25 Small Business Tax Forms All SMBs Should KnowQuickBooks

Understanding the Schedule C Worksheet

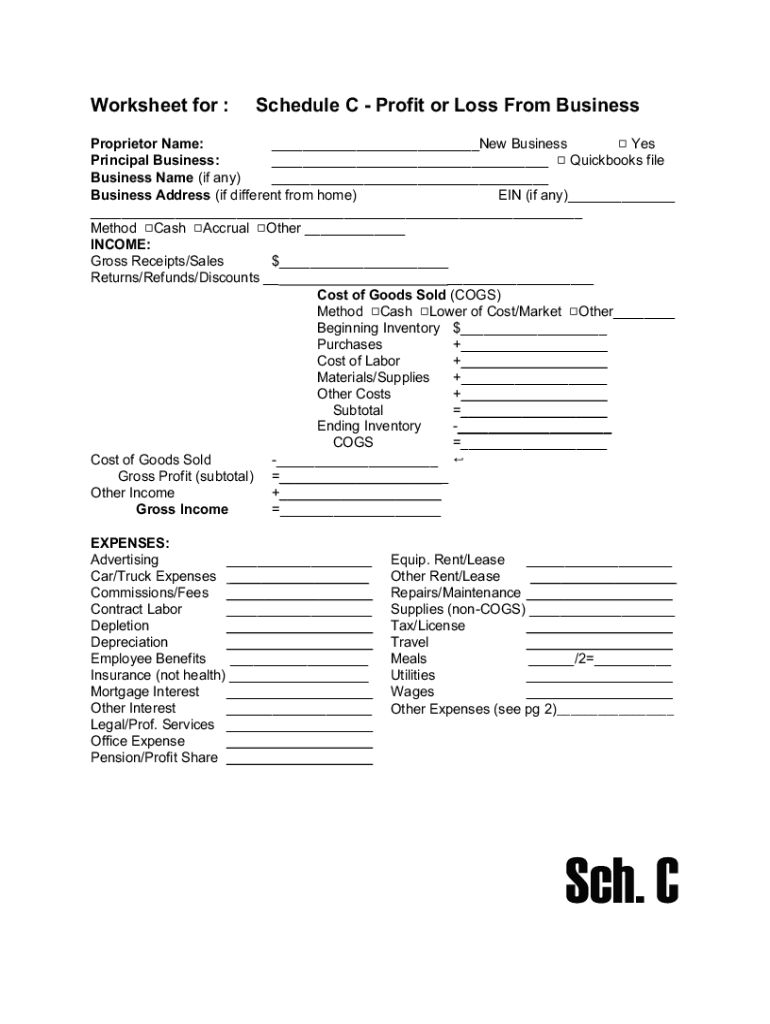

The Schedule C worksheet is an essential tax form used by sole proprietors in the United States to report income or loss from their business. It is part of the IRS Form 1040 series and helps self-employed individuals detail their business earnings and expenses. By accurately completing this form, taxpayers can determine their net profit or loss, which is crucial for calculating their overall tax liability.

Key Elements of the Schedule C Worksheet

The Schedule C worksheet includes several important sections that require careful attention. These sections typically cover:

- Business Information: This includes the business name, address, and type of business.

- Income: Total income from sales or services, including any returns or allowances.

- Expenses: Detailed categories of business expenses, such as advertising, utilities, and supplies.

- Net Profit or Loss: The calculation of total income minus total expenses, which determines the taxable income.

Steps to Complete the Schedule C Worksheet

Filling out the Schedule C worksheet involves several straightforward steps:

- Gather all relevant financial documents, including income statements and receipts for expenses.

- Fill in your business information at the top of the form.

- Report your total income from all business activities.

- List all deductible business expenses in the appropriate categories.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Review the completed form for accuracy before submission.

Filing Deadlines for the Schedule C Worksheet

It is important to be aware of the filing deadlines associated with the Schedule C worksheet. Typically, the form must be submitted by the same deadline as the individual income tax return, which is usually April 15 each year. If additional time is needed, taxpayers can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties.

IRS Guidelines for the Schedule C Worksheet

The IRS provides specific guidelines for completing the Schedule C worksheet. Taxpayers should ensure they follow these guidelines to avoid errors and potential audits. Key points include:

- Maintain accurate records of all income and expenses.

- Use the correct accounting method (cash or accrual) consistently.

- Be aware of which expenses are deductible and keep supporting documentation.

Common Penalties for Non-Compliance

Failure to accurately complete and file the Schedule C worksheet can result in various penalties. Common consequences include:

- Late Filing Penalties: If the form is submitted after the deadline without an extension, penalties may apply.

- Accuracy-Related Penalties: Errors in reporting income or expenses can lead to additional fines.

- Interest on Unpaid Taxes: Any taxes owed that are not paid by the deadline will accrue interest.

Quick guide on how to complete 25 small business tax forms all smbs should knowquickbooks

Complete 25 Small Business Tax Forms All SMBs Should KnowQuickBooks effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documentation, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents rapidly without delays. Handle 25 Small Business Tax Forms All SMBs Should KnowQuickBooks on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest method to alter and eSign 25 Small Business Tax Forms All SMBs Should KnowQuickBooks with ease

- Obtain 25 Small Business Tax Forms All SMBs Should KnowQuickBooks and click Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive details with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you'd like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Alter and eSign 25 Small Business Tax Forms All SMBs Should KnowQuickBooks and guarantee excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 25 small business tax forms all smbs should knowquickbooks

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a schedule C worksheet?

A schedule C worksheet is a tool used to help self-employed individuals organize their income and expenses for tax purposes. It provides a structured format that makes it easier to calculate net profit or loss from a business. Using a schedule C worksheet ensures that you maximize your deductions while accurately reporting your income.

-

How can airSlate SignNow help with a schedule C worksheet?

airSlate SignNow can simplify the process of completing your schedule C worksheet by allowing you to send and sign documents electronically. This means you can quickly share your worksheet with tax professionals or collaborators, ensuring a smooth review and filing process. With airSlate SignNow, you can easily manage these documents in one place.

-

Is there a cost associated with using airSlate SignNow for scheduling C worksheets?

Yes, there is a pricing structure associated with airSlate SignNow, which offers different plans based on features and usage levels. However, the cost is often outweighed by the time savings and efficiency gained through eSigning and document management, especially when handling tools like a schedule C worksheet.

-

Can I integrate other tools with airSlate SignNow for my schedule C worksheet?

Absolutely! airSlate SignNow integrates with various platforms such as Google Drive, Dropbox, and more, which makes it easier to access and manage your schedule C worksheet. These integrations allow you to streamline your workflow and keep all your documents organized in one system.

-

What features does airSlate SignNow offer for managing documents like schedule C worksheets?

airSlate SignNow offers features such as eSigning, document templates, and secure storage that enhance the management of your schedule C worksheet. You can create templates for recurring use, ensuring that your worksheets are always ready when you need them. Additionally, the audit trail feature provides accountability and verifies document integrity.

-

How secure is my data when using airSlate SignNow for schedule C worksheets?

Security is a top priority for airSlate SignNow. Your data, including sensitive information found in your schedule C worksheet, is protected with advanced encryption and access controls. This ensures that only authorized users can view or edit your documents, providing peace of mind while managing your finances.

-

Can I access my schedule C worksheet from mobile devices using airSlate SignNow?

Yes! airSlate SignNow has a mobile app that enables you to access your schedule C worksheet from anywhere, at any time. This flexibility empowers you to work on your documents on the go, allowing for travel, meetings, or spontaneous work sessions without missing a beat.

Get more for 25 Small Business Tax Forms All SMBs Should KnowQuickBooks

- Uw dv legal assistance project form

- Order dismissing divorce action form

- The hearingtrial will take approximately form

- Defendant lived in wyoming from the time of form

- Least 30 days before trial form

- Required disclosure of expert testimony form

- Summons doc templatepdffiller form

- Limited entry of appearance form

Find out other 25 Small Business Tax Forms All SMBs Should KnowQuickBooks

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online