Maryland Tax Power of Attorney Form 548 2023-2026

What is the Maryland Tax Power Of Attorney Form 548

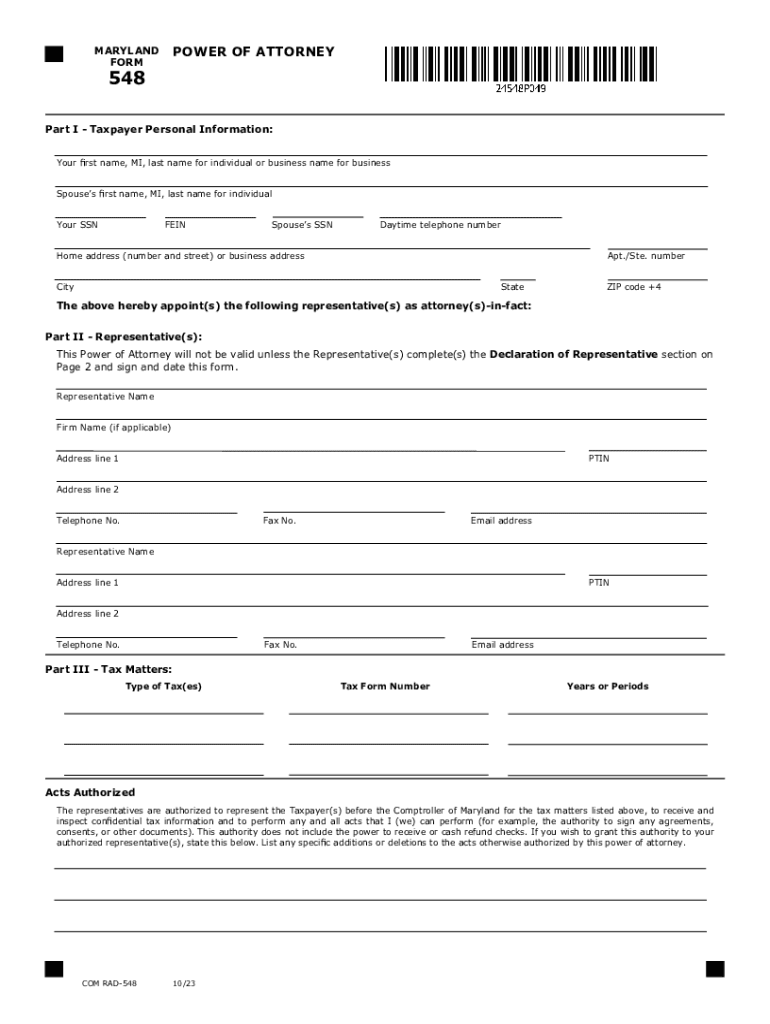

The Maryland Tax Power of Attorney Form 548 is a legal document that allows individuals to designate another person, known as an attorney-in-fact, to act on their behalf in tax matters. This form is particularly useful for those who may need assistance with filing taxes, responding to tax inquiries, or representing them in front of the Maryland Comptroller's office. By completing this form, taxpayers can ensure that their chosen representative has the authority to handle specific tax-related issues, streamlining communication and processes with the state tax authority.

How to use the Maryland Tax Power Of Attorney Form 548

To effectively use the Maryland Form 548, individuals must first complete the form by providing necessary information such as their name, address, and Social Security number, along with the details of the attorney-in-fact. Once the form is filled out, it must be signed and dated by the taxpayer. The completed form can then be submitted to the Maryland Comptroller's office, ensuring that the designated representative is recognized and authorized to act on behalf of the taxpayer. It is advisable to keep a copy of the submitted form for personal records.

Steps to complete the Maryland Tax Power Of Attorney Form 548

Completing the Maryland Form 548 involves several straightforward steps:

- Obtain the form: Download the Maryland Tax Power of Attorney Form 548 from an official source.

- Fill in taxpayer information: Provide your full name, address, and Social Security number in the designated fields.

- Designate your representative: Enter the name and contact information of the attorney-in-fact you wish to appoint.

- Specify the authority granted: Indicate the specific tax matters for which the attorney-in-fact will have authority.

- Sign and date: Ensure the form is signed and dated to validate the authorization.

- Submit the form: Send the completed form to the Maryland Comptroller's office.

Key elements of the Maryland Tax Power Of Attorney Form 548

The Maryland Form 548 includes several key elements that are essential for its validity:

- Taxpayer Information: Accurate details about the taxpayer, including name and Social Security number.

- Representative Information: Complete information about the designated attorney-in-fact.

- Scope of Authority: Clear specification of the tax matters the attorney-in-fact is authorized to handle.

- Signatures: The form must be signed by the taxpayer to confirm the designation.

Legal use of the Maryland Tax Power Of Attorney Form 548

The legal use of the Maryland Form 548 is to empower an individual to act on behalf of another in tax-related matters. This form is recognized by the Maryland Comptroller and is legally binding once properly executed. It is important to note that the powers granted through this form can be limited to specific tax issues or can be broad, depending on the taxpayer's preferences. This flexibility allows taxpayers to tailor the authority given to their representatives based on their unique needs.

Form Submission Methods

The Maryland Tax Power of Attorney Form 548 can be submitted to the Maryland Comptroller's office through various methods:

- By Mail: Send the completed form to the address specified on the form.

- In-Person: Deliver the form directly to a local Comptroller's office.

- Online Submission: Some taxpayers may be able to submit the form electronically, depending on the services offered by the Comptroller's office.

Quick guide on how to complete maryland tax power of attorney form 548

Manage Maryland Tax Power Of Attorney Form 548 with ease on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly and without hesitation. Handle Maryland Tax Power Of Attorney Form 548 on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The easiest way to alter and electronically sign Maryland Tax Power Of Attorney Form 548 effortlessly

- Locate Maryland Tax Power Of Attorney Form 548 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your delivery method for the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Maryland Tax Power Of Attorney Form 548 and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maryland tax power of attorney form 548

Create this form in 5 minutes!

How to create an eSignature for the maryland tax power of attorney form 548

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Maryland Form 548 and how does it relate to airSlate SignNow?

Maryland Form 548 is a crucial document used in specific tax reporting situations. With airSlate SignNow, users can easily eSign and send this form securely, ensuring compliance and efficiency in their filing processes.

-

How can I use airSlate SignNow to manage Maryland Form 548?

You can utilize airSlate SignNow's user-friendly interface to upload Maryland Form 548, add signers, and send it for eSignature. The platform allows for secure storage and easy retrieval of completed forms, making document management hassle-free.

-

What are the pricing options for using airSlate SignNow for Maryland Form 548?

airSlate SignNow offers flexible pricing plans tailored to various business needs. You can choose from individual plans to team subscriptions that fit the volume of documents like Maryland Form 548 you'll need to process.

-

Are there any special features for filling out Maryland Form 548 in airSlate SignNow?

Yes, airSlate SignNow provides features like form templates, text fields, and eSignature capabilities specifically designed to simplify the process of filling out Maryland Form 548. These features enhance user experience and efficiency.

-

What benefits does airSlate SignNow provide for signing Maryland Form 548?

Using airSlate SignNow to sign Maryland Form 548 offers a range of benefits, including reduced turnaround times, enhanced security, and customizable workflows. This ensures that your document is processed quickly and securely.

-

Can airSlate SignNow integrate with other software for handling Maryland Form 548?

Absolutely, airSlate SignNow seamlessly integrates with various applications and software, allowing users to automate and streamline the process of managing Maryland Form 548 and other documents, enhancing overall efficiency.

-

Is it safe to send Maryland Form 548 through airSlate SignNow?

Yes, airSlate SignNow employs industry-standard encryption and security protocols to protect your Maryland Form 548 and other sensitive documents during transmission and storage, ensuring your information remains confidential.

Get more for Maryland Tax Power Of Attorney Form 548

- Louisiana known as form

- Registered name of with the registry registration form

- Notice to pay rent or lease terminates residential form

- Entitled to the use of stables facilities at the location as above described for a total of form

- Referred to aslessee form

- The horse in competition form

- Of delivery shortage discrepancy or error and further agrees that such invoice or statement shall be presumed correct unless form

- Objection to hearing officer recommendation 15th judicial form

Find out other Maryland Tax Power Of Attorney Form 548

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online