Form 13551 Rev 11 Application to Participate in the IRS Acceptance Agent Program 2023-2026

What is the Form 13551 Rev 11 Application To Participate In The IRS Acceptance Agent Program

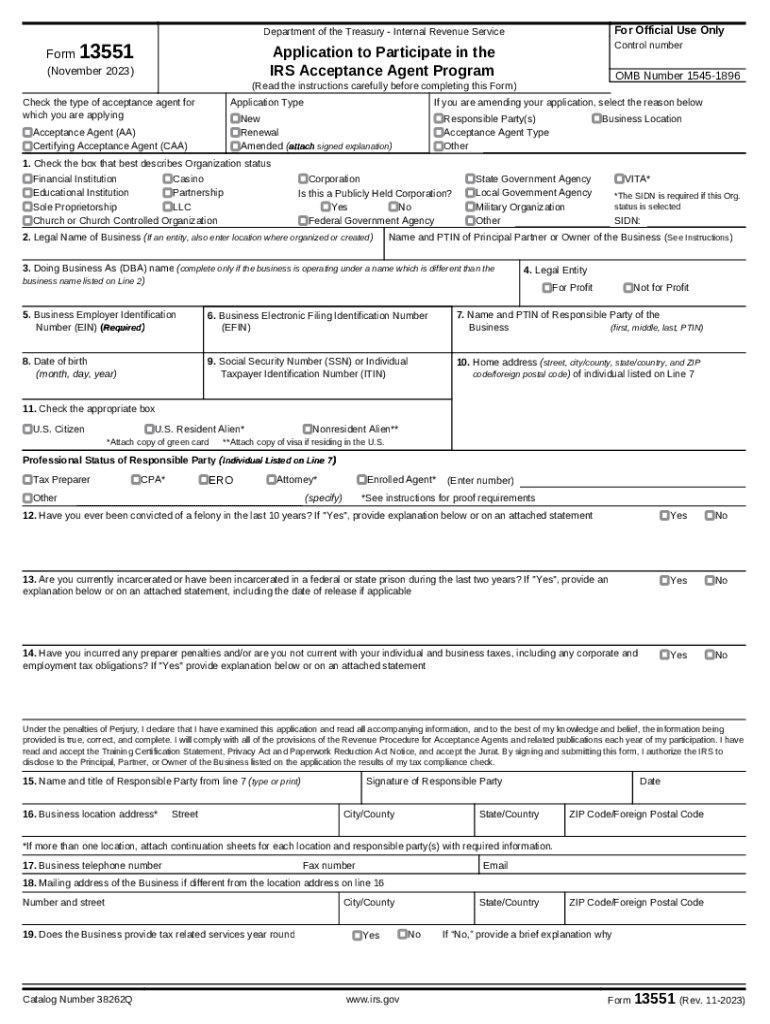

The Form 13551 Rev 11 is a crucial document for individuals or businesses wishing to become certified acceptance agents for the IRS. This form allows applicants to participate in the Acceptance Agent Program, which enables them to assist individuals in obtaining Individual Taxpayer Identification Numbers (ITINs). Acceptance agents play a vital role in the tax process by verifying the identity and foreign status of applicants, thus streamlining the ITIN application process.

Steps to complete the Form 13551 Rev 11 Application To Participate In The IRS Acceptance Agent Program

Completing the Form 13551 involves several important steps:

- Gather necessary information, including personal identification details and business information if applicable.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Provide supporting documentation, such as proof of identity and any relevant certifications.

- Review the completed form for accuracy before submission.

- Submit the form to the IRS through the designated method, which may include mailing or electronic submission.

Eligibility Criteria

To qualify for the Acceptance Agent Program, applicants must meet specific eligibility criteria. These include:

- Being a U.S. citizen or a legal resident.

- Having a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Demonstrating the ability to verify the identity of ITIN applicants.

- Complying with IRS regulations and guidelines throughout the application process.

Required Documents

When submitting the Form 13551, applicants must include several required documents to support their application. These typically include:

- A copy of a government-issued identification, such as a driver's license or passport.

- Proof of business registration if applying as a business entity.

- Any relevant certifications that demonstrate the applicant's qualifications to act as an acceptance agent.

Application Process & Approval Time

The application process for becoming a certified acceptance agent involves submitting the completed Form 13551 along with all required documents. After submission, the IRS will review the application. The approval time can vary, but applicants should expect a response within several weeks. It is advisable to monitor the status of the application and address any requests for additional information promptly.

IRS Guidelines

The IRS provides specific guidelines for the Acceptance Agent Program, outlining the responsibilities and expectations for certified acceptance agents. These guidelines include:

- Maintaining confidentiality of applicant information.

- Ensuring accurate and timely submission of ITIN applications.

- Adhering to all IRS regulations and updates related to the program.

Quick guide on how to complete form 13551 rev 11 application to participate in the irs acceptance agent program

Effortlessly Prepare Form 13551 Rev 11 Application To Participate In The IRS Acceptance Agent Program on Any Device

Managing documents online has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, alter, and eSign your documents quickly without any delays. Manage Form 13551 Rev 11 Application To Participate In The IRS Acceptance Agent Program across any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The Easiest Way to Alter and eSign Form 13551 Rev 11 Application To Participate In The IRS Acceptance Agent Program with Ease

- Locate Form 13551 Rev 11 Application To Participate In The IRS Acceptance Agent Program and click Get Form to begin.

- Utilize the available tools to complete your form.

- Mark important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to store your adjustments.

- Select your preferred method to submit your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, the hassle of searching for forms, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 13551 Rev 11 Application To Participate In The IRS Acceptance Agent Program and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 13551 rev 11 application to participate in the irs acceptance agent program

Create this form in 5 minutes!

How to create an eSignature for the form 13551 rev 11 application to participate in the irs acceptance agent program

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process of how to become a certified acceptance agent?

To become a certified acceptance agent, individuals must complete an application with the IRS, which includes background checks and a training program. After receiving certification, agents can assist clients with document submissions and provide necessary verification services.

-

What are the benefits of becoming a certified acceptance agent?

Becoming a certified acceptance agent allows individuals to provide essential services that assist clients with IRS forms and tax filings. This certification can enhance your business credibility and expand your service offerings, ultimately leading to increased revenue.

-

Is there a cost associated with how to become a certified acceptance agent?

Yes, there are costs involved in how to become a certified acceptance agent, including application fees and potential costs for training materials or courses. However, these initial investments can lead to signNow financial returns as you grow your acceptance agent business.

-

What features does the airSlate SignNow platform offer for certified acceptance agents?

The airSlate SignNow platform offers a range of features designed for certified acceptance agents, including eSignature capabilities, document tracking, and secure storage. These features improve the efficiency of handling client documents and ensure compliance with IRS guidelines.

-

How does airSlate SignNow integrate with other tools for certified acceptance agents?

airSlate SignNow integrates seamlessly with various business applications, allowing certified acceptance agents to streamline their workflows. This integration capability enhances productivity by connecting documents and signatures with accounting, tax software, and client management tools.

-

Can certified acceptance agents benefit from using airSlate SignNow for their operations?

Absolutely! Certified acceptance agents can benefit signNowly from using airSlate SignNow, as it simplifies document management and eSigning processes. With its user-friendly interface, agents can efficiently manage client documents while ensuring security and compliance.

-

What kind of support is available for certified acceptance agents using airSlate SignNow?

airSlate SignNow provides dedicated support for certified acceptance agents, including access to helpful resources and customer service representatives. This support ensures that agents can navigate the platform effectively and resolve any issues that may arise during their operations.

Get more for Form 13551 Rev 11 Application To Participate In The IRS Acceptance Agent Program

Find out other Form 13551 Rev 11 Application To Participate In The IRS Acceptance Agent Program

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF