Form 3676 2017-2026

What is the Form 3676

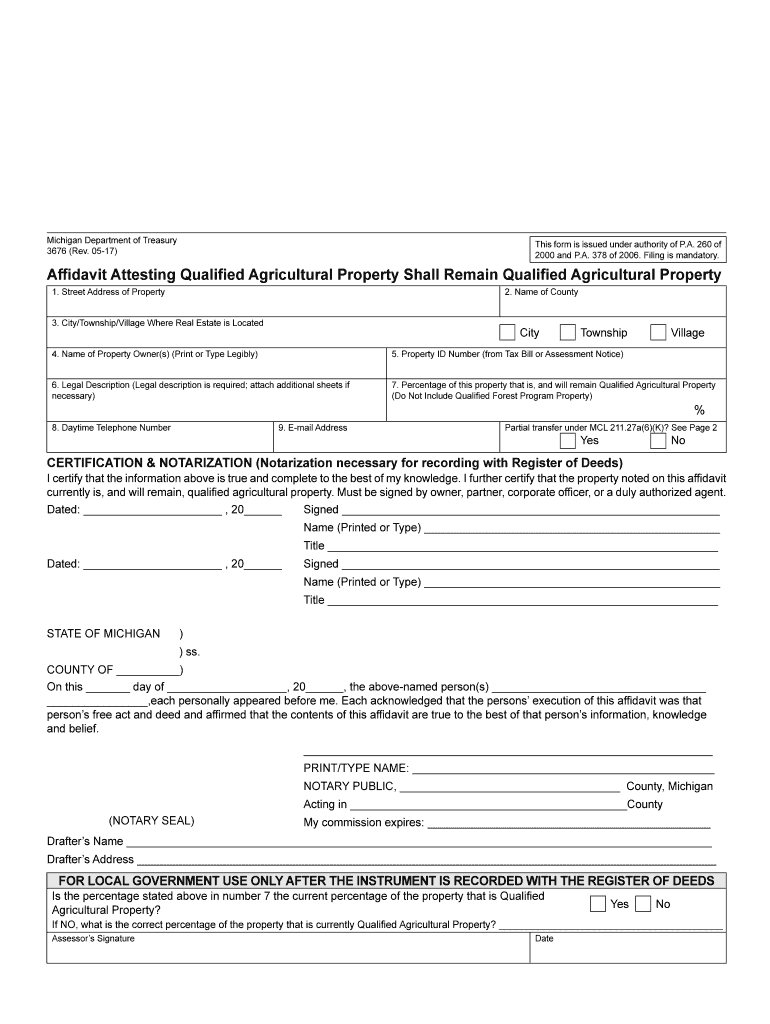

The 2010 Form 3676 is a document utilized primarily for agricultural purposes, allowing farmers and agricultural businesses to report specific information related to their operations. This form is essential for those seeking to claim certain tax benefits or exemptions under U.S. tax law. By completing this form, individuals and entities can affirm their eligibility for various agricultural-related deductions and credits, ensuring compliance with IRS regulations.

How to use the Form 3676

To effectively use the 2010 Form 3676, individuals must first ensure they meet the eligibility criteria outlined by the IRS. Once eligibility is confirmed, the form can be filled out with the necessary information regarding agricultural activities. This includes details about the type of agricultural production, the scale of operations, and any relevant financial data. After completing the form, it should be submitted to the appropriate tax authority, either electronically or via mail, depending on the specific instructions provided by the IRS.

Steps to complete the Form 3676

Completing the 2010 Form 3676 involves several clear steps:

- Gather all necessary documentation related to your agricultural activities, including income statements and expense records.

- Download the latest version of the 2010 Form 3676 from a reliable source.

- Fill in the required fields with accurate information, ensuring all data corresponds to your records.

- Review the completed form for any errors or omissions.

- Submit the form according to IRS guidelines, ensuring it is sent before the specified deadlines.

Legal use of the Form 3676

The 2010 Form 3676 is legally recognized for use in claiming agricultural tax benefits. It is crucial for users to understand the legal implications of the information provided on the form. Misrepresentation or inaccuracies can lead to penalties or disqualification from tax benefits. Therefore, it is advisable to consult with a tax professional or legal advisor to ensure compliance with all applicable laws and regulations when using this form.

Filing Deadlines / Important Dates

Filing deadlines for the 2010 Form 3676 can vary based on individual circumstances and the specific tax year. Generally, forms must be submitted by the annual tax filing deadline, which is typically April 15 for most taxpayers. However, agricultural producers may have different deadlines based on their fiscal year or specific tax situations. It is essential to stay informed about any changes in deadlines announced by the IRS to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The 2010 Form 3676 can be submitted through various methods. Taxpayers may choose to file online using IRS-approved e-filing software, which often simplifies the process and provides immediate confirmation of submission. Alternatively, the form can be mailed directly to the appropriate tax office, ensuring it is sent well before the deadline. In-person submission may also be an option at designated IRS offices, although this method may require an appointment.

Quick guide on how to complete form 3676 affidavit attesting that qualified state of michigan

Your assistance manual on how to prepare your Form 3676

If you're wondering how to create and transmit your Form 3676, here are some brief guidelines on how to simplify tax filing.

To begin, simply register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that enables you to modify, draft, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and revisit to adjust responses where necessary. Optimize your tax management with advanced PDF editing, eSigning, and intuitive sharing.

Follow these steps to finish your Form 3676 in a matter of minutes:

- Establish your account and start working on PDFs within minutes.

- Utilize our directory to locate any IRS tax document; explore various forms and schedules.

- Click Get form to access your Form 3676 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and correct any errors.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes with airSlate SignNow. Keep in mind that submitting by paper can increase errors and delay refunds. Of course, before e-filing your taxes, consult the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct form 3676 affidavit attesting that qualified state of michigan

FAQs

-

How do I get admission to TU if I have qualified for the JEE Mains? I am from Assam, and I want to do so under the state quota. Will there be any state rank list to be released, or do I have fill out any form?

If you haven't filled up any form then I am not sure if you are gonna get any chance now….This is the procedure they follow--- after you have qualified in JEE-MAINS. You have to fill up a form through which they come to know that you have qualified. Then they give a list of student according to their ranks (both AIR & state ranks). Then according to that there's three list A,B & C in which there's all the quota and all. And they relaese one list in general. According to that list theu release a date of your counselling .Note- The form fillup is must.

-

What are the forms of the various universities and states that need to be filled out after the NEET results are released?

For All India Quota and Deemed universities online counselling will be done by Medical Counselling Committee(MCC) Visit NEET UG 2016 Registration starts on 3rd July 2017.For state quota and private medical/dental colleges Counselling will be done by respective state authorities. List is given on MCI website. Visit Official Website of Medical Council of India.Karnataka Registration started on 3rd June and has been extended till 26th June 2017.(Initially the last date was mentioned as 8th, then they extended till 15th, again got extended till 20th, Now it has been extended till 26th).Hope this helps.

-

How does one run for president in the united states, is there some kind of form to fill out or can you just have a huge fan base who would vote for you?

If you’re seeking the nomination of a major party, you have to go through the process of getting enough delegates to the party’s national convention to win the nomination. This explains that process:If you’re not running as a Democrat or Republican, you’ll need to get on the ballot in the various states. Each state has its own rules for getting on the ballot — in a few states, all you have to do is have a slate of presidential electors. In others, you need to collect hundreds or thousands of signatures of registered voters.

-

What’s the title of a person who can take a complex Excel spreadsheet and turn it into a user friendly, intuitive form that’s easy to fill out? How can I hire someone with those skills? It contains , financial, quoting & engineering data.

Look for an SaaS developer, someone with JavaScript, PHP, and MySQL skills to create Cloud-hosted browser-based forms and reports who also has a modicum of financial analysis background.Dumping obsolete Excel client server architecture as soon as you can will be the best thing you can do to bring your operation into the 21st Century.

-

If you were the President/PM and/or Senator that oversaw the United States of America and Japan combining to form a nation of 600+ million people, how would you ensure a good transition and how would you like the new culture to turn out?

As someone who has lived in both countries, I simply cannot begin to fatham how the U.S. and Japan would become a single united culture. U.S. and Japanese culture is so far apart in many ways.But, if I HAD to do it, here is how I would do it:First, the government would be modeled after the US government with the same constitution.Second, I would drastically…DRASTICALLY reduce the power of the federal government. Every administrative agency except those involved with law enforcement and tax collection would be gone and all responsibility would go to the states. Basically, we have the FBI, CIA, USCIS, IRS, and the like. We would still have the military as well. I would also etch in the Constitution that this is all the federal government will ever be responsible for: no growth in federal power. The federal government will only be responsible for protecting the God-given freedoms of its citizens (both internally and externally), and that’s it. All other powers will be the responsibility of the state.Third, Japan would be the 51st state.And that’s that. The Japanese will be able to maintain their cultural norms without government interference. At the same time, the rest of America can do the same.

Create this form in 5 minutes!

How to create an eSignature for the form 3676 affidavit attesting that qualified state of michigan

How to create an eSignature for your Form 3676 Affidavit Attesting That Qualified State Of Michigan in the online mode

How to make an eSignature for the Form 3676 Affidavit Attesting That Qualified State Of Michigan in Google Chrome

How to make an electronic signature for signing the Form 3676 Affidavit Attesting That Qualified State Of Michigan in Gmail

How to create an eSignature for the Form 3676 Affidavit Attesting That Qualified State Of Michigan right from your mobile device

How to make an eSignature for the Form 3676 Affidavit Attesting That Qualified State Of Michigan on iOS

How to generate an electronic signature for the Form 3676 Affidavit Attesting That Qualified State Of Michigan on Android

People also ask

-

What is the 2010 form 3676 agricultural?

The 2010 form 3676 agricultural is a tax form used by agricultural producers in the U.S. to claim certain exemptions. This form helps in simplifying tax deductions related to agricultural activities, making it essential for eligible businesses. Understanding this form can signNowly benefit agribusinesses.

-

How can airSlate SignNow help with the 2010 form 3676 agricultural?

airSlate SignNow provides an efficient way to prepare, sign, and send the 2010 form 3676 agricultural electronically. With features like templates and eSignature, you can streamline your workflow and ensure your documents are properly handled. This eliminates the hassle of paper forms and speeds up the submission process.

-

What are the pricing options for using airSlate SignNow with the 2010 form 3676 agricultural?

airSlate SignNow offers several pricing plans that are tailored to meet diverse business needs. Depending on the features you require for handling documents like the 2010 form 3676 agricultural, you can choose from individual, business, or enterprise plans. All plans provide the core functionalities you need at a cost-effective rate.

-

Are there any specific features in airSlate SignNow for managing the 2010 form 3676 agricultural?

Yes, airSlate SignNow has specific features designed for managing the 2010 form 3676 agricultural effectively. These include customizable templates, automated workflows, and secure storage. By leveraging these tools, you can ensure compliance and accuracy when handling this form.

-

Can I integrate airSlate SignNow with other applications when using the 2010 form 3676 agricultural?

Absolutely! airSlate SignNow offers seamless integrations with various applications, enhancing your ability to manage the 2010 form 3676 agricultural. Whether you use accounting software, customer relationship management tools, or cloud storage services, integration simplifies your document management process.

-

What are the benefits of eSigning the 2010 form 3676 agricultural with airSlate SignNow?

Signing the 2010 form 3676 agricultural with airSlate SignNow offers numerous benefits, including speed and convenience. eSigning reduces turnaround time and helps avoid delays often associated with traditional signing methods. Additionally, it provides a secure and legally binding solution, adding peace of mind to your process.

-

How secure is the airSlate SignNow platform when dealing with the 2010 form 3676 agricultural?

The airSlate SignNow platform prioritizes security, particularly for crucial documents like the 2010 form 3676 agricultural. With features like encryption, secure cloud storage, and compliance with industry regulations, your documents remain protected. You can trust airSlate SignNow for safe document management and eSigning.

Get more for Form 3676

Find out other Form 3676

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT