Dtf 17 Form 2016

What is the Dtf 17 Form

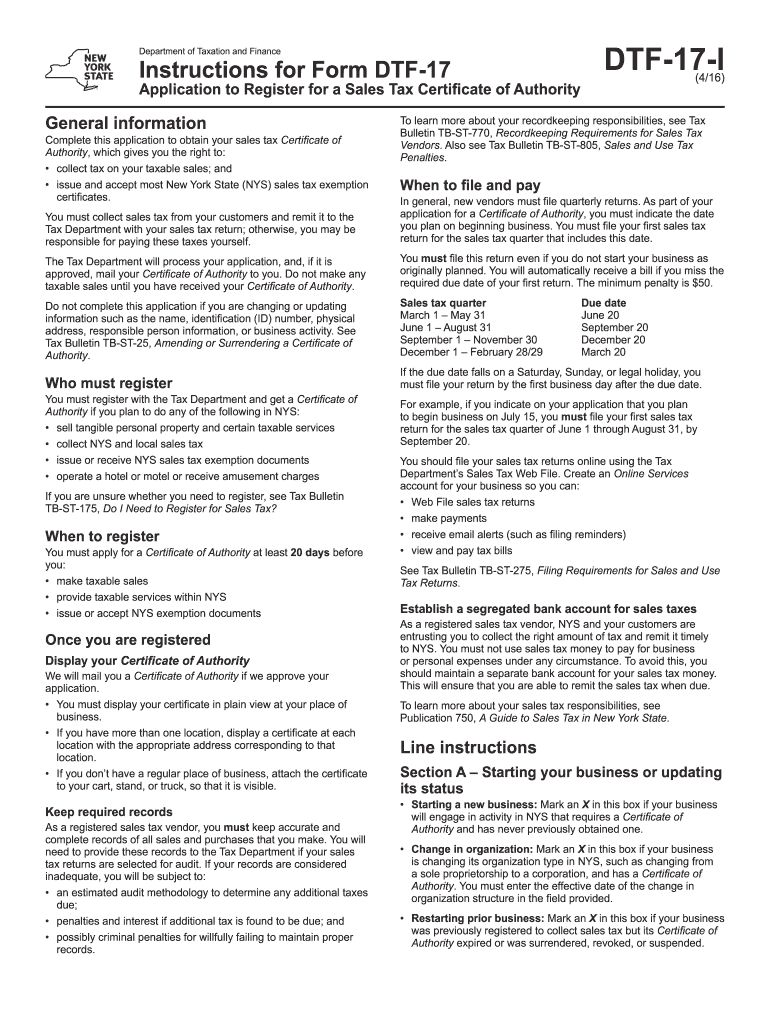

The Dtf 17 Form is a tax-related document used primarily in the state of New York. It is designed for individuals and businesses to report specific tax information related to their income and financial activities. This form is essential for ensuring compliance with state tax laws and regulations. Understanding the purpose and requirements of the Dtf 17 Form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Dtf 17 Form

Using the Dtf 17 Form involves several key steps. First, you need to gather all necessary financial documents that support the information you will report. This includes income statements, deduction records, and any relevant tax credits. Once you have the required documents, you can fill out the form accurately, ensuring that all information is complete and truthful. After completing the form, it can be submitted electronically or via mail, depending on your preference and the guidelines provided by the state.

Steps to complete the Dtf 17 Form

Completing the Dtf 17 Form involves a systematic approach:

- Gather all necessary financial documents, including W-2s, 1099s, and receipts for deductions.

- Download the Dtf 17 Form from the official state website or access it through a trusted e-signature platform.

- Fill out the form carefully, ensuring all fields are completed accurately.

- Review the form for any errors or omissions before finalizing.

- Sign the form electronically or manually, depending on your submission method.

- Submit the completed form by the specified deadline.

Legal use of the Dtf 17 Form

The Dtf 17 Form is legally recognized as a valid document for tax reporting in New York. It must be completed in accordance with state laws and regulations to ensure its legal validity. Using the form properly helps taxpayers avoid legal issues, including fines and audits. It is important to stay informed about any changes in tax laws that may affect the completion and submission of the Dtf 17 Form.

Filing Deadlines / Important Dates

Filing deadlines for the Dtf 17 Form are crucial for compliance. Typically, the form must be submitted by the tax filing deadline, which is usually April fifteenth for individual taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or special filing situations. Keeping track of these important dates ensures that taxpayers submit their forms on time and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Dtf 17 Form can be submitted through various methods to accommodate different preferences. Taxpayers can file the form online using secure e-signature platforms, which provide a convenient and efficient way to submit documents. Alternatively, the form can be mailed to the appropriate tax authority or submitted in person at designated offices. Each method has its own advantages, such as speed for online submissions or personal assistance for in-person filings.

Quick guide on how to complete dtf 17 2016 form

Your assistance manual on how to prepare your Dtf 17 Form

If you’re looking to understand how to complete and submit your Dtf 17 Form, here are some brief guidelines on how to simplify tax processing signNowly.

To start, all you need to do is create your airSlate SignNow account to revolutionize your online documentation. airSlate SignNow is an extremely user-friendly and robust document management solution that allows you to edit, create, and finalize your tax papers with ease. Utilizing its editor, you can toggle between text, check boxes, and electronic signatures and return to adjust responses where necessary. Enhance your tax administration with advanced PDF editing, eSigning, and easy sharing options.

Follow the instructions below to complete your Dtf 17 Form in just a few minutes:

- Establish your account and start working on PDFs within minutes.

- Browse our collection to locate any IRS tax form; explore different versions and schedules.

- Click Obtain form to access your Dtf 17 Form in our editor.

- Complete the required fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-binding electronic signature (if applicable).

- Review your document and correct any mistakes.

- Save your changes, print a copy, send it to your recipient, and download it to your device.

Refer to this manual to electronically file your taxes using airSlate SignNow. Please be aware that submitting in paper form can increase the likelihood of return errors and postpone refunds. Additionally, before e-filing your taxes, check the IRS website for the submission guidelines relevant to your state.

Create this form in 5 minutes or less

Find and fill out the correct dtf 17 2016 form

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

When do we have to fill the form for the NDA exam 2016-17 ? (See question details)

Dear FriendUPSC conducts NDA exam twice in a year. NDA/NA 1 exam conduct in April and NDA/NA 2 exam conducts in September. NDA 1 exam 2016 has been conducted on 17 April 2016, while NDA 2 exam 2016 will be conducted on 19 September 2016.The application form for NDA 2 exam 2016 will be available from 6 June to 15 July 2016. The application form of NDA exam available in online mode. The Application Procedure is a two step process. In first step, candidates fill the online applications and in second step, candidates remit a payment against application fee of Rupees 100 (Only for general and OBC category candidates)). Payment mode: Bank Challan or Online through Net Banking of SBI or via SBI Debit/Credit CardsFor NDA I 2016, candidates must be born between July 2, 1997 and July 1, 2000 For NDA II 2016, candidates must be born between January 2, 1998 and January 1, 2001.To know more details on NDA 2016, you can follow- NDA 2016, NDA 2016 Application FormI hope it will help you..

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

How can I fill out an improvement exam form for session 17-18 online?

first of all this time improvement form will be available in 3rd week of October.when the form is available then you have to open that link and fill your board roll no. and year of passing. after that you have to verify your details and then it will ask which subjects you want to apply for improvement. in this you can choose all subjects or a particular subject of your choice then you have to pay some amount for the improvement form. i think you have to generate a challan and pay it in a bank after that you have to send some documents to cbse regional office. the documents are your acknowledgement page, 12th marksheet xerox ,challan xerox then you have to download your admit card which will be available in month of February. you will get your marksheet at your address by post so please fill the correct address in form because according to that you will get the exam centre and regional office .

-

What engineering college forms should I fill for 2016-17?

Apply for BITSAT first. After that, apply for the following universities which conduct their own entrance exams, according to your convenience.1. Your state entrance exam2. Indraprasth university, Delhi3. Bharti Vidyapeeth university, Pune*4. NMIMS, Mumbai*5. SRM university*6. VIT university**7. UPES, Dehradun8. COMEDK, KarnatakaAlso, never take the risk of attempting only one exam. Keep 2-3 options handy.The * university are costlier, they cost about 3-4 lakhs per year.** Apply to UPES only if you have interest in Petroleum and Fuel studies.Keep SRM and VIT as your last options, but do give their entrance exams.All the best.Just remember, One sheet of exam cannot determine your future.But multiple sheets surely do.

Create this form in 5 minutes!

How to create an eSignature for the dtf 17 2016 form

How to make an electronic signature for the Dtf 17 2016 Form in the online mode

How to create an electronic signature for the Dtf 17 2016 Form in Chrome

How to generate an electronic signature for signing the Dtf 17 2016 Form in Gmail

How to generate an electronic signature for the Dtf 17 2016 Form from your smart phone

How to generate an eSignature for the Dtf 17 2016 Form on iOS devices

How to generate an electronic signature for the Dtf 17 2016 Form on Android devices

People also ask

-

What is the Dtf 17 Form and how is it used?

The Dtf 17 Form is a crucial document used for tax purposes, specifically in New York State. It allows individuals and businesses to report their financial information accurately. With airSlate SignNow, you can easily fill out, sign, and send your Dtf 17 Form electronically, streamlining the process and ensuring compliance.

-

How can airSlate SignNow help me manage the Dtf 17 Form?

AirSlate SignNow simplifies the management of the Dtf 17 Form by providing an intuitive platform for document creation, signing, and sharing. You can customize the form to meet your specific needs and ensure that all required fields are filled out correctly. This helps reduce errors and saves time during tax season.

-

Is there a cost associated with using airSlate SignNow for the Dtf 17 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost-effective solution allows you to choose a plan that fits your budget while providing all the necessary features for managing the Dtf 17 Form efficiently. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for the Dtf 17 Form?

AirSlate SignNow provides a range of features for managing the Dtf 17 Form, including electronic signatures, document templates, and secure cloud storage. These features enhance collaboration and ensure that your documents are easily accessible from anywhere. Plus, the user-friendly interface makes it simple for anyone to use.

-

Can I integrate airSlate SignNow with other software for the Dtf 17 Form?

Absolutely! AirSlate SignNow integrates seamlessly with various software solutions, including CRM and accounting software, to streamline the process of managing the Dtf 17 Form. This integration helps automate workflows and ensures that your documents are always up-to-date.

-

What are the benefits of using airSlate SignNow for the Dtf 17 Form?

Using airSlate SignNow for the Dtf 17 Form offers multiple benefits, including enhanced efficiency, reduced turnaround time, and improved accuracy. The platform's electronic signature feature eliminates the need for printing and scanning, making the entire process faster and more environmentally friendly.

-

Is airSlate SignNow secure for submitting the Dtf 17 Form?

Yes, airSlate SignNow prioritizes security for all documents, including the Dtf 17 Form. We use advanced encryption and compliance measures to protect your sensitive information, ensuring that your documents are secure during transmission and storage.

Get more for Dtf 17 Form

- Modification agreement sample form

- New york commercial lease s3amazonawscom form

- Dor stay order st louis county form

- Pdf worker report of injury form c060 january wcb worker report of injury form c060

- Blank carrier profile template 270305312 form

- Opra request form hopatcong borough

- Written agreement studentparent handbook agreement k12 form

- Physician certification statement form

Find out other Dtf 17 Form

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form