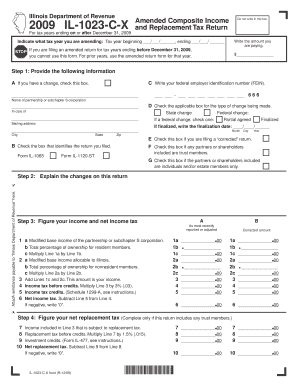

IL 1023 C X Illinois Department of Revenue Tax Illinois Form

Understanding the IL 1023 C X Form

The IL 1023 C X is a tax form issued by the Illinois Department of Revenue. This form is primarily used for claiming exemptions from certain taxes for qualifying organizations. It is essential for non-profit entities, educational institutions, and other organizations seeking tax-exempt status under Illinois law. Understanding the purpose and requirements of this form is crucial for compliance and to ensure that your organization can benefit from the applicable tax exemptions.

Steps to Complete the IL 1023 C X Form

Completing the IL 1023 C X form involves several important steps:

- Gather necessary documentation that supports your organization's eligibility for tax exemption.

- Fill out the form accurately, providing all required information, including your organization's name, address, and tax identification number.

- Detail the specific tax exemptions you are applying for, ensuring that you meet the criteria outlined by the Illinois Department of Revenue.

- Review the completed form for accuracy and completeness before submission.

Required Documents for the IL 1023 C X Form

To successfully submit the IL 1023 C X form, certain documents must be included:

- Proof of your organization's tax-exempt status, such as a letter from the IRS.

- Bylaws or governing documents that outline your organization's purpose and operations.

- Financial statements or budgets that demonstrate your organization's financial health and activities.

Filing Deadlines for the IL 1023 C X Form

It is important to be aware of the filing deadlines for the IL 1023 C X form to avoid penalties. Generally, the form should be submitted within the timeframe specified by the Illinois Department of Revenue, typically coinciding with the organization's fiscal year. Late submissions may result in the loss of tax-exempt status or additional penalties.

Legal Use of the IL 1023 C X Form

The IL 1023 C X form serves a legal purpose in establishing an organization's eligibility for tax exemptions in Illinois. Proper use of this form ensures compliance with state tax laws and provides the necessary documentation for maintaining tax-exempt status. Organizations must adhere to the legal requirements set forth by the Illinois Department of Revenue when completing and submitting this form.

Who Issues the IL 1023 C X Form

The IL 1023 C X form is issued by the Illinois Department of Revenue. This state agency is responsible for administering tax laws in Illinois, including the oversight of tax-exempt organizations. Understanding the role of the Department of Revenue is important for organizations seeking guidance on the form and its requirements.

Quick guide on how to complete il 1023 c x illinois department of revenue tax illinois

Effortlessly complete IL 1023 C X Illinois Department Of Revenue Tax Illinois on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you require to generate, modify, and eSign your documents quickly without any hindrances. Handle IL 1023 C X Illinois Department Of Revenue Tax Illinois on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign IL 1023 C X Illinois Department Of Revenue Tax Illinois with ease

- Locate IL 1023 C X Illinois Department Of Revenue Tax Illinois and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive data using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all information thoroughly and click on the Done button to save your changes.

- Select how you wish to submit your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate the printing of new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and eSign IL 1023 C X Illinois Department Of Revenue Tax Illinois and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 1023 c x illinois department of revenue tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 1023 C X Illinois Department Of Revenue Tax Illinois form?

The IL 1023 C X Illinois Department Of Revenue Tax Illinois form is a tax exemption application used by organizations in Illinois to request exemption from state taxes. This form is crucial for non-profit organizations looking to comply with state tax regulations and save on costs.

-

How can airSlate SignNow help with the IL 1023 C X Illinois Department Of Revenue Tax Illinois form?

airSlate SignNow simplifies the submission process for the IL 1023 C X Illinois Department Of Revenue Tax Illinois form by allowing users to easily create, eSign, and send documents securely. Its user-friendly platform ensures that your submissions are completed accurately and promptly, saving valuable time.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers competitive pricing plans to accommodate different business needs. Whether you're a small organization or a large enterprise, there’s a plan that includes features tailored to facilitate the handling of documents like the IL 1023 C X Illinois Department Of Revenue Tax Illinois form.

-

What features does airSlate SignNow provide to assist with document management?

airSlate SignNow includes features such as document templates, secure eSigning, and cloud storage, which enhance document management. These tools allow users to efficiently process the IL 1023 C X Illinois Department Of Revenue Tax Illinois form and other crucial documents, improving overall workflow.

-

Can airSlate SignNow integrate with other software applications?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing its functionality. This allows users to streamline processes and manage the IL 1023 C X Illinois Department Of Revenue Tax Illinois form alongside their existing tools, creating a more cohesive workflow.

-

Why is using airSlate SignNow beneficial for submitting the IL 1023 C X form?

Using airSlate SignNow for submitting the IL 1023 C X Illinois Department Of Revenue Tax Illinois form improves efficiency and accuracy. The platform's electronic signature feature reduces the likelihood of errors and speeds up the review process, ensuring timely submissions to the Illinois Department of Revenue.

-

Does airSlate SignNow offer customer support for users of the IL 1023 C X form?

Absolutely! airSlate SignNow provides robust customer support to assist users with any questions related to the IL 1023 C X Illinois Department Of Revenue Tax Illinois form. Our dedicated team is available to help ensure that your forms are filled out correctly and submitted without issues.

Get more for IL 1023 C X Illinois Department Of Revenue Tax Illinois

- Form ct941x must be filed and paid electronically unless certain conditions are met

- For january 1 december 31 2020 or other tax year beginning form

- Mining license tax form

- State of connecticut department of revenue services rev form

- Get the free to request an official transcript print and form

- Instructions for form 6100 formerly form taxalaskagov

- Wwwpdffillercom537169861 alaska federal2020 form ak 6390i fill online printable fillable blank

- Portalctgov drs drs formsunrelated returns ctgov connecticuts official state website

Find out other IL 1023 C X Illinois Department Of Revenue Tax Illinois

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement