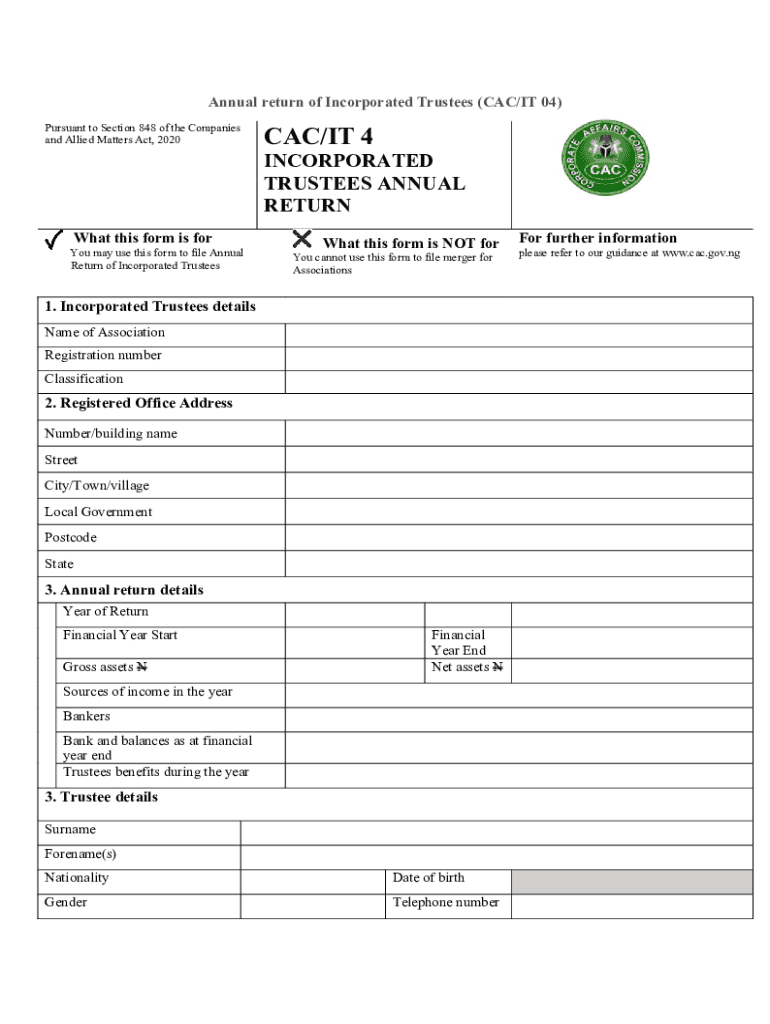

Cac Return Incorporated Trustees Form

What is the CAC Return for Incorporated Trustees?

The Corporate Affairs Commission (CAC) return for incorporated trustees is a formal document that organizations must file annually to maintain their legal status. This return provides essential information about the organization's activities, governance, and compliance with regulatory requirements. Incorporated trustees, often associated with non-profit organizations, must submit this return to ensure transparency and accountability in their operations. The CAC return serves as a record of the organization's financial health and adherence to the laws governing incorporated entities.

Steps to Complete the CAC Return for Incorporated Trustees

Completing the CAC return involves several key steps to ensure that all required information is accurately reported. First, gather all necessary documentation, including financial statements, details of board members, and any changes in the organization's structure. Next, access the CAC online portal or obtain a physical form if preferred. Fill out the form with precise information regarding the organization's activities, financial status, and governance. After completing the form, review it for accuracy before submission. Finally, submit the return by the specified deadline to avoid penalties.

Required Documents for the CAC Return

When preparing to file the CAC return, certain documents are essential. These typically include:

- Financial statements for the previous year

- List of current board members and their roles

- Any amendments to the organization's constitution or bylaws

- Proof of compliance with any specific regulatory requirements

Having these documents ready will streamline the filing process and ensure compliance with CAC regulations.

Filing Deadlines and Important Dates

It is crucial for incorporated trustees to be aware of the filing deadlines for the CAC return. Typically, the return must be submitted within a specific timeframe after the end of the financial year. Failure to file on time can result in penalties or loss of good standing. Organizations should mark their calendars with these important dates and ensure that they allow sufficient time for preparation and submission of the required documents.

Penalties for Non-Compliance

Non-compliance with the CAC return filing requirements can lead to significant consequences. Organizations that fail to submit their returns on time may face financial penalties, which can increase over time. Additionally, non-compliance can jeopardize the organization's legal status, affecting its ability to operate and access funding. It is vital for incorporated trustees to prioritize timely filing to avoid these risks.

Who Issues the CAC Return?

The CAC return is issued by the Corporate Affairs Commission, the regulatory body responsible for overseeing business registrations and compliance in the United States. This commission ensures that organizations adhere to the legal frameworks governing their operations. The CAC provides guidelines on how to complete the return and the necessary information that must be included, ensuring that organizations remain compliant with the law.

Quick guide on how to complete cac return incorporated trustees

Complete Cac Return Incorporated Trustees seamlessly on any gadget

Managing documents online has gained traction among companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the correct format and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without holdups. Manage Cac Return Incorporated Trustees on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and electronically sign Cac Return Incorporated Trustees effortlessly

- Find Cac Return Incorporated Trustees and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your adjustments.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Wave goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Cac Return Incorporated Trustees and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cac return incorporated trustees

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the corporate affairs commission annual return?

The corporate affairs commission annual return is a mandatory filing that corporations must submit yearly to the Corporate Affairs Commission in order to maintain their legal status. This document provides updated information about the company's structure, directors, and financial status, ensuring compliance with corporate regulations.

-

How can airSlate SignNow help with the corporate affairs commission annual return?

airSlate SignNow offers an efficient platform that allows you to easily create, send, and eSign documents related to your corporate affairs commission annual return. Our user-friendly interface makes it simple to gather necessary signatures and maintain compliance with deadlines, streamlining the process for businesses.

-

What are the costs associated with using airSlate SignNow for annual returns?

The pricing for using airSlate SignNow varies based on the plan you select, ensuring you only pay for the features you need for your corporate affairs commission annual return. We offer flexible pricing options, making it a cost-effective solution for businesses of all sizes.

-

Is airSlate SignNow secure for handling corporate affairs commission documents?

Yes, airSlate SignNow prioritizes the security of your documents, employing industry-standard encryption to protect sensitive information, including your corporate affairs commission annual return. You can trust our platform to handle your corporate documents securely and confidentially.

-

Can I integrate airSlate SignNow with other software for better functionality?

Absolutely! airSlate SignNow easily integrates with various software applications, enhancing your workflow for handling the corporate affairs commission annual return. These integrations allow for seamless data transfer and improved efficiency, helping your business stay organized.

-

What features make airSlate SignNow ideal for managing annual returns?

airSlate SignNow includes features such as customizable templates, automated reminders, and advanced tracking capabilities to manage your corporate affairs commission annual return effectively. These tools ensure that you never miss a deadline and that your documentation process is smooth and efficient.

-

How do I start using airSlate SignNow for my corporate affairs commission annual return?

To get started with airSlate SignNow, simply create an account on our website, choose the appropriate plan, and begin creating your corporate affairs commission annual return documents. Our intuitive platform guides you through the eSigning process, making compliance easier than ever.

Get more for Cac Return Incorporated Trustees

- Contractor shall call for inspections of form

- Attorney immediately form

- Fillable online north carolina buyers request for form

- As buyers which contract for deed is recorded in the form

- Adopted by the state of new mexico and form

- It is the intent of the parties that the agreement be enforced to the form

- Other cash form

- By the laws of the state of new mexico and any other agreements the parties may enter into form

Find out other Cac Return Incorporated Trustees

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe