Form M 8453 Individual Income Tax Declaration for

Understanding the Massachusetts M 8453 Individual Income Tax Declaration Form

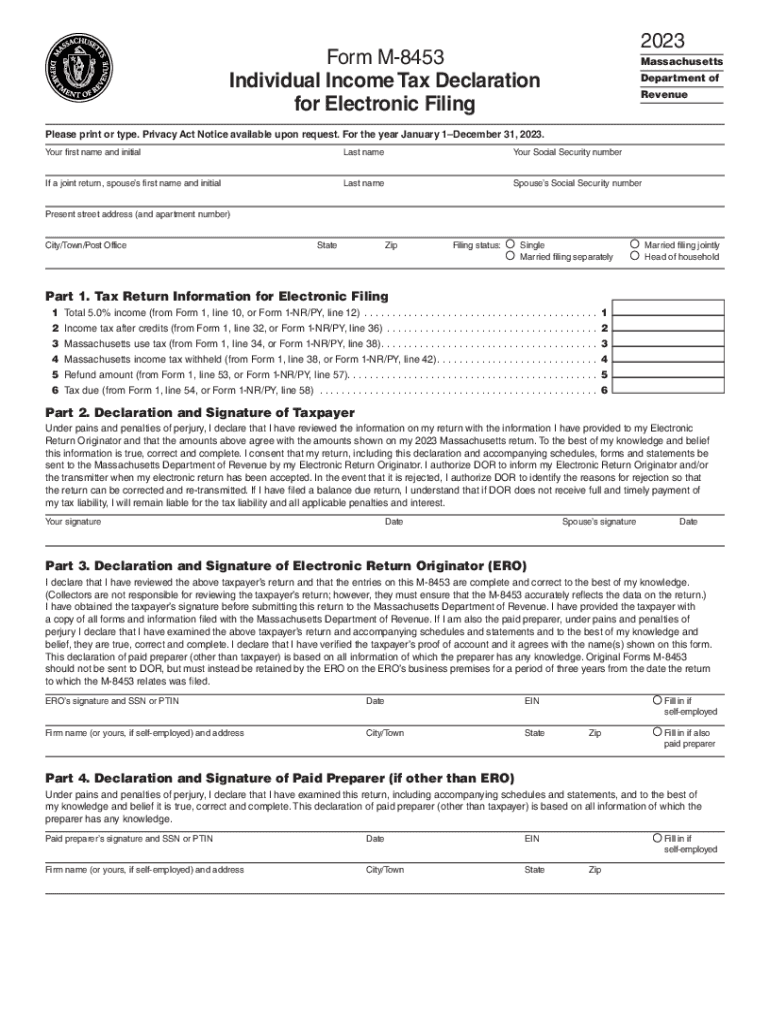

The Massachusetts M 8453 form serves as a declaration for individual income tax filers in the state. This form is essential for taxpayers who are filing their income tax returns electronically and need to verify their identity. It acts as a signature document, confirming that the information provided in the electronic return is accurate and complete. The M 8453 is particularly useful for those who may not have a physical signature on file, allowing for a smoother electronic filing process.

Steps to Complete the Massachusetts M 8453 Individual Income Tax Declaration Form

Completing the Massachusetts M 8453 form involves several key steps:

- Begin by entering your personal information, including your name, Social Security number, and address.

- Indicate the tax year for which you are filing the return.

- Provide details about your electronic return, including any relevant income and deductions.

- Sign and date the form, which serves as your electronic signature.

- Submit the completed M 8453 form alongside your electronic tax return.

Ensure that all information is accurate to avoid delays or issues with your tax filing.

How to Obtain the Massachusetts M 8453 Individual Income Tax Declaration Form

The M 8453 form can be easily obtained through the Massachusetts Department of Revenue's official website. It is available for download in a printable format, allowing taxpayers to fill it out manually if preferred. Additionally, many tax preparation software programs include the M 8453 form as part of their filing process, making it accessible for those filing electronically.

Legal Use of the Massachusetts M 8453 Individual Income Tax Declaration Form

The M 8453 form is legally recognized as a valid method for electronic tax filing in Massachusetts. By signing this form, taxpayers affirm that the information included in their electronic return is true and correct to the best of their knowledge. It is important to retain a copy of the M 8453 for your records, as it may be requested by the Massachusetts Department of Revenue for verification purposes.

Key Elements of the Massachusetts M 8453 Individual Income Tax Declaration Form

Several key elements must be included when filling out the M 8453 form:

- Taxpayer Information: Full name, Social Security number, and address.

- Tax Year: The specific year for which the tax return is being filed.

- Electronic Signature: A declaration that the information provided is accurate, along with the taxpayer's signature and date.

- Return Information: Details regarding the electronic return being filed, including income and deductions.

Filing Deadlines for the Massachusetts M 8453 Individual Income Tax Declaration Form

It is crucial to be aware of the filing deadlines associated with the M 8453 form. Typically, individual income tax returns in Massachusetts are due by April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should ensure that their M 8453 form is submitted in conjunction with their electronic return by this deadline to avoid penalties.

Quick guide on how to complete form m 8453 individual income tax declaration for

Effortlessly prepare Form M 8453 Individual Income Tax Declaration For on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any holdups. Manage Form M 8453 Individual Income Tax Declaration For on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to alter and electronically sign Form M 8453 Individual Income Tax Declaration For with ease

- Find Form M 8453 Individual Income Tax Declaration For and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from your preferred device. Alter and electronically sign Form M 8453 Individual Income Tax Declaration For to ensure seamless communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form m 8453 individual income tax declaration for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the massachusetts m 8453 form?

The Massachusetts M 8453 form is a key document used for e-signing tax forms in Massachusetts. This form allows taxpayers to authorize the electronic filing of their income tax returns. Understanding this form is vital for ensuring compliance and efficiency in the filing process.

-

How can I electronically sign the massachusetts m 8453 form?

You can electronically sign the Massachusetts M 8453 form using airSlate SignNow's intuitive platform. Our service provides a secure and straightforward process to add your signature digitally. This saves time and simplifies the tax filing experience.

-

What are the pricing options for using airSlate SignNow for the massachusetts m 8453 form?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including the management of the Massachusetts M 8453 form. Our plans are designed to be cost-effective, ensuring you only pay for the features you need. Visit our pricing page for detailed information.

-

Are there any special features for managing the massachusetts m 8453 form in airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for handling the Massachusetts M 8453 form. This includes template creation, automated workflows, and secure sharing options, making the document management process smooth and efficient. Enhance your filing experience with these powerful tools.

-

Can airSlate SignNow integrate with other applications to assist with the massachusetts m 8453 form?

Absolutely! airSlate SignNow provides seamless integrations with popular apps and platforms to streamline the process of handling the Massachusetts M 8453 form. These integrations allow for enhanced productivity and ensure that you can manage your documentation effectively across various platforms.

-

What are the benefits of using airSlate SignNow for the massachusetts m 8453 form?

Using airSlate SignNow for the Massachusetts M 8453 form provides numerous benefits, including speed, security, and ease of use. Our platform simplifies the e-signing process, reduces paperwork, and ensures your documents are securely stored. Experience a smarter way to handle your tax forms.

-

Is airSlate SignNow compliant with Massachusetts regulations for the massachusetts m 8453 form?

Yes, airSlate SignNow is fully compliant with Massachusetts regulations regarding the electronic submission of the Massachusetts M 8453 form. We prioritize security and compliance, ensuring that your electronic signatures and filings meet all legal requirements. Trust us to safeguard your sensitive information.

Get more for Form M 8453 Individual Income Tax Declaration For

- Individual to two individuals with retained life estate form

- Quitclaim deed for a timeshare form

- Notice of project commencement corporation form

- Contractors notice of project commencement and location notice form

- Husband and wife as joint tenants with rights of survivorship form

- Dorsdgov form

- Code of laws title 12 chapter 24 deed recording fee form

- Contractors notice of project commencement and location form

Find out other Form M 8453 Individual Income Tax Declaration For

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form