MO 1120S S Corporation Income Tax Return 2024

What is the MO 1120S S Corporation Income Tax Return

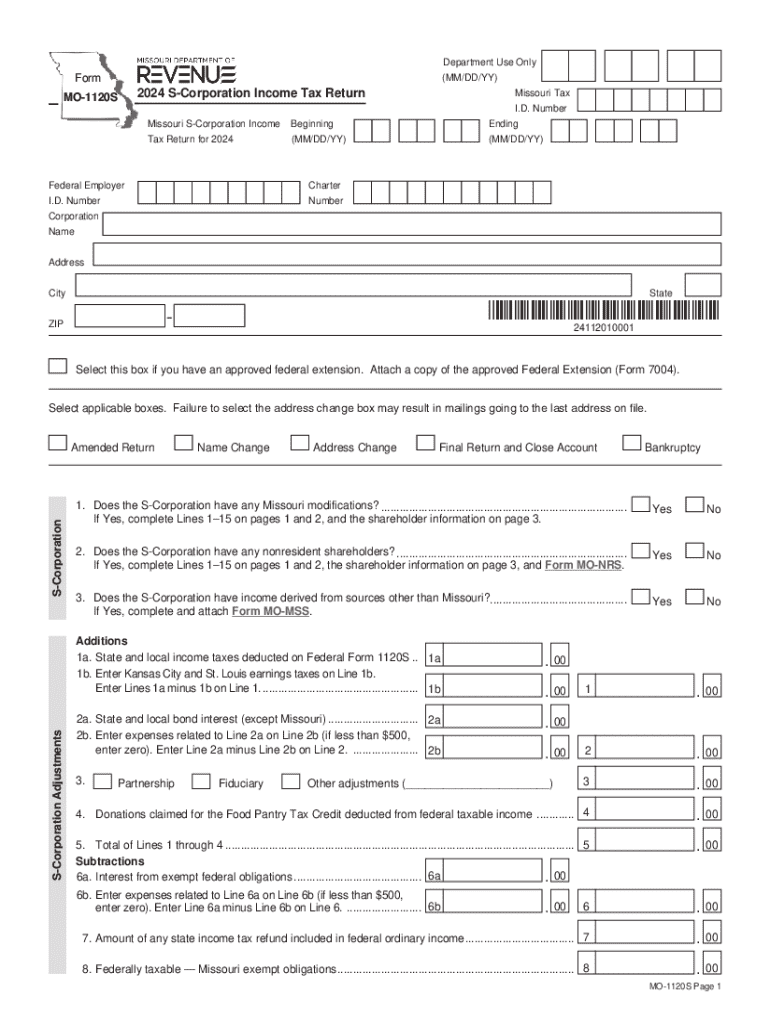

The MO 1120S S Corporation Income Tax Return is a specific tax form used by S corporations operating in Missouri. This form allows S corporations to report their income, deductions, and credits to the state. Unlike traditional corporations, S corporations pass their income directly to shareholders, who then report it on their personal tax returns. The MO 1120S ensures that the state receives the necessary information to assess tax liabilities accurately.

How to use the MO 1120S S Corporation Income Tax Return

Using the MO 1120S form involves several steps. First, gather all financial records, including income statements, balance sheets, and any relevant deductions. Next, download the form from the Missouri Department of Revenue website or obtain a physical copy. Fill out the form with accurate financial data, ensuring all sections are completed. Once the form is filled out, review it for accuracy before submission. It can be submitted online, by mail, or in person, depending on your preference.

Steps to complete the MO 1120S S Corporation Income Tax Return

Completing the MO 1120S form requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including financial statements and previous tax returns.

- Access the MO 1120S form and instructions.

- Fill in the corporation's name, address, and federal identification number.

- Report total income, deductions, and credits accurately in the designated sections.

- Calculate the total tax due based on the information provided.

- Sign and date the form, ensuring that it is submitted by the appropriate deadline.

Filing Deadlines / Important Dates

Filing deadlines for the MO 1120S form are crucial for compliance. Typically, S corporations must file their income tax returns by the fifteenth day of the fourth month following the end of their tax year. For corporations operating on a calendar year, this means the deadline is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to stay informed about any changes in deadlines or requirements from the Missouri Department of Revenue.

Required Documents

To complete the MO 1120S form, several documents are necessary. These include:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income received during the tax year.

- Documentation of any deductions or credits claimed.

- Previous year's tax return for reference.

Penalties for Non-Compliance

Failure to file the MO 1120S form on time or inaccurately can result in penalties. The Missouri Department of Revenue may impose fines for late filings, which can accumulate over time. Additionally, incorrect information may lead to audits or further scrutiny. It is essential for S corporations to ensure compliance with all filing requirements to avoid these penalties and maintain good standing with the state.

Create this form in 5 minutes or less

Find and fill out the correct mo 1120s s corporation income tax return

Create this form in 5 minutes!

How to create an eSignature for the mo 1120s s corporation income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri income tax return form?

The Missouri income tax return form is a document that residents of Missouri must complete to report their income and calculate their tax liability. This form is essential for ensuring compliance with state tax laws and can be easily filled out using airSlate SignNow's eSigning features.

-

How can airSlate SignNow help with the Missouri income tax return form?

airSlate SignNow provides a user-friendly platform that allows you to fill out and eSign your Missouri income tax return form quickly and securely. With our solution, you can streamline the process, ensuring that your documents are completed accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the Missouri income tax return form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Our cost-effective solution ensures that you can manage your Missouri income tax return form without breaking the bank, providing excellent value for businesses and individuals alike.

-

What features does airSlate SignNow offer for completing the Missouri income tax return form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are all beneficial for completing your Missouri income tax return form. These tools enhance efficiency and ensure that your tax documents are handled with care.

-

Can I integrate airSlate SignNow with other software for my Missouri income tax return form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage your Missouri income tax return form alongside your other business tools. This seamless integration helps streamline your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for my Missouri income tax return form?

Using airSlate SignNow for your Missouri income tax return form provides numerous benefits, including time savings, enhanced security, and ease of use. Our platform simplifies the eSigning process, allowing you to focus on what matters most—your business.

-

Is airSlate SignNow secure for handling my Missouri income tax return form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Missouri income tax return form is protected. We utilize advanced encryption and security protocols to safeguard your sensitive information throughout the eSigning process.

Get more for MO 1120S S Corporation Income Tax Return

- It 40es form

- Critical incident report alaska form

- Health and safety checklist for classrooms this checklist will help teachers and support staff to identify common health and form

- Classic division player registration form pa west soccer association

- Houghton elementary school form

- Capital campaign pledge form 219021196

- State of emergency tax relief cdtfa ca gov form

- Cdtfa 501 dg government entity diesel fuel tax return 439503397 form

Find out other MO 1120S S Corporation Income Tax Return

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template