Alaska Mining License Tax Return Short Form 2013

What is the Alaska Mining License Tax Return Short Form

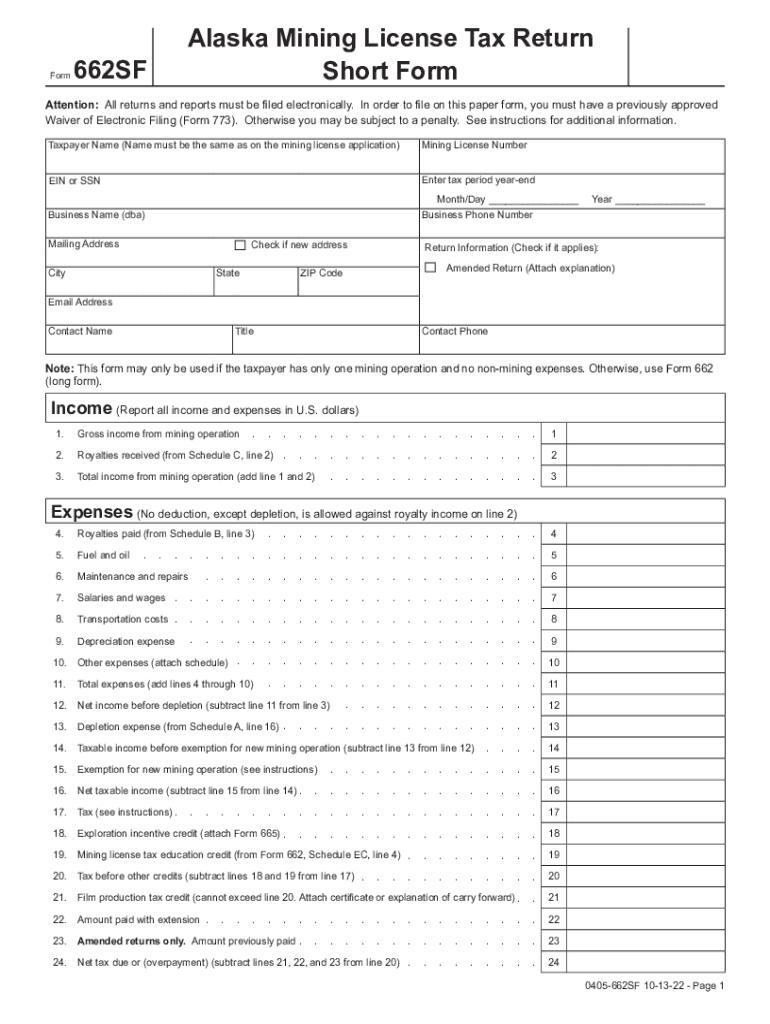

The Alaska Mining License Tax Return Short Form, often referred to as the 662sf form, is a simplified tax document used by mining companies operating in Alaska. This form is specifically designed for entities engaged in mining activities to report their gross income and calculate the associated mining license tax. The short form streamlines the reporting process for smaller operations, allowing them to fulfill their tax obligations efficiently while ensuring compliance with state regulations.

How to use the Alaska Mining License Tax Return Short Form

To use the Alaska Mining License Tax Return Short Form effectively, taxpayers should first gather all necessary financial information related to their mining operations. This includes records of gross income, allowable deductions, and any other relevant financial data. Once the information is compiled, the taxpayer can fill out the form, ensuring all sections are completed accurately. After filling out the form, it should be reviewed for any errors before submission to the appropriate state tax authority.

Steps to complete the Alaska Mining License Tax Return Short Form

Completing the Alaska Mining License Tax Return Short Form involves several key steps:

- Gather financial records, including income statements and expense reports related to mining activities.

- Obtain the 662sf form from the Alaska Department of Revenue or authorized sources.

- Fill in the required information, including gross income and applicable deductions.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated filing deadline, either online or via mail.

Required Documents

When completing the Alaska Mining License Tax Return Short Form, several documents are essential:

- Gross income statements from mining operations.

- Expense reports detailing allowable deductions.

- Previous tax returns for reference, if applicable.

- Any supporting documentation that verifies income and expenses.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines for the Alaska Mining License Tax Return Short Form. Typically, the form must be submitted by June 30 of the year following the tax year. However, taxpayers should always verify the specific deadlines each year, as they may vary based on state regulations or changes in tax law.

Penalties for Non-Compliance

Failing to file the Alaska Mining License Tax Return Short Form on time can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action for continued non-compliance. It is essential for mining operators to understand these consequences and ensure timely submission of their tax returns to avoid unnecessary financial burdens.

Quick guide on how to complete alaska mining license tax return short form

Complete Alaska Mining License Tax Return Short Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed agreements, as you can locate the appropriate template and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Alaska Mining License Tax Return Short Form on any device using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and electronically sign Alaska Mining License Tax Return Short Form with ease

- Locate Alaska Mining License Tax Return Short Form and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Alaska Mining License Tax Return Short Form and ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska mining license tax return short form

Create this form in 5 minutes!

How to create an eSignature for the alaska mining license tax return short form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Alaska mining license tax return?

An Alaska mining license tax return is a required document that mining businesses in Alaska must submit to report their taxable income from mining operations. It includes details such as gross income, deductions, and taxable income. Submitting a correct return ensures compliance with state regulations and helps avoid penalties.

-

How can airSlate SignNow help with my Alaska mining license tax return?

airSlate SignNow provides an easy-to-use platform to electronically sign and manage your Alaska mining license tax return documents. By streamlining the eSigning process, it reduces the time needed for document preparation and submission. This efficiency allows you to focus on your mining operations instead of paperwork.

-

What features does airSlate SignNow offer for managing tax returns?

airSlate SignNow offers features such as document templates, secure eSignatures, and collaboration tools. These features enhance your ability to prepare, edit, and finalize your Alaska mining license tax return efficiently. Additionally, it allows for easy sharing and tracking of documents, ensuring everyone stays informed.

-

Is there a cost associated with using airSlate SignNow for my Alaska mining license tax return?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be budget-friendly. The pricing plans vary based on the features you need, allowing you to choose an option that fits your budget. Investing in this solution can save you money in the long run by simplifying your Alaska mining license tax return process.

-

Can airSlate SignNow integrate with my existing accounting software for tax returns?

Absolutely! airSlate SignNow offers integrations with various accounting software, helping you streamline your Alaska mining license tax return filings. These integrations allow for seamless data transfer, eliminating manual entry errors and ensuring your reports are up-to-date and accurate.

-

What are the benefits of eSigning my Alaska mining license tax return?

ESigning your Alaska mining license tax return with airSlate SignNow offers numerous benefits, including speed and convenience. You can sign documents from anywhere, anytime, which is ideal for busy mining operations. Additionally, eSigning helps to ensure that your records are secure and legally binding.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like the Alaska mining license tax return. The platform uses advanced encryption and secure data storage solutions to protect your information. You can rest assured that your documents are safe from unauthorized access.

Get more for Alaska Mining License Tax Return Short Form

- 35 05r suborddoc form

- Real estate open book examsocial science homework help form

- When recorded return to real estate contract long form

- 50 05r mtgdoc form

- Bill of sale form oklahoma release of mortgage templates

- Dc law library 4281802 procedures for release of form

- Quitclaim deed what are the tax implicationsmoney form

- The judgment creditor in an action form

Find out other Alaska Mining License Tax Return Short Form

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later