Fillable Online INSURED LOCATION Name & Location of 2020-2026

Understanding the Insured Location Section

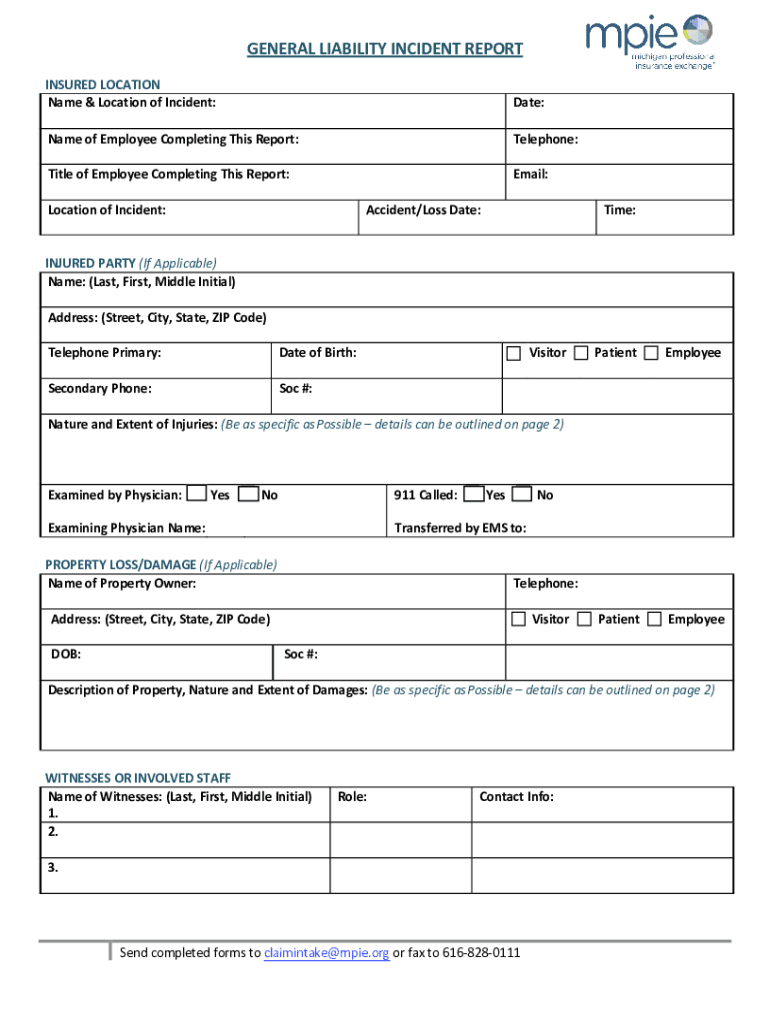

The insured location section of the general liability incident report form is crucial for accurately identifying where an incident occurred. This section typically requires specific details, including the name of the insured party and the exact address of the location. Providing precise information helps ensure that the report aligns with the insurance policy and facilitates a smoother claims process.

When filling out this section, it is important to double-check the address for accuracy, including street numbers, names, and any relevant unit or suite numbers. This information is vital for the insurance company to assess the claim effectively.

Steps to Complete the Insured Location Section

Completing the insured location section involves several straightforward steps:

- Identify the insured party: Enter the name of the individual or business that holds the insurance policy.

- Provide the address: Fill in the complete address where the incident took place, ensuring all details are correct.

- Include additional information: If applicable, add any relevant details such as unit numbers or specific areas within the location.

Following these steps carefully can help prevent delays in processing the incident report.

Legal Considerations for the Insured Location

Understanding the legal implications of the insured location is essential when filling out the general liability incident report form. The insured location must be covered under the terms of the insurance policy for claims to be valid. If an incident occurs at a location not listed in the policy, the claim may be denied.

It is advisable to review the insurance policy to confirm that the location is included and to understand any specific coverage limitations that may apply. This knowledge can aid in making informed decisions regarding the incident report.

Common Mistakes in the Insured Location Section

Several common mistakes can occur when filling out the insured location section, which may lead to complications in the claims process:

- Incorrect address details: Failing to provide the correct street address or omitting important information can result in delays.

- Listing an uninsured location: Including a location not covered by the insurance policy can lead to claim denial.

- Inconsistent information: Providing different names or addresses in various sections of the report can create confusion.

Being aware of these potential pitfalls can help ensure that the report is completed accurately and efficiently.

Examples of Insured Location Entries

Providing clear examples can help guide users in filling out the insured location section accurately. Here are a few scenarios:

- For a retail store: ABC Retail, 123 Main St, Suite 4B, Springfield, IL 62701.

- For a residential property: John Doe, 456 Elm St, Apt 2A, Anytown, CA 90210.

- For a commercial office: XYZ Corp, 789 Oak Ave, Floor 3, Metropolis, NY 10001.

These examples illustrate the level of detail required and emphasize the importance of accuracy in the insured location section.

Obtaining the General Liability Incident Report Form

The general liability incident report form can typically be obtained from the insurance provider's website or through direct contact with their customer service. Some companies may also provide a fillable online version, which allows for easier completion and submission.

It is essential to ensure that you are using the most current version of the form, as updates may occur that reflect changes in policy or legal requirements. Always verify with the insurance provider for the latest version to avoid any issues during the claims process.

Quick guide on how to complete fillable online insured location name ampampamp location of

Accomplish Fillable Online INSURED LOCATION Name & Location Of seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can access the required form and store it securely online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Handle Fillable Online INSURED LOCATION Name & Location Of on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Fillable Online INSURED LOCATION Name & Location Of effortlessly

- Find Fillable Online INSURED LOCATION Name & Location Of and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Fillable Online INSURED LOCATION Name & Location Of and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online insured location name ampampamp location of

Create this form in 5 minutes!

How to create an eSignature for the fillable online insured location name ampampamp location of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a general liability incident report form, and why is it important?

A general liability incident report form is a document used to record details about incidents that may result in legal claims against a business. It is important because it helps businesses track and manage incidents, ensuring they have the documentation needed for insurance purposes and compliance.

-

How does airSlate SignNow assist in creating a general liability incident report form?

airSlate SignNow provides an intuitive platform that allows users to create, customize, and eSign a general liability incident report form effortlessly. With drag-and-drop features and templates, businesses can generate forms quickly, streamlining their incident reporting process.

-

What features does the general liability incident report form include?

The general liability incident report form in airSlate SignNow includes fields for incident details, witnesses, and involved parties, along with signature fields for accountability. Additionally, users can add custom branding and notes, ensuring the form meets their specific needs.

-

Is airSlate SignNow subscription-based for using the general liability incident report form?

Yes, airSlate SignNow operates on a subscription-based model, providing various pricing plans to fit different business needs. These plans enable businesses to access the general liability incident report form along with other essential features, ensuring a cost-effective solution.

-

Can I integrate the general liability incident report form with other tools?

Absolutely! airSlate SignNow offers seamless integrations with popular business applications such as Google Drive, Salesforce, and more. This capability allows you to enhance your workflow and ensure that your general liability incident report form fits seamlessly into your existing business processes.

-

What are the benefits of using airSlate SignNow for a general liability incident report form?

Using airSlate SignNow for your general liability incident report form offers multiple benefits, including time savings, enhanced security, and easy accessibility. Businesses can efficiently send, sign, and store their forms, providing a hassle-free way to manage incident documentation.

-

Is the general liability incident report form customizable?

Yes, the general liability incident report form is highly customizable in airSlate SignNow. Users can modify fields, add logos, and adjust layouts to create a form that reflects their brand and meets their unique incident reporting requirements.

Get more for Fillable Online INSURED LOCATION Name & Location Of

- Lead based paint disclosure for sales transaction arkansas form

- Lead based paint disclosure for rental transaction arkansas form

- Notice of lease for recording arkansas form

- Materialmans lien notice general arkansas form

- Materialmans lien notice electrical arkansas form

- Ar lien 497296647 form

- Account affidavit form

- Arkansas liens form

Find out other Fillable Online INSURED LOCATION Name & Location Of

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors