ORGAN DONOR DEDUCTION 2021

What is the ORGAN DONOR DEDUCTION

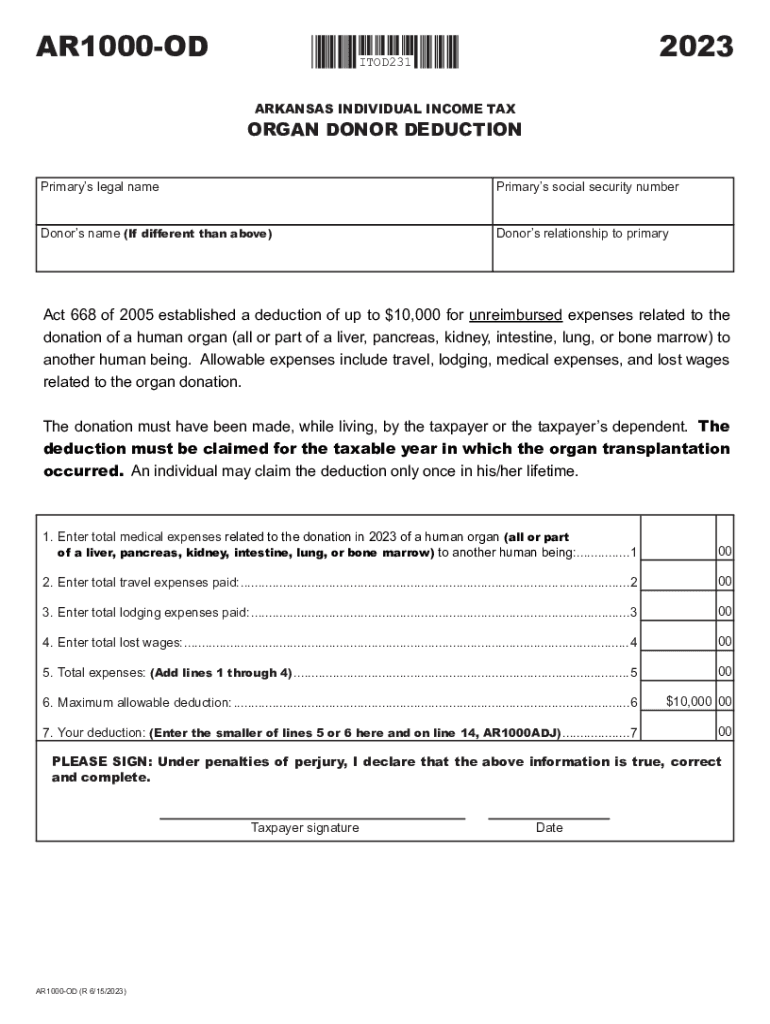

The ORGAN DONOR DEDUCTION is a tax benefit available to individuals who have made the generous decision to donate organs. This deduction allows donors to claim certain expenses associated with the donation process on their federal tax returns. Eligible expenses may include travel costs, medical expenses, and other related out-of-pocket costs incurred while facilitating the organ donation. By providing this deduction, the government aims to encourage organ donation and support individuals who contribute to saving lives through their altruistic actions.

How to use the ORGAN DONOR DEDUCTION

To utilize the ORGAN DONOR DEDUCTION, donors must first ensure they meet the eligibility criteria set by the IRS. Once eligibility is confirmed, donors should gather all relevant documentation, including receipts for travel and medical expenses. When filing taxes, these expenses can be itemized on Schedule A of Form 1040. It is important to keep detailed records of all expenses related to the donation, as the IRS may require proof of these costs during an audit.

Steps to complete the ORGAN DONOR DEDUCTION

Completing the ORGAN DONOR DEDUCTION involves several key steps:

- Determine eligibility by reviewing IRS guidelines for organ donation deductions.

- Collect all necessary documentation, including receipts for travel and medical expenses related to the donation.

- Fill out Schedule A of Form 1040 to itemize the deduction.

- Include the total amount of eligible expenses in the appropriate section of your tax return.

- Retain copies of all documents for your records in case of future inquiries.

Legal use of the ORGAN DONOR DEDUCTION

The ORGAN DONOR DEDUCTION is legally recognized under U.S. tax law, allowing qualifying individuals to deduct certain expenses from their taxable income. To ensure compliance, donors should adhere strictly to IRS guidelines regarding what constitutes eligible expenses. It is advisable to consult with a tax professional if there are uncertainties about the legal aspects of claiming this deduction.

IRS Guidelines

The IRS provides specific guidelines regarding the ORGAN DONOR DEDUCTION, outlining what expenses can be claimed and the necessary documentation required. According to IRS regulations, only unreimbursed expenses directly related to the organ donation process are eligible for deduction. This includes transportation costs, lodging, and medical expenses incurred as a result of the donation. Familiarizing oneself with these guidelines is crucial for a successful claim.

Required Documents

When claiming the ORGAN DONOR DEDUCTION, donors must provide certain documents to substantiate their claims. Required documents typically include:

- Receipts for travel expenses, including airfare, gas, and lodging.

- Medical bills related to the organ donation procedure.

- Any other documentation that verifies the expenses incurred during the donation process.

Keeping organized records will facilitate the filing process and ensure compliance with IRS requirements.

Eligibility Criteria

To qualify for the ORGAN DONOR DEDUCTION, individuals must meet specific eligibility criteria established by the IRS. Generally, the donor must have made a qualified organ donation to a transplant center, and the expenses claimed must be directly related to the donation process. Additionally, the donor cannot have received any reimbursement for the expenses claimed. Understanding these criteria is essential for those wishing to take advantage of this tax benefit.

Quick guide on how to complete organ donor deduction

Effortlessly Prepare ORGAN DONOR DEDUCTION on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle ORGAN DONOR DEDUCTION on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Alter and eSign ORGAN DONOR DEDUCTION with Ease

- Locate ORGAN DONOR DEDUCTION and click Get Form to begin.

- Utilize our tools to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and press the Done button to save your changes.

- Choose your preferred method to share your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes requiring new printed copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign ORGAN DONOR DEDUCTION to ensure seamless communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct organ donor deduction

Create this form in 5 minutes!

How to create an eSignature for the organ donor deduction

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ORGAN DONOR DEDUCTION and how can it benefit me?

The ORGAN DONOR DEDUCTION allows eligible individuals to deduct certain expenses related to organ donation on their tax returns. By utilizing airSlate SignNow, you can efficiently manage the necessary documentation for the ORGAN DONOR DEDUCTION, ensuring a seamless experience. It's a beneficial way to support your altruism while also receiving potential tax savings.

-

How does airSlate SignNow support the process of claiming the ORGAN DONOR DEDUCTION?

airSlate SignNow offers a user-friendly platform to create, send, and eSign the necessary documents for claiming the ORGAN DONOR DEDUCTION. With our digital signature solutions, you can ensure that all forms are properly executed and submitted, making the claiming process straightforward and compliant. Easily access templates and tracking features to keep everything organized.

-

Is there a cost involved in using airSlate SignNow for the ORGAN DONOR DEDUCTION?

Yes, airSlate SignNow offers cost-effective pricing plans that can accommodate various needs when claiming the ORGAN DONOR DEDUCTION. Our subscription models provide flexibility, allowing you to choose the plan that best fits your volume of documents and user requirements. Benefit from transparent pricing without hidden fees or additional costs.

-

What features does airSlate SignNow offer for managing documents related to ORGAN DONOR DEDUCTION?

airSlate SignNow includes a range of features designed to streamline document management for the ORGAN DONOR DEDUCTION, such as templates, eSignature capabilities, and document tracking. These tools help you create professional documents quickly and ensure they are signed and stored securely. Access to audit trails also guarantees compliance and verification of signatures.

-

Can I integrate airSlate SignNow with other platforms when preparing for the ORGAN DONOR DEDUCTION?

Absolutely! airSlate SignNow supports integration with various third-party applications, making it easy to access and manage documents for the ORGAN DONOR DEDUCTION. Whether you're using CRM systems, cloud storage, or accounting software, the integrations enhance workflow efficiency, allowing you to seamlessly incorporate our eSigning solution into your existing processes.

-

Is airSlate SignNow secure for handling sensitive information related to the ORGAN DONOR DEDUCTION?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all sensitive information related to the ORGAN DONOR DEDUCTION is protected. We employ industry-standard encryption and follow legal regulations to maintain the privacy and integrity of your documents. Trust in our secure platform to safeguard your data during the signing process.

-

How does airSlate SignNow streamline the eSigning process for the ORGAN DONOR DEDUCTION?

airSlate SignNow simplifies the eSigning process for documents required for the ORGAN DONOR DEDUCTION by offering an intuitive interface and automated workflows. Users can easily send documents for signatures, track their status, and receive notifications upon completion. This efficiency reduces time spent on paperwork, allowing you to focus on other important tasks.

Get more for ORGAN DONOR DEDUCTION

- Free rhode island quit claim deed templates pdf ampamp docx form

- Reaffirmation agreement faqsdistrict of rhode island form

- Purchase and sale agreement private parties sailing form

- Untitled rhode island department of state nellie m gorbea form

- In this affidavit a lien is a legal claim of another against property for a the payment of a debt or b the form

- That if we fail to move into the property by the specified time that form

- Rhode island last will and testament single adult wadult form

- State of county of on this day of 20 i certify that form

Find out other ORGAN DONOR DEDUCTION

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online