Nebraska Dept of Revenue Change of Address Form 22a 2016

What is the Nebraska Dept Of Revenue Change Of Address Form 22a

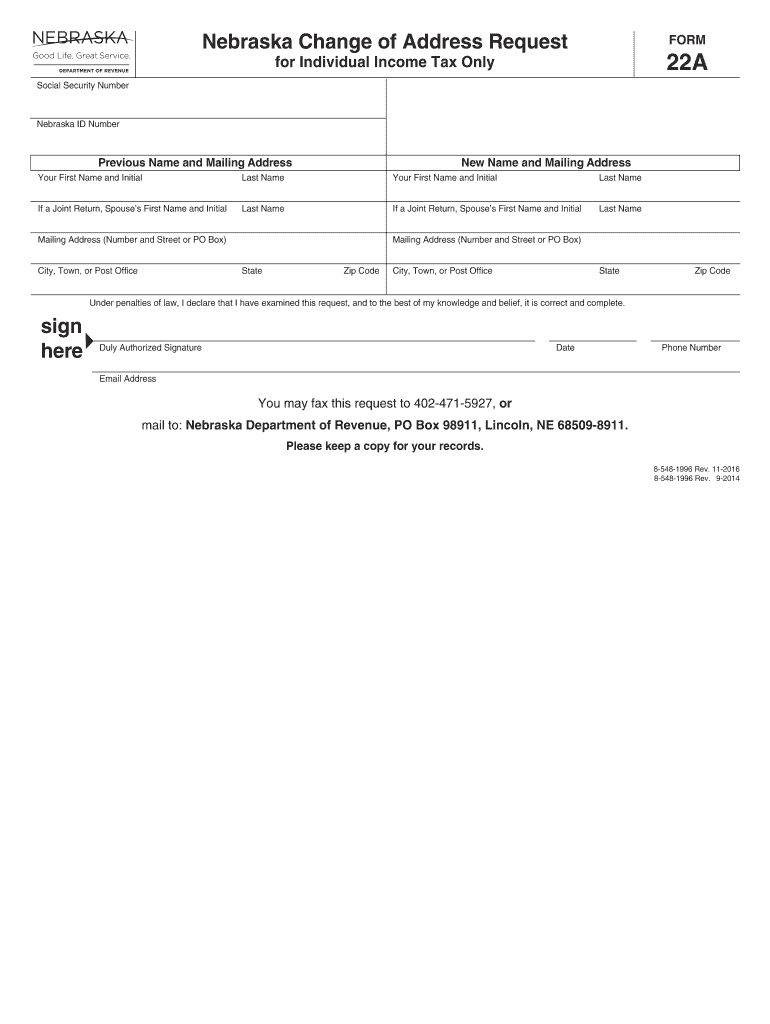

The Nebraska Dept of Revenue Change of Address Form 22a is a specific document used by residents of Nebraska to officially update their address with the state tax authority. This form is essential for ensuring that all tax-related correspondence, including notices and refunds, are sent to the correct address. It is particularly important for individuals who have recently moved or changed their mailing address to maintain accurate records with the Nebraska Department of Revenue.

How to use the Nebraska Dept Of Revenue Change Of Address Form 22a

To use the Nebraska Dept of Revenue Change of Address Form 22a, individuals must first obtain the form, which can be filled out online or printed for manual completion. The form requires basic personal information, including the previous address, new address, and identification details such as Social Security numbers. After completing the form, it should be submitted according to the specified submission methods to ensure the address change is processed promptly.

Steps to complete the Nebraska Dept Of Revenue Change Of Address Form 22a

Completing the Nebraska Dept of Revenue Change of Address Form 22a involves several straightforward steps:

- Access the form through the Nebraska Department of Revenue website or other official sources.

- Fill in your personal information, including your name, Social Security number, and both your previous and new addresses.

- Review the information for accuracy to avoid any delays in processing.

- Sign and date the form to validate your request.

- Submit the completed form via the preferred method, either online, by mail, or in person.

Legal use of the Nebraska Dept Of Revenue Change Of Address Form 22a

The Nebraska Dept of Revenue Change of Address Form 22a is legally recognized as a valid means for taxpayers to inform the state of their address changes. Proper use of this form ensures compliance with state tax regulations and helps avoid potential penalties or issues with tax filings. It is crucial for taxpayers to understand that failing to update their address may result in missed communications regarding tax obligations or refunds.

Required Documents

When completing the Nebraska Dept of Revenue Change of Address Form 22a, no additional documents are typically required. However, it is advisable to have personal identification information, such as your Social Security number, readily available. This information helps verify your identity and ensures the accuracy of the address change being processed.

Form Submission Methods

The Nebraska Dept of Revenue Change of Address Form 22a can be submitted through various methods, providing flexibility for taxpayers. The available submission options include:

- Online: Many taxpayers prefer to submit the form electronically through the Nebraska Department of Revenue’s online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided on the form.

- In-Person: Taxpayers may also choose to deliver the form in person at their local Nebraska Department of Revenue office.

Quick guide on how to complete ne form request 2016 2019

Your assistance manual on how to prepare your Nebraska Dept Of Revenue Change Of Address Form 22a

If you wish to learn how to generate and submit your Nebraska Dept Of Revenue Change Of Address Form 22a, here are a few brief instructions to make tax submission less challenging.

To begin, you simply need to set up your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, create, and finalize your tax documents with ease. With its editor, you can switch between text, checkboxes, and eSignatures and return to adjust details as necessary. Simplify your tax handling with advanced PDF editing, eSigning, and intuitive sharing.

Follow these steps to finalize your Nebraska Dept Of Revenue Change Of Address Form 22a in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Nebraska Dept Of Revenue Change Of Address Form 22a in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Select the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make use of this manual to electronically file your taxes with airSlate SignNow. Be aware that submitting on paper can lead to return errors and delay refunds. Of course, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ne form request 2016 2019

FAQs

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

Do military personnel need money to fill out a leave request form?

It’s great that you asked. The answer is NO. Also, whatever you are doing with this person, STOP!Bloody hell, how many of these “I need your money to see you sweetheart” scammers are there? It’s probably that or someone totally misunderstood something.All military paperwork is free! However, whether their commander or other sort of boss will let them return or not depends on the nature of duty, deployment terms, and other conditions. They can’t just leave on a whim, that would be desertion and it’s (sorry I don’t know how it works in America) probably punishable by firing (as in termination of job) or FIRING (as in execution)!!!Soldiers are generally paid enough to fly commercial back to home country.Do not give these people any money or any contact information! If you pay him, you’ll probably get a receipt from Nigeria and nothing else.

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

What is the new procedure in filling out the AIIMS 2019 form? What is the last date to fill out its form?

AIIMS has introduced the PAAR facility (Prospective Applicant Advanced Registration) for filling up the application form. Through PAAR facility, the process application form is divided into two steps- basic registration and final registration.Basic Registration:On this part you have to fill up your basic details like Full name, parent’s name, date of birth, gender, category, state of domicile, ID proof/number and others. No paAIIMS Final RegistrationA Code will be issued to the candidates who complete the Basic Registration. You have to use the same code to login again and fill the form.At this stage, candidates are required to fill out the entire details of their personal, professional and academic background. Also, they have to submit the application fee as per their category.Here I have explained the two steps for AIIMS 2019 form.For more details visit aim4aiims’s website:About AIIMS Exam 2019

Create this form in 5 minutes!

How to create an eSignature for the ne form request 2016 2019

How to generate an electronic signature for the Ne Form Request 2016 2019 in the online mode

How to make an eSignature for the Ne Form Request 2016 2019 in Chrome

How to generate an eSignature for putting it on the Ne Form Request 2016 2019 in Gmail

How to create an electronic signature for the Ne Form Request 2016 2019 straight from your smartphone

How to generate an electronic signature for the Ne Form Request 2016 2019 on iOS

How to generate an electronic signature for the Ne Form Request 2016 2019 on Android devices

People also ask

-

What is the Nebraska Dept Of Revenue Change Of Address Form 22a?

The Nebraska Dept Of Revenue Change Of Address Form 22a is a document that allows individuals or businesses to officially update their address with the Nebraska Department of Revenue. This form is essential for ensuring that you receive important tax information and notices at your new address.

-

How can I complete the Nebraska Dept Of Revenue Change Of Address Form 22a easily?

You can complete the Nebraska Dept Of Revenue Change Of Address Form 22a easily using airSlate SignNow's digital signing platform. Our user-friendly interface allows you to fill out the form, sign it electronically, and submit it directly to the Nebraska Department of Revenue without any hassle.

-

Is there a fee associated with submitting the Nebraska Dept Of Revenue Change Of Address Form 22a?

There is no fee for submitting the Nebraska Dept Of Revenue Change Of Address Form 22a itself, but ensure you check with the Nebraska Department of Revenue for any related fees. Using airSlate SignNow, you can manage your documents efficiently at a minimal cost, making it an economical choice.

-

What features does airSlate SignNow offer for managing the Nebraska Dept Of Revenue Change Of Address Form 22a?

airSlate SignNow offers several features for managing the Nebraska Dept Of Revenue Change Of Address Form 22a, including customizable templates, electronic signatures, and secure document storage. These features streamline the process, making it faster and more efficient for users to manage their address changes.

-

Can I track the status of my Nebraska Dept Of Revenue Change Of Address Form 22a with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Nebraska Dept Of Revenue Change Of Address Form 22a in real-time. You will receive notifications once your document is signed and submitted, providing peace of mind that your address change is being processed.

-

What are the benefits of using airSlate SignNow for the Nebraska Dept Of Revenue Change Of Address Form 22a?

Using airSlate SignNow for the Nebraska Dept Of Revenue Change Of Address Form 22a offers several benefits, including enhanced security, time savings, and convenience. Our platform ensures that your documents are stored securely and accessible from anywhere, making it easy to manage your tax-related paperwork.

-

Does airSlate SignNow integrate with other software for filing the Nebraska Dept Of Revenue Change Of Address Form 22a?

Yes, airSlate SignNow integrates seamlessly with various software applications, allowing you to file the Nebraska Dept Of Revenue Change Of Address Form 22a alongside your other business processes. This integration enhances workflow efficiency and minimizes errors during the submission process.

Get more for Nebraska Dept Of Revenue Change Of Address Form 22a

- College application v2017 xlsx de la salle araneta university form

- Maryland form

- Liveandworkwell com release of information form 5546034

- Aec rental company form

- Chapter 21 alcohol vocabulary practice answer key form

- H2053 form

- Presidentceo evaluation form

- Job application maine central institute mci school form

Find out other Nebraska Dept Of Revenue Change Of Address Form 22a

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe