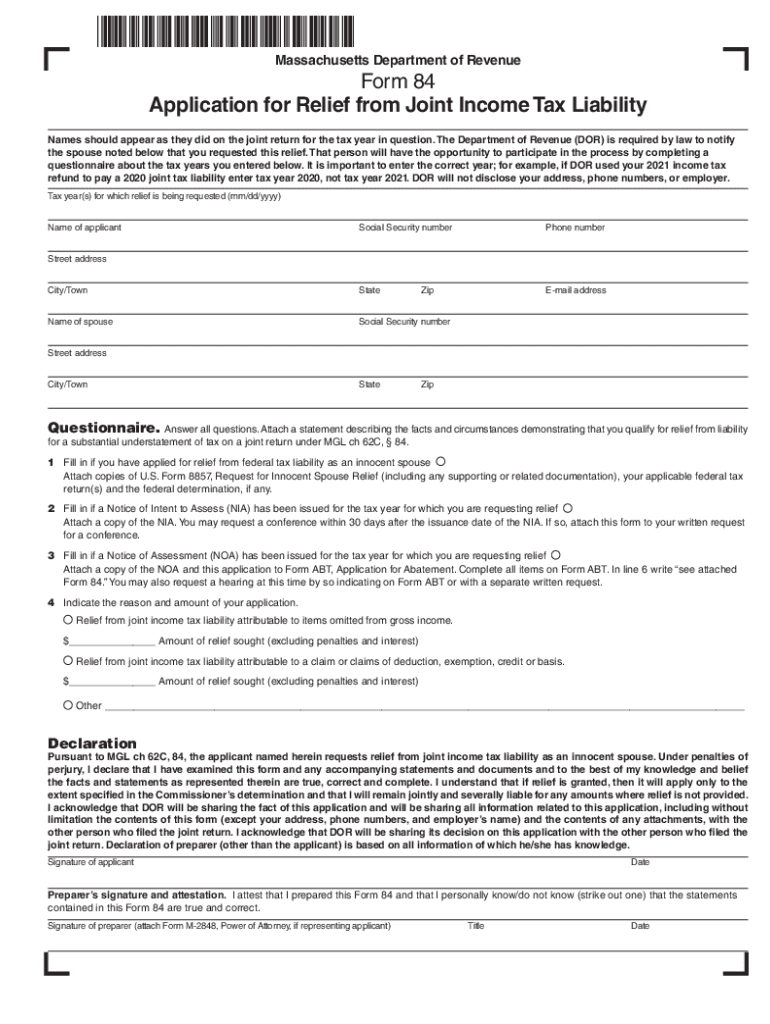

The Department of Revenue DOR is Required by Law to Notify Form

Filing Deadlines and Important Dates

Understanding the key deadlines for tax filing in Massachusetts is essential for managing your 2023 Massachusetts tax liability effectively. The Massachusetts Department of Revenue typically sets specific dates for filing individual income tax returns, which usually align with federal deadlines. For the 2023 tax year, the deadline for filing your state tax return is generally April 15, 2024. If you need additional time, you may file for an extension, but it is crucial to pay any estimated taxes owed by the original deadline to avoid penalties.

Required Documents

To accurately calculate your 2023 Massachusetts tax liability, you will need several important documents. These include:

- Your W-2 forms from employers, which report your annual income.

- 1099 forms for any freelance or contract work.

- Records of any other income, such as rental income or dividends.

- Receipts for deductible expenses, including medical expenses, mortgage interest, and charitable contributions.

- Previous year’s tax return for reference.

Gathering these documents in advance can streamline the filing process and ensure you claim all eligible deductions.

Penalties for Non-Compliance

Failing to comply with Massachusetts tax regulations can result in significant penalties. If you do not file your tax return by the deadline, you may incur a late filing penalty, which can be a percentage of the unpaid tax. Additionally, if you do not pay your tax liability on time, interest will accrue on the unpaid amount. Understanding these penalties can motivate timely and accurate filing, helping you avoid unnecessary financial burdens.

Taxpayer Scenarios

Your 2023 Massachusetts tax liability may vary based on your specific taxpayer scenario. Here are some common situations:

- Self-Employed Individuals: If you are self-employed, you must report all income and may need to pay estimated taxes quarterly.

- Retired Individuals: Retirees may have different tax considerations, such as pension income and Social Security benefits.

- Students: Students may qualify for certain deductions or credits, especially if they are working part-time or receiving scholarships.

Each scenario has unique implications for tax liability, making it important to understand your specific situation.

Form Submission Methods

Massachusetts offers multiple methods for submitting your tax forms, allowing flexibility based on your preferences. You can file your 2023 tax return online through the Massachusetts Department of Revenue's website, which is often the fastest option. Alternatively, you can mail your completed forms to the appropriate address based on your location. In-person filing is also available at designated state offices, although this may require an appointment. Each method has its advantages, so choose the one that best fits your needs.

Quick guide on how to complete the department of revenue dor is required by law to notify

Effortlessly Prepare The Department Of Revenue DOR Is Required By Law To Notify on Any Device

Web-based document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to find the appropriate template and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage The Department Of Revenue DOR Is Required By Law To Notify on any device with airSlate SignNow's Android or iOS applications and enhance any document-related activity today.

How to Modify and eSign The Department Of Revenue DOR Is Required By Law To Notify with Ease

- Find The Department Of Revenue DOR Is Required By Law To Notify and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to secure your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign The Department Of Revenue DOR Is Required By Law To Notify to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the department of revenue dor is required by law to notify

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can airSlate SignNow help reduce my 2023 Massachusetts tax liability?

Using airSlate SignNow can streamline your document processes, allowing for more efficient record-keeping and timely submissions related to your 2023 Massachusetts tax liability. By minimizing errors and delays in documentation, you can help ensure compliance and potentially identify deductions that may reduce your tax burden.

-

What features does airSlate SignNow offer that are important for managing 2023 Massachusetts tax liability?

airSlate SignNow provides features like document eSigning, templates for tax documents, and secure storage for important tax records. These features are essential for managing your 2023 Massachusetts tax liability efficiently and ensuring that all relevant documents are easily accessible and securely stored.

-

Is airSlate SignNow a cost-effective solution for managing 2023 Massachusetts tax liability?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes regarding managing their 2023 Massachusetts tax liability. Its pricing plans are tailored to offer great value while ensuring you have all the necessary tools to handle your documentation needs without overspending.

-

Can airSlate SignNow integrate with other financial software for better management of 2023 Massachusetts tax liability?

Absolutely! airSlate SignNow integrates seamlessly with various financial software applications, allowing you to streamline your tax management processes. This integration can help ensure that the documents you need for your 2023 Massachusetts tax liability are synchronized and ready for use, improving overall efficiency.

-

What benefits does airSlate SignNow provide specifically for businesses preparing for their 2023 Massachusetts tax liability?

airSlate SignNow offers numerous benefits for businesses preparing for their 2023 Massachusetts tax liability, including faster document turnaround, greater accountability through trackable eSignatures, and reduced paper waste. By simplifying the eSigning process, businesses can focus more on strategic financial decisions rather than administrative tasks.

-

How secure is airSlate SignNow for handling documents related to 2023 Massachusetts tax liability?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption methods to protect sensitive documents, ensuring that any information related to your 2023 Massachusetts tax liability remains confidential and secure from unauthorized access.

-

What types of documents can I manage with airSlate SignNow to address my 2023 Massachusetts tax liability?

You can manage a variety of documents with airSlate SignNow, including tax forms, contracts, and invoices that all may impact your 2023 Massachusetts tax liability. The ability to eSign and store these documents securely means you can maintain proper records needed for tax preparation and filing.

Get more for The Department Of Revenue DOR Is Required By Law To Notify

- Motion to fix fees form

- Motion to fix case for sentencing form

- The petition of a person of the full age of majority domiciled form

- Application for public defender huntingdon county court form

- Probate no form

- Rule to show cause 21st judicial district court form

- Petition to annul consent judgment form

- Enforcement of judgments travelgov us department of state form

Find out other The Department Of Revenue DOR Is Required By Law To Notify

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now