Form 14900 Worksheet Fill Out & Sign Online 2018

Understanding the Mortgage Interest Deduction

The mortgage interest deduction allows homeowners in the United States to deduct interest paid on their home loans from their taxable income. This deduction can significantly reduce the amount of federal income tax owed, making homeownership more affordable. It is essential to understand the limits and eligibility criteria for this deduction to maximize its benefits. Homeowners can typically deduct interest on loans up to one million dollars for primary residences and up to $100,000 for home equity loans, as outlined in IRS guidelines.

IRS Guidelines for Claiming Mortgage Interest

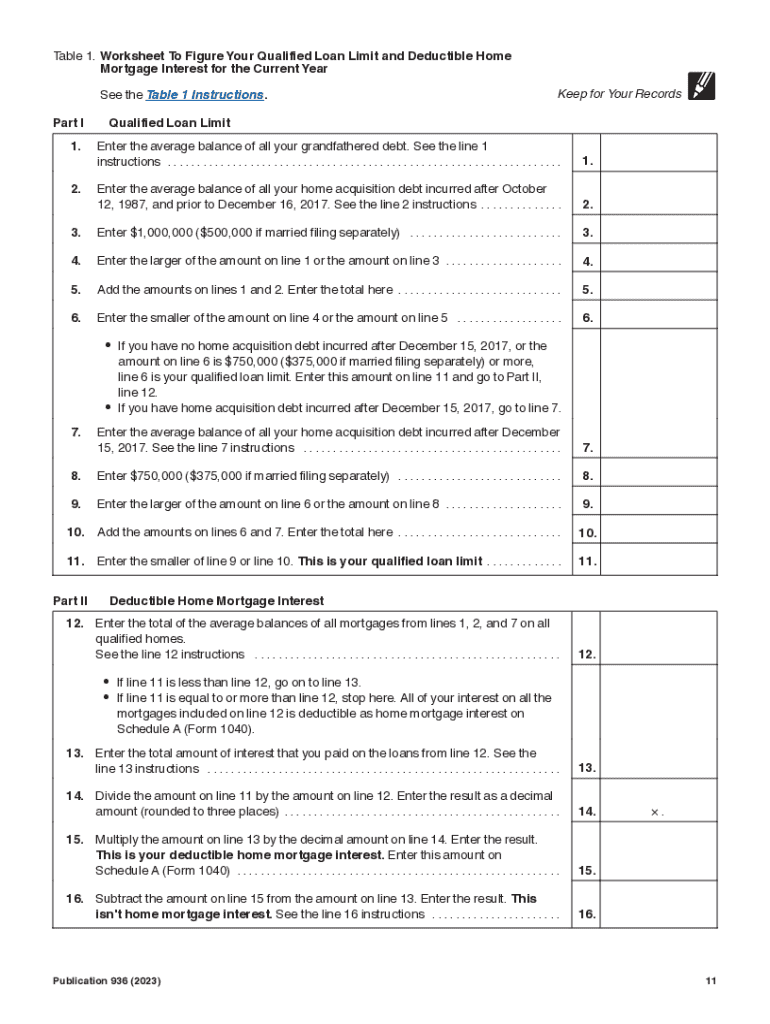

To claim the mortgage interest deduction, taxpayers must itemize their deductions on Schedule A of their tax return. The IRS requires the use of Form 1098, which reports the amount of mortgage interest paid during the year. Taxpayers should keep accurate records and documentation of all mortgage payments, including any points paid to secure the loan. It is crucial to refer to IRS Publication 936 for detailed information on eligibility and the calculation of the deduction.

Steps to Complete the Mortgage Interest Deduction

Completing the mortgage interest deduction involves several steps:

- Gather Form 1098 from your lender, which details the interest paid.

- Review IRS Publication 936 to confirm eligibility and understand limits.

- Complete Schedule A of your tax return, entering the mortgage interest amount.

- Submit your tax return by the filing deadline, ensuring all forms are accurate.

Required Documentation for Mortgage Interest Deduction

To successfully claim the mortgage interest deduction, homeowners need specific documentation. The primary document is Form 1098, provided by the lender, which shows the total interest paid. Additionally, homeowners should maintain records of their mortgage statements and any other relevant financial documents that support their claim. Keeping these records organized will facilitate the tax filing process and ensure compliance with IRS requirements.

Common Taxpayer Scenarios for Mortgage Interest Deduction

Different taxpayer scenarios can affect the applicability of the mortgage interest deduction. For instance, first-time homebuyers may benefit significantly from the deduction, as they often have larger interest payments in the initial years of the mortgage. Self-employed individuals may also use the deduction if they have a home office. Understanding how various situations impact eligibility can help taxpayers make informed decisions about their finances.

Filing Deadlines for Mortgage Interest Deduction

Taxpayers must be aware of important filing deadlines to ensure they claim the mortgage interest deduction. The typical deadline for filing federal income tax returns is April 15. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also consider any state-specific deadlines that may apply. Timely filing is essential to avoid penalties and ensure the deduction is applied correctly.

Quick guide on how to complete form 14900 worksheet fill out ampamp sign online

Complete Form 14900 Worksheet Fill Out & Sign Online effortlessly on any gadget

Digital document management has grown in popularity among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Form 14900 Worksheet Fill Out & Sign Online on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to alter and eSign Form 14900 Worksheet Fill Out & Sign Online with ease

- Find Form 14900 Worksheet Fill Out & Sign Online and click on Get Form to begin.

- Employ the tools we provide to complete your form.

- Emphasize pertinent parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to finalize your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing out new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Alter and eSign Form 14900 Worksheet Fill Out & Sign Online and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14900 worksheet fill out ampamp sign online

Create this form in 5 minutes!

How to create an eSignature for the form 14900 worksheet fill out ampamp sign online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mortgage interest and how is it calculated?

Mortgage interest is the cost charged by lenders to borrow money for purchasing real estate. It is calculated as a percentage of the loan amount over the life of the mortgage. Understanding how mortgage interest works can help you estimate your monthly payments and the total cost of your loan.

-

How does airSlate SignNow help with mortgage interest documentation?

airSlate SignNow simplifies the process of signing documents related to mortgage interest. It allows users to easily eSign contracts, disclosures, and loan agreements, ensuring that all paperwork is completed accurately and efficiently. This feature saves you time and reduces stress during critical transactions.

-

Can I manage multiple mortgage interest documents with airSlate SignNow?

Yes, airSlate SignNow allows you to handle multiple mortgage interest documents seamlessly. You can create, send, and store various mortgage-related forms and agreements in one central location. This makes tracking important documents for multiple properties or loans much easier.

-

What are the pricing options for airSlate SignNow for mortgage-related transactions?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs, including those dealing with mortgage interest documents. Whether you're a small business or a large enterprise, there’s a plan suitable for you. You can choose a plan based on the number of users and documents you expect to work with.

-

How secure is airSlate SignNow when handling mortgage interest documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive mortgage interest documents. The platform complies with industry standards for data encryption and security protocols to ensure that your documents remain safe throughout the signing process. Your information is protected from unauthorized access.

-

Does airSlate SignNow integrate with other platforms for managing mortgage interest?

Yes, airSlate SignNow offers integrations with various platforms, which can enhance your management of mortgage interest documents. Whether you're using CRM systems or accounting software, these integrations allow for a seamless flow of information, helping you work more efficiently.

-

What benefits does eSigning mortgage interest documents provide?

eSigning mortgage interest documents with airSlate SignNow accelerates the closing process and reduces paperwork. You can obtain signatures from all parties quickly, ensuring that deals move forward without unnecessary delays. Additionally, electronic signatures are legally binding and save you from postal delays.

Get more for Form 14900 Worksheet Fill Out & Sign Online

Find out other Form 14900 Worksheet Fill Out & Sign Online

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract