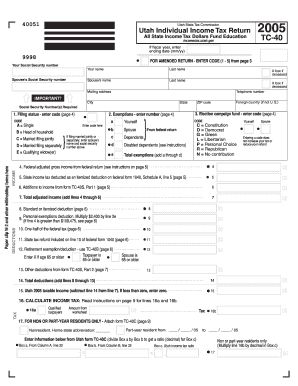

Utah State Income Tax Return Tax Utah Form

What is the Utah State Income Tax Return?

The Utah State Income Tax Return is a form used by residents of Utah to report their income, calculate their tax liability, and claim any deductions or credits they may be eligible for. This document is essential for ensuring compliance with state tax laws and is typically required for individuals, businesses, and other entities earning income within the state. The tax return captures various sources of income, including wages, dividends, and capital gains, and is used to determine the amount of state income tax owed to the Utah State Tax Commission.

Steps to complete the Utah State Income Tax Return

Completing the Utah State Income Tax Return involves several key steps:

- Gather necessary documentation, including W-2 forms, 1099s, and records of other income.

- Determine your filing status, such as single, married filing jointly, or head of household.

- Calculate your total income and any allowable deductions or credits.

- Fill out the appropriate sections of the tax return form, ensuring all information is accurate.

- Review your completed return for any errors or omissions before submission.

- Submit your tax return electronically or by mail, following the specific guidelines provided by the Utah State Tax Commission.

Required Documents

When preparing to file your Utah State Income Tax Return, it is important to collect the following documents:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as interest or dividends.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

- Any relevant tax credit forms, if applicable.

Form Submission Methods

Taxpayers in Utah have several options for submitting their state income tax return:

- Online Submission: Many taxpayers choose to file electronically through approved e-filing software, which can streamline the process and reduce errors.

- Mail Submission: Taxpayers can print their completed tax return and mail it to the appropriate address provided by the Utah State Tax Commission.

- In-Person Submission: Some individuals may prefer to file their returns in person at designated tax offices, where assistance may be available.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Utah State Income Tax Return to avoid penalties:

- The standard deadline for filing is typically April 15 for individual taxpayers.

- Extensions may be available, allowing additional time to file, but any taxes owed must still be paid by the original deadline.

- Check for any specific deadlines related to business entities or special circumstances.

Penalties for Non-Compliance

Failure to comply with Utah tax laws can result in various penalties, including:

- Late Filing Penalty: A percentage of the unpaid tax amount may be charged for each month the return is late.

- Late Payment Penalty: Interest may accrue on any unpaid taxes, increasing the total amount owed.

- Potential Legal Action: Continued non-compliance may lead to further legal consequences, including liens or garnishments.

Quick guide on how to complete utah state income tax return tax utah

Finish [SKS] effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The easiest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure confidential information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether it's via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] and ensure excellent communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Utah State Income Tax Return Tax Utah

Create this form in 5 minutes!

How to create an eSignature for the utah state income tax return tax utah

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What day do they release tax refunds?

When will I receive my tax refund? If the IRS accepts your return by:Direct deposit could be sent as early as:Or your check could be mailed as early as: March 25 April 15 April 22 April 1 April 22 April 29 April 8 April 29 May 6 April 15 May 6 May 138 more rows • Feb 21, 2024

-

How do I find out where my Utah state tax refund is?

Go to the Utah Taxpayer Access Point website , opens in a new tab and click Check your refund status under the Refunds section of the website. You'll be able to search for your refund information. Write down the warrant number. Call us at 801-957-7760 or for faster service, email us at taxpayments@utah.gov.

-

What is Utah state income tax?

Utah Tax Rates, Collections, and Burdens Utah has a flat 4.55 percent individual income tax rate. Utah has a 4.55 percent corporate income tax rate.

-

How long does it take the state to send your tax return?

However, each state has its own process for handling state income taxes. If you expect a refund, your state may take only a few days to process it or the state may take a few months. There is no hard-and-fast rule but you can expect paper returns to take signNowly longer to process than e-filed returns.

-

What refund usually comes first, state or federal?

As you might expect, every state does things a little differently when it comes to issuing tax refunds and it's not possible to say for sure when everyone will receive their state tax refunds. Although, state refunds often come faster than those being processed through the federal system.

-

When can I expect my Utah state tax return?

Individual Income Tax Refund Due to our efforts to protect your identity, please allow 120 days from the date you filed your return or 120 days from March 1, whichever is later, to process your return and refund request.

-

Does Utah direct deposit tax refunds?

If we cannot direct deposit your refund we will mail you a refund check to the address on your return. You can also choose direct deposit if you use Taxpayer Access Point to file your return.

-

Am I required to file a Utah state tax return?

You must file a Utah TC-40 return if you: are a Utah resident or part-year resident who must file a federal return, are a nonresident or part-year resident with income from Utah sources who must file a federal return, or. want a refund of any income tax overpaid.

Get more for Utah State Income Tax Return Tax Utah

- Power in diversity conference registration form january 27 29 st stcloudstate

- Audio basics 1984 davidreaton com form

- Us club soccer tournament hosting application packet msbrillafc form

- 3 an explanation of how the amount due on the monthly billing capeevansville form

- 4589 michigan business tax film credit assignment michigan form

- Tournament hosting application packet usp soccer form

- Medicare enrollment forms ober kaler

- Fileext june 22 form

Find out other Utah State Income Tax Return Tax Utah

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile