Dtf 17 2018-2026

What is the DTF 17?

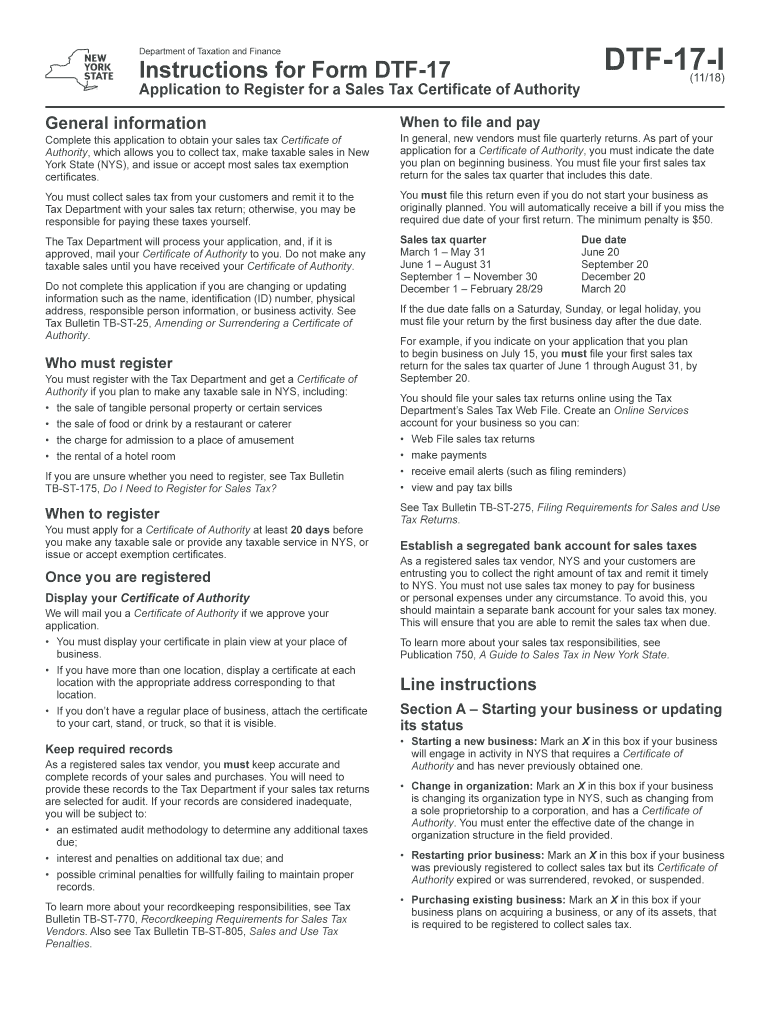

The DTF 17, also known as the New York State Certificate of Authority, is a crucial document for businesses operating in New York. This form allows businesses to collect sales tax from customers legally. It is issued by the New York State Department of Taxation and Finance and is essential for any entity that sells taxable goods or services in the state. Obtaining this certificate signifies that a business is compliant with state tax laws and is authorized to conduct sales tax activities.

How to Obtain the DTF 17

To obtain the DTF 17, businesses must complete an application process through the New York State Department of Taxation and Finance. This process typically involves the following steps:

- Visit the official website of the New York State Department of Taxation and Finance.

- Locate the application for the Certificate of Authority.

- Fill out the necessary information, including business details and ownership structure.

- Submit the application online or by mail, depending on your preference.

Once submitted, the application will be reviewed, and if approved, the Certificate of Authority will be issued, allowing the business to legally collect sales tax.

Steps to Complete the DTF 17

Completing the DTF 17 involves several key steps to ensure accuracy and compliance. Here’s how to fill out the form:

- Provide the legal name of the business and any trade names used.

- Include the business address, contact information, and the type of business entity (e.g., LLC, corporation).

- Detail the owners or partners involved in the business.

- Indicate the nature of the business activities and the products or services offered.

- Review all information for accuracy before submission.

Completing the form accurately is essential to avoid delays in processing and to ensure compliance with state regulations.

Legal Use of the DTF 17

The DTF 17 serves as a legal document that allows businesses to collect sales tax from customers. It is important to understand the legal implications of this certificate:

- Businesses must display the Certificate of Authority at their place of business.

- Sales tax must be collected on all taxable sales made by the business.

- Failure to comply with sales tax collection can result in penalties and fines from the state.

Understanding the legal responsibilities associated with the DTF 17 is crucial for maintaining compliance and avoiding legal issues.

Required Documents

When applying for the DTF 17, businesses may need to provide specific documents to support their application. Commonly required documents include:

- Proof of business registration, such as Articles of Incorporation or a business license.

- Identification information for all owners or partners.

- Any previous tax identification numbers, if applicable.

Having these documents ready can streamline the application process and ensure that the form is completed correctly.

Form Submission Methods

The DTF 17 can be submitted through various methods, providing flexibility for businesses. The submission options include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if preferred.

Choosing the right submission method can depend on the urgency and convenience for the business owner.

Quick guide on how to complete dtf 17 2018 2019 form

Your assistance manual on how to prepare your Dtf 17

If you’re looking to understand how to finalize and submit your Dtf 17, here are some concise guidelines on how to simplify the tax filing process.

To begin, all you need to do is create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document management solution that enables you to modify, draft, and finalize your income tax forms with ease. With its editor, you can toggle between text, check boxes, and electronic signatures, making it possible to revisit and alter answers as necessary. Enhance your tax management experience with advanced PDF editing, eSigning, and user-friendly sharing capabilities.

Follow the steps below to finalize your Dtf 17 in just a few minutes:

- Create your account and begin editing PDFs in just a few moments.

- Utilize our directory to locate any IRS tax form; explore different versions and schedules.

- Click Get form to access your Dtf 17 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-valid eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print a copy, send it to your recipient, and download it to your device.

Refer to this manual for electronically filing your taxes with airSlate SignNow. Be aware that submitting paper forms can lead to increased errors and delayed refunds. Additionally, before e-filing your taxes, make sure to check the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct dtf 17 2018 2019 form

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the dtf 17 2018 2019 form

How to make an electronic signature for your Dtf 17 2018 2019 Form online

How to make an eSignature for your Dtf 17 2018 2019 Form in Google Chrome

How to generate an eSignature for putting it on the Dtf 17 2018 2019 Form in Gmail

How to make an eSignature for the Dtf 17 2018 2019 Form from your mobile device

How to make an electronic signature for the Dtf 17 2018 2019 Form on iOS devices

How to generate an electronic signature for the Dtf 17 2018 2019 Form on Android OS

People also ask

-

What is Dtf 17 in the context of airSlate SignNow?

Dtf 17 refers to a specific version of the airSlate SignNow platform that enhances electronic signature capabilities. This version offers improved features for document management, making it easier for businesses to send and eSign documents efficiently. With Dtf 17, users can enjoy a streamlined workflow and enhanced security for their important documents.

-

How does Dtf 17 improve document signing processes?

Dtf 17 signNowly improves document signing processes by providing a user-friendly interface and advanced automation features. Users can customize workflows to fit their specific needs, reducing the time it takes to get documents signed. Additionally, Dtf 17 includes integrations with popular applications, allowing for seamless data transfer and management.

-

What are the pricing options for Dtf 17?

airSlate SignNow offers competitive pricing plans for Dtf 17, catering to businesses of all sizes. Plans typically include various features, such as unlimited document signing and access to advanced templates. Customers can choose a plan that best fits their needs, ensuring they get the best value for their investment in Dtf 17.

-

Can Dtf 17 be integrated with other software?

Yes, Dtf 17 is designed to integrate seamlessly with a wide range of software applications, including CRMs, document management systems, and productivity tools. This integration capability allows businesses to enhance their workflows and improve efficiency. Whether you use Salesforce, Google Workspace, or other platforms, Dtf 17 can help streamline your document processes.

-

What benefits does Dtf 17 offer for businesses?

Dt 17 offers numerous benefits for businesses, including increased efficiency, reduced turnaround time for document signing, and enhanced security. By using Dtf 17, companies can eliminate paper-based processes and create a more environmentally friendly workflow. Additionally, the platform provides robust tracking and reporting features, allowing businesses to monitor their document status easily.

-

Is Dtf 17 suitable for small businesses?

Absolutely! Dtf 17 is suitable for small businesses looking for an easy-to-use and cost-effective eSignature solution. With its affordable pricing plans and essential features, small businesses can optimize their document signing processes without breaking the bank. The user-friendly interface of Dtf 17 also ensures that teams can quickly adopt the platform with minimal training.

-

What types of documents can be signed using Dtf 17?

With Dtf 17, users can sign a variety of documents ranging from contracts and agreements to consent forms and invoices. The platform supports multiple file formats, making it versatile for different business needs. This flexibility allows organizations to manage their document signing processes more effectively, regardless of the type of document.

Get more for Dtf 17

Find out other Dtf 17

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF