Nebraska Change of Address Request for Individual Incom 2021-2026

What is the Nebraska Change of Address Request for Individual Income?

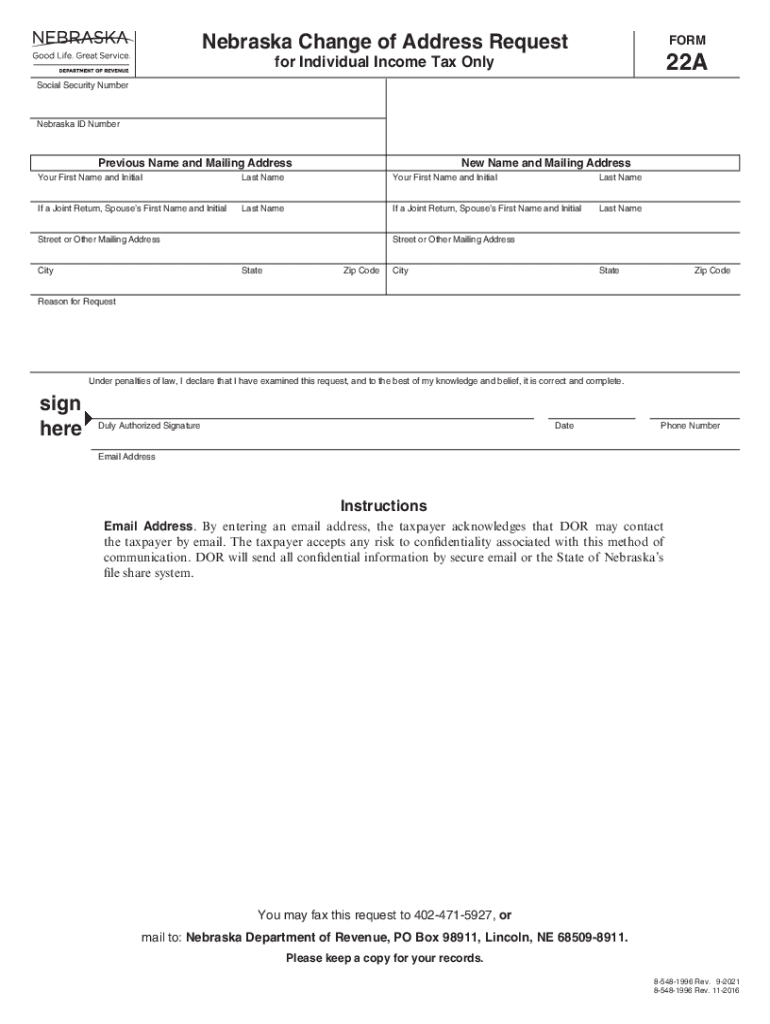

The Nebraska Change of Address Request for Individual Income, commonly referred to as the Nebraska Form 22A, is a vital document used by residents to update their address with the Nebraska Department of Revenue. This form is essential for individuals who have changed their residence and need to ensure that their tax records reflect the new address. Accurate address information is crucial for receiving important tax-related correspondence and ensuring compliance with state tax laws.

Steps to Complete the Nebraska Change of Address Request for Individual Income

Completing the Nebraska Form 22A involves several straightforward steps:

- Obtain the form: The Nebraska Form 22A can be downloaded from the Nebraska Department of Revenue website or filled out online.

- Fill out personal information: Provide your full name, old address, and new address. Ensure that all information is accurate to avoid delays.

- Review the form: Double-check all entries for accuracy, including your Social Security number and any other identifying information.

- Sign and date the form: Your signature is necessary to validate the request. Make sure to date the form to indicate when the request was made.

- Submit the form: You can submit the completed form online, by mail, or in person at your local Department of Revenue office.

Legal Use of the Nebraska Change of Address Request for Individual Income

The Nebraska Form 22A serves a legal purpose in maintaining accurate tax records with the state. Submitting this form ensures that the Nebraska Department of Revenue has your correct address on file, which is essential for the delivery of tax documents, notices, and refunds. Failure to update your address may lead to missed communications and potential penalties for non-compliance with state tax regulations.

Required Documents for the Nebraska Change of Address Request for Individual Income

When filling out the Nebraska Form 22A, you typically do not need to submit additional documents. However, having certain information on hand can facilitate the process:

- Your Social Security number

- Your previous address

- Your new address

- Any prior correspondence from the Nebraska Department of Revenue

Form Submission Methods for the Nebraska Change of Address Request for Individual Income

The Nebraska Form 22A can be submitted through various methods to accommodate different preferences:

- Online: Fill out and submit the form through the Nebraska Department of Revenue's online portal.

- By Mail: Print the completed form and send it to the appropriate address listed on the form.

- In-Person: Visit your local Department of Revenue office to submit the form directly.

Filing Deadlines for the Nebraska Change of Address Request for Individual Income

While there are no strict deadlines for submitting the Nebraska Form 22A, it is advisable to update your address as soon as possible after a move. Timely submission helps prevent issues with tax notifications and ensures that you receive any refunds or important documents without delay. Keeping your address current is part of your responsibility as a taxpayer.

Quick guide on how to complete nebraska change of address request for individual incom

Conveniently prepare Nebraska Change Of Address Request For Individual Incom on any device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed papers, allowing users to easily find the right template and safely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any hold-ups. Manage Nebraska Change Of Address Request For Individual Incom on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronic sign Nebraska Change Of Address Request For Individual Incom effortlessly

- Find Nebraska Change Of Address Request For Individual Incom and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click the Done button to finalize your changes.

- Choose your preferred method of sharing your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Edit and electronically sign Nebraska Change Of Address Request For Individual Incom to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nebraska change of address request for individual incom

Create this form in 5 minutes!

How to create an eSignature for the nebraska change of address request for individual incom

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

The best way to make an e-signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the Nebraska Form 22A, and how can airSlate SignNow help with it?

The Nebraska Form 22A is a specific document required for certain legal and business transactions in Nebraska. airSlate SignNow simplifies the process of filling out, signing, and sending this form electronically. With our platform, users can ensure that the Nebraska Form 22A is completed accurately and signed securely, saving time and reducing the risk of errors.

-

How much does it cost to use airSlate SignNow for handling the Nebraska Form 22A?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Our plans are designed to be cost-effective, allowing you to manage documents like the Nebraska Form 22A without breaking the bank. You can explore our subscription options online to find the plan that fits your budget.

-

What features does airSlate SignNow offer for managing the Nebraska Form 22A?

airSlate SignNow comes equipped with features that enhance the management of documents like the Nebraska Form 22A. These include customizable templates, automated workflows, and an intuitive signing experience. Our platform ensures that you can create, send, and track the form efficiently.

-

Is airSlate SignNow secure for processing the Nebraska Form 22A?

Yes, airSlate SignNow prioritizes document security, including for the Nebraska Form 22A. We use advanced encryption and authentication methods to protect your sensitive information. You can trust that your data remains secure throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for Nebraska Form 22A?

Absolutely! airSlate SignNow offers seamless integrations with various applications that can streamline your workflow involving the Nebraska Form 22A. Whether you use CRM systems or document management software, our platform can connect to enhance your document management processes.

-

What are the benefits of using airSlate SignNow for the Nebraska Form 22A?

Using airSlate SignNow to manage the Nebraska Form 22A provides numerous benefits, including speed, security, and ease of use. Our platform allows you to sign and send documents in just a few clicks, reducing turnaround time. Additionally, using airSlate SignNow promotes environmental sustainability by minimizing paper use.

-

How does airSlate SignNow ensure compliance with legal standards for the Nebraska Form 22A?

airSlate SignNow is designed to comply with relevant legal standards for electronic signatures, relevant for documents like the Nebraska Form 22A. Our platform adheres to e-signature laws, ensuring that your signed documents are legally binding and recognized. You can be confident that your use of airSlate SignNow meets the necessary compliance requirements.

Get more for Nebraska Change Of Address Request For Individual Incom

- Delaware notice form

- Assignment of mortgage by individual mortgage holder delaware form

- Delaware pay rent form

- Delaware lease form

- Assignment of mortgage by corporate mortgage holder delaware form

- Consent order guardian of the person delaware form

- Consent order permanent guardian of the person delaware form

- Petition guardianship of form

Find out other Nebraska Change Of Address Request For Individual Incom

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding