Crs 1 Form 2017

What is the CRS 1 Form?

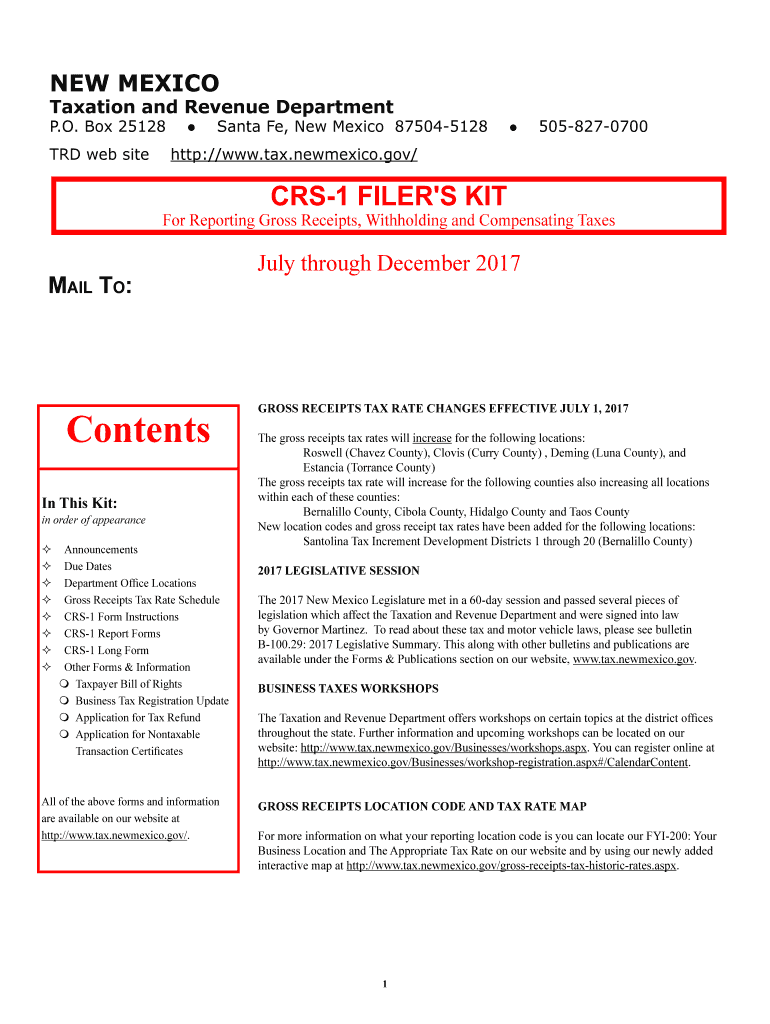

The CRS 1 form, also known as the New Mexico CRS-1 form, is a crucial document used for reporting gross receipts tax in the state of New Mexico. This form is designed for businesses to report their gross receipts and pay the corresponding tax. It is essential for compliance with state tax laws and helps ensure that businesses contribute to state revenue. The CRS 1 form can be used by various types of entities, including sole proprietors, corporations, and partnerships.

How to Use the CRS 1 Form

Using the CRS 1 form involves several steps to ensure accurate reporting of gross receipts. First, gather all necessary financial records, including sales receipts and invoices. Next, accurately calculate your gross receipts for the reporting period. Once you have your figures, fill out the CRS 1 form by entering the total gross receipts, any deductions, and the resulting taxable amount. Finally, submit the completed form along with any payment due to the New Mexico Taxation and Revenue Department.

Filing Deadlines / Important Dates

Filing deadlines for the CRS 1 form are typically quarterly, with specific due dates depending on the reporting period. For example, the first quarter (January to March) is due by April 25, the second quarter (April to June) by July 25, the third quarter (July to September) by October 25, and the fourth quarter (October to December) by January 25 of the following year. It is crucial to adhere to these deadlines to avoid penalties and interest on late payments.

Steps to Complete the CRS 1 Form

Completing the CRS 1 form involves a systematic approach:

- Gather all sales records for the reporting period.

- Calculate total gross receipts, including all sales and services provided.

- Determine any allowable deductions, such as returns or discounts.

- Fill out the form with the calculated totals.

- Review the form for accuracy before submission.

- Submit the form electronically or via mail, along with any payment due.

Required Documents

When completing the CRS 1 form, certain documents are necessary to ensure accurate reporting. These include:

- Sales receipts and invoices for the reporting period.

- Records of any deductions claimed, such as returns or discounts.

- Previous CRS 1 forms for reference, if applicable.

- Any correspondence from the New Mexico Taxation and Revenue Department regarding your account.

Penalties for Non-Compliance

Failure to file the CRS 1 form on time or inaccuracies in reporting can lead to penalties imposed by the state. Common penalties include fines for late filing, interest on unpaid taxes, and potential legal action for continued non-compliance. It is essential for businesses to stay informed about their filing obligations to avoid these consequences.

Quick guide on how to complete crs 1 form 2017 2019

Your assistance manual on how to prepare your Crs 1 Form

If you’re interested in learning how to complete and submit your Crs 1 Form, here are a few straightforward instructions on how to simplify tax submission.

To begin, all you need to do is register your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document platform that allows you to modify, generate, and finalize your income tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and return to modify responses whenever necessary. Enhance your tax administration with advanced PDF altering, eSigning, and easy sharing options.

Follow the instructions below to complete your Crs 1 Form in just a few minutes:

- Establish your account and start working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Press Get form to access your Crs 1 Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-recognized eSignature (if required).

- Examine your document and correct any inaccuracies.

- Preserve changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Be aware that filing on paper can increase return errors and delay refunds. Naturally, before e-filing your taxes, review the IRS website for filing guidelines in your area.

Create this form in 5 minutes or less

Find and fill out the correct crs 1 form 2017 2019

FAQs

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the crs 1 form 2017 2019

How to create an eSignature for the Crs 1 Form 2017 2019 online

How to generate an electronic signature for your Crs 1 Form 2017 2019 in Chrome

How to create an electronic signature for putting it on the Crs 1 Form 2017 2019 in Gmail

How to create an electronic signature for the Crs 1 Form 2017 2019 straight from your smart phone

How to generate an electronic signature for the Crs 1 Form 2017 2019 on iOS

How to generate an eSignature for the Crs 1 Form 2017 2019 on Android

People also ask

-

What is the Crs 1 Form and how does it work with airSlate SignNow?

The Crs 1 Form is a crucial document for various business applications, and airSlate SignNow simplifies its signing process. With our platform, you can easily create, send, and eSign the Crs 1 Form digitally, ensuring a seamless workflow. This not only saves time but also enhances security and compliance.

-

How much does it cost to use airSlate SignNow for the Crs 1 Form?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those who require the Crs 1 Form. Our plans are designed to be cost-effective, allowing you to choose the features that best suit your requirements. You can also benefit from a free trial to explore our offerings before making a commitment.

-

What features does airSlate SignNow provide for managing the Crs 1 Form?

When managing the Crs 1 Form, airSlate SignNow provides features like document templates, easy sharing, and real-time tracking. These tools streamline the signing process and help ensure that your documents are completed efficiently. Additionally, our platform supports in-app annotations for better collaboration.

-

Can I integrate airSlate SignNow with other software for handling the Crs 1 Form?

Yes, airSlate SignNow seamlessly integrates with various applications, making it easy to manage the Crs 1 Form alongside your existing workflows. You can connect with popular tools like Google Drive, Salesforce, and more for a streamlined experience. This integration enhances productivity and keeps your documents organized.

-

Is it secure to sign the Crs 1 Form using airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security when handling the Crs 1 Form. We utilize advanced encryption and authentication methods to protect your documents and ensure that sensitive information remains confidential. You can trust our platform to keep your electronic signatures secure.

-

What benefits can I expect when using airSlate SignNow for the Crs 1 Form?

Using airSlate SignNow for the Crs 1 Form offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced document tracking. Our easy-to-use interface allows users to sign documents from any device, which makes it convenient for businesses on the go. Additionally, digital signing eliminates the need for paper, contributing to a more sustainable practice.

-

Can I customize the Crs 1 Form on airSlate SignNow?

Yes, you can easily customize the Crs 1 Form using airSlate SignNow’s intuitive editor. This feature allows you to add your company logo, adjust fields, and tailor the document to meet your specific needs. Customization helps ensure that your Crs 1 Form aligns with your branding and operational requirements.

Get more for Crs 1 Form

Find out other Crs 1 Form

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free