C14 Form

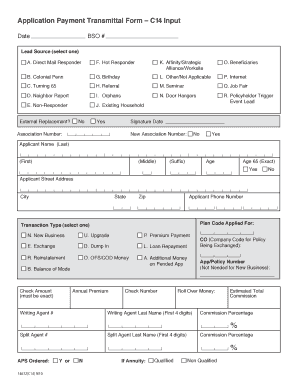

What is the C14 Form

The C14 form is a specific document used primarily for tax purposes in the United States. It is often associated with various tax filings and is essential for individuals and businesses to report income, deductions, and other financial information accurately. Understanding the purpose of the C14 form is crucial for compliance with IRS regulations and ensuring that all necessary information is submitted correctly.

How to use the C14 Form

Using the C14 form involves several steps to ensure that all required information is accurately filled out. First, gather all necessary financial documents, including income statements and deduction records. Next, carefully complete each section of the form, ensuring that all figures are accurate and reflect your financial situation. After completing the form, review it for any errors before submission. It is important to retain a copy for your records.

Steps to complete the C14 Form

Completing the C14 form can be broken down into a series of straightforward steps:

- Gather necessary documents, such as W-2s, 1099s, and receipts for deductions.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately.

- Detail any deductions or credits you are eligible for.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the C14 Form

The legal use of the C14 form is paramount for ensuring compliance with federal tax laws. This form must be filed accurately and on time to avoid penalties. Misuse or incorrect information can lead to legal repercussions, including fines or audits by the IRS. It is advisable to consult with a tax professional if there are uncertainties regarding the completion or submission of the form.

Filing Deadlines / Important Dates

Filing deadlines for the C14 form are crucial for taxpayers to adhere to in order to avoid penalties. Typically, the form must be submitted by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these dates, which can vary from year to year.

Who Issues the Form

The C14 form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement of tax laws in the United States. The IRS provides the necessary guidelines and instructions for completing the form, ensuring that taxpayers have access to the information needed for proper filing.

Quick guide on how to complete c14 form

Easily Prepare C14 Form on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to quickly create, modify, and eSign your documents without delays. Manage C14 Form on any device with airSlate SignNow’s Android or iOS applications and simplify your document-related tasks today.

Edit and eSign C14 Form Effortlessly

- Locate C14 Form and click on Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes a few seconds and has the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to finalize your changes.

- Select your preferred method for sending your form, whether by email, SMS, or a shareable link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, the hassle of tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Edit and eSign C14 Form and ensure excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the c14 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a c14 form and how is it used?

The c14 form is a specific document used for various administrative purposes, often in the context of compliance and regulatory submissions. It streamlines the process of collecting signatures and approvals. Using the c14 form with airSlate SignNow simplifies document management and ensures you stay compliant.

-

How much does it cost to use the c14 form with airSlate SignNow?

Pricing for using airSlate SignNow to work with the c14 form varies based on the plan you select. Our subscription options provide a cost-effective solution for businesses of all sizes. You'll find that our pricing structure is designed to deliver great value while making document signing and management accessible.

-

What features does airSlate SignNow offer for the c14 form?

When using the c14 form with airSlate SignNow, you can benefit from features like customizable templates, automatic reminders, and secure cloud storage. These features enhance the efficiency of your document signing process while ensuring that all information is securely managed. Additionally, you can track the status of your c14 forms in real time.

-

Are c14 forms legally binding when signed through airSlate SignNow?

Yes, c14 forms signed through airSlate SignNow are legally binding, provided that all parties adhere to e-signature laws. Our platform complies with major regulations like eIDAS and ESIGN, ensuring your document's legal standing is upheld. This allows you to confidently go paperless with your c14 forms.

-

Can I integrate airSlate SignNow with other tools for managing c14 forms?

Absolutely! airSlate SignNow offers seamless integrations with a variety of applications and platforms, enabling you to manage your c14 forms alongside your existing workflows. Integrations with tools like Google Drive, Salesforce, and more ensure that you can streamline your document processes effectively.

-

What benefits does airSlate SignNow provide for handling c14 forms?

Using airSlate SignNow for your c14 forms provides signNow benefits, including enhanced efficiency, reduced paperwork, and quick turnaround times. The platform is designed to simplify the signing process, eliminate delays, and improve overall productivity. By going digital, your team can focus more on core tasks rather than administrative processes.

-

Is there customer support available for issues related to the c14 form?

Yes, airSlate SignNow provides dedicated customer support to assist you with any issues related to c14 forms. Our knowledgeable support team is available to help you troubleshoot problems and maximize your use of our platform. We ensure that you have the resources needed to effectively manage your documents.

Get more for C14 Form

- Complete if applicable the undersigned is the present holder of the above referenced form

- Control number vt sdeed 4 form

- Warranty deed where a limited partnership is the form

- Fillable online complaint for relief from abuse fax email form

- An order for relief from abuse was entered in the above case on form

- Litigants address for notification form

- The johnson city community concert band donor doc template form

- Form 818

Find out other C14 Form

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure