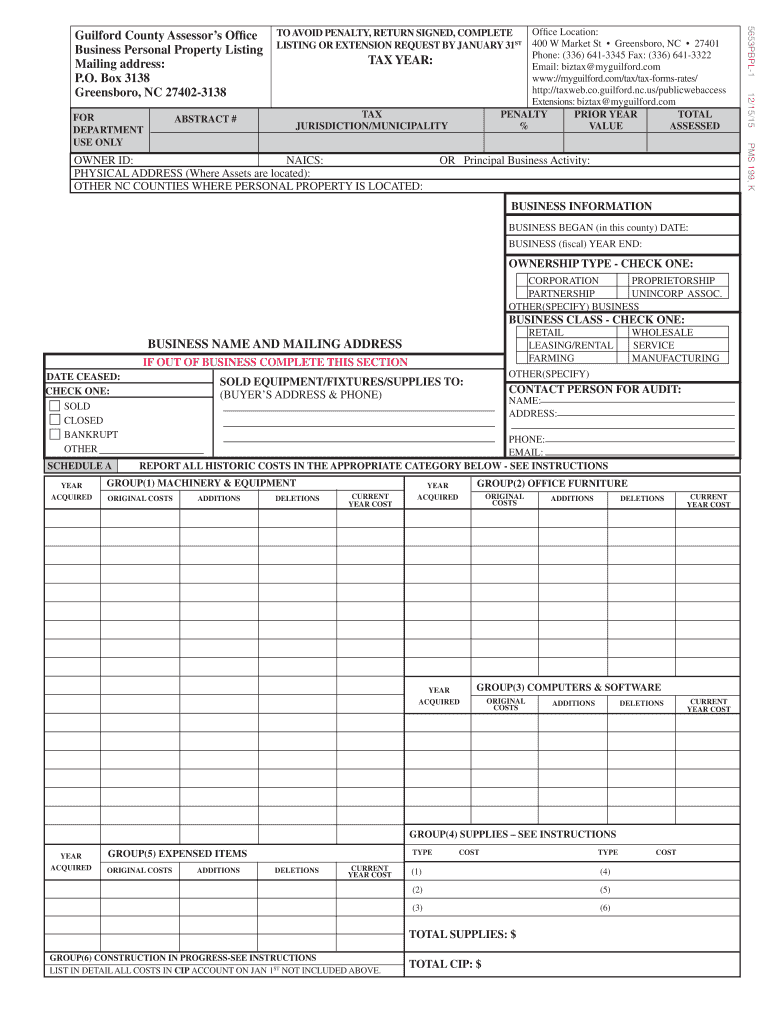

Guilford County Property Tax Exemption Form 2015

What is the Guilford County Property Tax Exemption Form

The Guilford County Property Tax Exemption Form is a crucial document designed to assist eligible property owners in claiming exemptions on their property taxes. This form is essential for individuals who meet specific criteria, such as seniors, disabled persons, or veterans, allowing them to reduce their tax burden. By submitting this form, taxpayers can ensure they receive the financial relief they qualify for under local and state laws.

How to use the Guilford County Property Tax Exemption Form

Using the Guilford County Property Tax Exemption Form involves a straightforward process. First, ensure that you meet the eligibility requirements for the exemption. Next, download the form from the appropriate county website or obtain a physical copy from the local tax office. Fill out the form accurately, providing all required information, including personal details and property specifics. Once completed, submit the form according to the instructions provided, either online, by mail, or in person.

Steps to complete the Guilford County Property Tax Exemption Form

Completing the Guilford County Property Tax Exemption Form requires careful attention to detail. Follow these steps:

- Gather necessary documentation, such as proof of age, disability, or veteran status.

- Download or obtain the form from the local tax office.

- Fill in your personal information, including name, address, and property details.

- Provide any additional information required for the exemption you are applying for.

- Review your form for accuracy and completeness.

- Submit the form according to the specified submission method.

Eligibility Criteria

To qualify for the Guilford County Property Tax Exemption, applicants must meet certain eligibility criteria. Common requirements include being a senior citizen, a person with disabilities, or a veteran. Additionally, applicants may need to demonstrate financial need or meet specific income limits. It is important to review the detailed eligibility guidelines provided by the Guilford County tax authority to ensure compliance.

Required Documents

When completing the Guilford County Property Tax Exemption Form, several documents may be required to support your application. These typically include:

- Proof of age or disability, such as a birth certificate or medical documentation.

- Veteran status verification, if applicable.

- Income verification documents, such as tax returns or pay stubs.

- Property ownership documents, including a deed or tax bill.

Form Submission Methods

The Guilford County Property Tax Exemption Form can be submitted through various methods, ensuring convenience for applicants. Options typically include:

- Online submission through the county's tax office website.

- Mailing the completed form to the designated tax office address.

- In-person submission at the local tax office during business hours.

Quick guide on how to complete guilford county property tax exemption form 2015

Your assistance manual on how to prepare your Guilford County Property Tax Exemption Form

If you’re curious about how to finalize and send your Guilford County Property Tax Exemption Form, here are some concise instructions on how to make tax reporting easier.

To begin, you just need to create your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that allows you to edit, draft, and finish your income tax documents with ease. With its editor, you can switch between text, check boxes, and eSignatures and revisit to modify answers as necessary. Optimize your tax administration with advanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your Guilford County Property Tax Exemption Form in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Use our directory to find any IRS tax form; explore variations and schedules.

- Click Obtain form to access your Guilford County Property Tax Exemption Form in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to affix your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Make the most of this manual to submit your taxes electronically with airSlate SignNow. Please keep in mind that filing on paper can lead to mistakes in returns and postpone refunds. Naturally, before e-filing your taxes, check the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct guilford county property tax exemption form 2015

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

If my father left me his house and property in Texas, San Jacinto county and was tax exempt on his property taxes how do I know what taxes to pay? The house is still in his name.

There is no blanket property tax exemption in Texas. There are a number of possible partial exemptions that will reduce the taxes due, however those all expired with him.The county tax collector can tell you what taxes are outstanding. You need to notify the tax assessor's office of his death. You also need to go through probate to get the deed put in your name.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

Why is it so hard to figure out how many exemptions and allowances one should claim on tax forms? Why isn't this specified clearly?

You should only filed the number of exemptions and/or allowances truly reflected in your household. If you are single, check Single, then it's one exemption, you. If you are Married filing Jointly, that is two exemptions(2 people) plus one exemption for each child). Or other person considered a dependent.Hope that helps. Exemptions are based on number of people in your household you can legally claim as dependents. Allowances are item that come off your taxable income for things like retirement places, childcare, etc.If you have further questions, it's best to contact a tax professional in your area. Most do free consultation, charging only for work we do for clients.

Create this form in 5 minutes!

How to create an eSignature for the guilford county property tax exemption form 2015

How to create an electronic signature for the Guilford County Property Tax Exemption Form 2015 online

How to create an eSignature for your Guilford County Property Tax Exemption Form 2015 in Chrome

How to generate an eSignature for putting it on the Guilford County Property Tax Exemption Form 2015 in Gmail

How to create an electronic signature for the Guilford County Property Tax Exemption Form 2015 straight from your smart phone

How to make an eSignature for the Guilford County Property Tax Exemption Form 2015 on iOS devices

How to create an electronic signature for the Guilford County Property Tax Exemption Form 2015 on Android OS

People also ask

-

What is the Guilford County Property Tax Exemption Form?

The Guilford County Property Tax Exemption Form is a document that allows eligible homeowners in Guilford County to claim a tax exemption for their property. This form must be completed and submitted to the local tax office to reduce the taxable value of your property, granting potential savings on your property taxes.

-

How can airSlate SignNow assist with the Guilford County Property Tax Exemption Form?

airSlate SignNow provides a seamless platform for filling out, signing, and submitting the Guilford County Property Tax Exemption Form electronically. Our solution ensures that the process is quick, efficient, and legally compliant, simplifying the otherwise cumbersome paperwork.

-

What features does airSlate SignNow offer for processing the Guilford County Property Tax Exemption Form?

airSlate SignNow offers features such as customizable templates, eSigning capabilities, and secure document storage, all of which enhance the experience of handling the Guilford County Property Tax Exemption Form. Users can easily access their documents, track signers, and ensure everything is completed on time.

-

Is there a cost associated with using airSlate SignNow for the Guilford County Property Tax Exemption Form?

airSlate SignNow offers flexible pricing plans that cater to various needs, including both individual and business users. While the basic plan may cover your needs, additional features for managing the Guilford County Property Tax Exemption Form may require an upgraded plan for optimal use.

-

What benefits can I expect from using airSlate SignNow for my tax exemption forms?

Using airSlate SignNow for your Guilford County Property Tax Exemption Form allows for faster processing times and reduced errors through its electronic signing process. Furthermore, it provides audit trails for accountability and compliance, ensuring your submissions are tracked and verifiable.

-

Can I integrate airSlate SignNow with other software when working on the Guilford County Property Tax Exemption Form?

Yes, airSlate SignNow supports integration with various third-party applications, making it easier to manage your documents alongside other tools. This capability enhances the workflow for processing the Guilford County Property Tax Exemption Form, enabling greater efficiency and coordination.

-

How secure is the information submitted through the Guilford County Property Tax Exemption Form on airSlate SignNow?

airSlate SignNow prioritizes security with features like encryption and secure access protocols to protect your data. Any information submitted with the Guilford County Property Tax Exemption Form is safeguarded, giving users peace of mind when handling sensitive financial documents.

Get more for Guilford County Property Tax Exemption Form

- Clts waivers claim form jefferson county jeffersoncountywi

- What does form 4924 rev 05 13

- Universit de tunis el manar formulaire de stage du fst rnu

- Beaufort county treasurer form

- Boy scout troop 17 totin39 chip quiz boy scout troop 17 roanoke troop17roanoke form

- Individualized service plan form

- Landscape irrigation auditor blank worksheets form

- The international center for reiki training presents an compassionatereiki form

Find out other Guilford County Property Tax Exemption Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document