used for?

The Film Tax Credit Monthly Reporting Form 08 FFORM qxd Film is used by production companies to report their qualifying expenses and tax credits associated with film production. This form ensures compliance with state regulations and helps optimize tax benefits, making it essential for financial planning.

-

How can airSlate SignNow assist with the Film Tax Credit Monthly Reporting Form 08 FFORM qxd Film?

airSlate SignNow streamlines the process of preparing and submitting the Film Tax Credit Monthly Reporting Form 08 FFORM qxd Film by providing an easy-to-use platform for eSigning and document management. Our solution helps reduce turnaround times and enhances collaboration among team members involved in the reporting process.

-

Is there a cost associated with using airSlate SignNow for the Film Tax Credit Monthly Reporting Form 08 FFORM qxd Film?

Yes, airSlate SignNow offers flexible pricing plans to suit various business needs, thereby facilitating the eSigning of the Film Tax Credit Monthly Reporting Form 08 FFORM qxd Film. You can choose a plan that best fits your budget while still gaining access to our full suite of features, helping you save time and money.

-

Can airSlate SignNow integrate with other software for managing the Film Tax Credit Monthly Reporting Form 08 FFORM qxd Film?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and project management tools, enhancing your workflow related to the Film Tax Credit Monthly Reporting Form 08 FFORM qxd Film. This integration allows for better data synchronization and ensures that all relevant information is easily accessible.

-

What are the key benefits of using airSlate SignNow for film tax credit reporting?

Using airSlate SignNow for film tax credit reporting offers numerous benefits, including enhanced document security, reduced administrative burden, and improved compliance. By utilizing our platform for the Film Tax Credit Monthly Reporting Form 08 FFORM qxd Film, businesses can focus more on their core activities while ensuring accurate and timely submissions.

-

How secure is airSlate SignNow when handling the Film Tax Credit Monthly Reporting Form 08 FFORM qxd Film?

airSlate SignNow prioritizes security and compliance, employing advanced encryption and authentication measures to protect sensitive data related to the Film Tax Credit Monthly Reporting Form 08 FFORM qxd Film. This ensures that your documents remain confidential and secure throughout the signing process.

-

How quickly can I get started with airSlate SignNow for the Film Tax Credit Monthly Reporting Form 08 FFORM qxd Film?

Getting started with airSlate SignNow is simple and can be done within minutes. You can sign up online, set up your account, and begin preparing your Film Tax Credit Monthly Reporting Form 08 FFORM qxd Film right away, facilitating a rapid onboarding experience.

Get more for Film Tax CreditMonthly ReportingForm08 FFORM qxd Film

- 1 form no 35 see rule 45 appeal to the commissioner

- Model cerere inscriere politie completata form

- To download admission form islamia college peshawar icp edu

- Tpri student summary sheet form

- Laptop checkout form 367911859

- Schedule z additional information required for net nstar

- Petition for an incomplete columbus college of art and design ccad form

- 19 pa code 17 2 consent to use of similar name form

Find out other Film Tax CreditMonthly ReportingForm08 FFORM qxd Film

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy