Form 1041 Schedule K 1 Internal Revenue Service

What is the Form 1041 Schedule K-1?

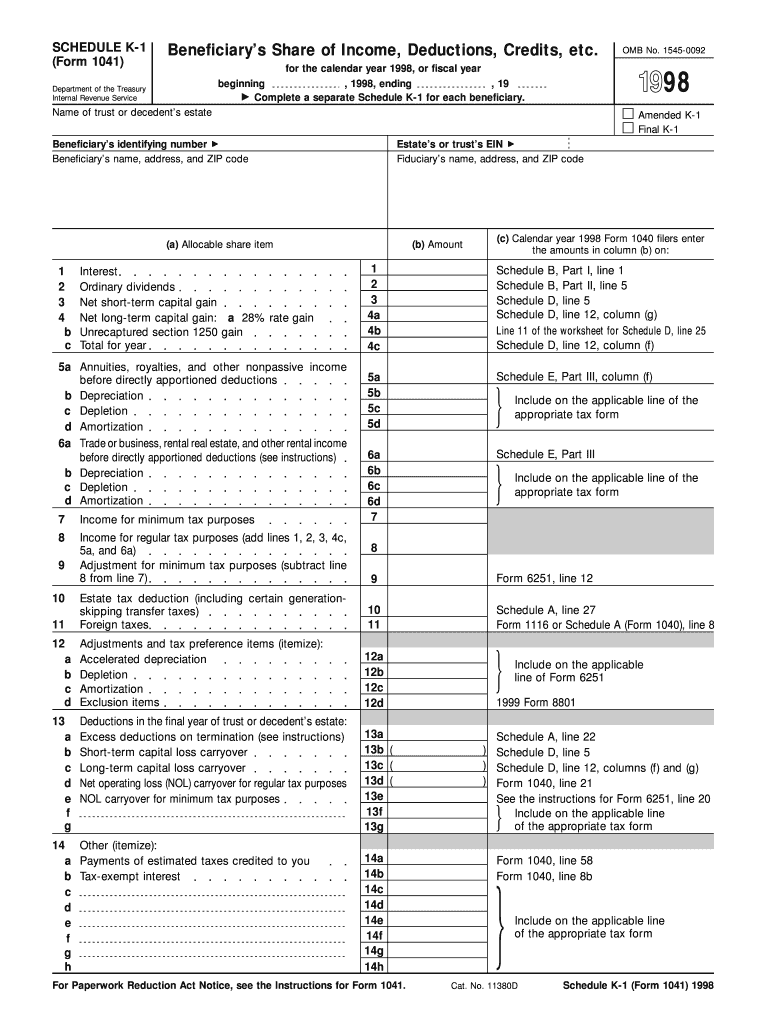

The Form 1041 Schedule K-1 is a tax document issued by the Internal Revenue Service (IRS) that reports income, deductions, and credits from estates and trusts to beneficiaries. This form is essential for beneficiaries who receive distributions from a trust or estate, as it provides the necessary information to report on their individual tax returns. Each beneficiary receives a separate Schedule K-1 detailing their share of the trust's or estate's income, which can include interest, dividends, capital gains, and other income types.

How to use the Form 1041 Schedule K-1

Beneficiaries use the Form 1041 Schedule K-1 to report income received from estates or trusts on their personal tax returns. The information provided on the K-1 helps beneficiaries determine their tax liability based on the income distributed to them. It is crucial to accurately enter the amounts from the K-1 into the appropriate sections of Form 1040 or other relevant tax forms to ensure compliance with IRS regulations.

Steps to complete the Form 1041 Schedule K-1

Completing the Form 1041 Schedule K-1 involves several key steps:

- Gather necessary financial information from the estate or trust.

- Fill out the beneficiary's information, including name, address, and taxpayer identification number.

- Report the income received, including ordinary income, capital gains, and other distributions.

- Calculate any deductions or credits that the beneficiary is entitled to claim.

- Ensure all information is accurate and complete before submitting the form to the IRS.

Key elements of the Form 1041 Schedule K-1

Several key elements must be included in the Form 1041 Schedule K-1:

- Beneficiary Information: Name, address, and taxpayer identification number.

- Entity Information: Name and employer identification number (EIN) of the estate or trust.

- Income Reporting: Detailed breakdown of income types, including interest, dividends, and capital gains.

- Deductions and Credits: Any deductions or credits that the beneficiary can claim.

Filing Deadlines / Important Dates

Filing deadlines for Form 1041 Schedule K-1 are crucial for compliance. The estate or trust must file Form 1041 by the fifteenth day of the fourth month following the end of the tax year. Beneficiaries should receive their K-1 forms in a timely manner to ensure they can accurately report their income on their individual tax returns. It is advisable to keep track of these deadlines to avoid penalties and ensure proper tax filing.

Digital vs. Paper Version

The Form 1041 Schedule K-1 can be completed and submitted in both digital and paper formats. Digital submission often allows for easier tracking and quicker processing times. However, some beneficiaries may prefer paper forms for record-keeping purposes. Regardless of the method chosen, it is essential to ensure that all information is accurate and complete to avoid issues with the IRS.

Quick guide on how to complete form 1041 schedule k 1 internal revenue service

Complete [SKS] seamlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to edit and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and eSign [SKS] and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1041 Schedule K 1 Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the form 1041 schedule k 1 internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1041 Schedule K 1 from the Internal Revenue Service?

The Form 1041 Schedule K 1 is a tax document used by estates and trusts to report income, deductions, and credits to beneficiaries. It provides detailed information on the income that beneficiaries must report on their personal tax returns, according to the Internal Revenue Service guidelines.

-

How does airSlate SignNow assist with the Form 1041 Schedule K 1 process?

airSlate SignNow streamlines the completion and submission process of Form 1041 Schedule K 1 by allowing businesses to securely eSign and send documents electronically. Our platform ensures that your K 1 forms are processed quickly and accurately, helping you stay compliant with Internal Revenue Service regulations.

-

What features does airSlate SignNow offer for managing Form 1041 Schedule K 1?

airSlate SignNow offers features such as customizable templates, real-time collaboration, and secure document storage specifically for managing Form 1041 Schedule K 1. These features make it easier for users to fill out and share tax documents while maintaining compliance with the Internal Revenue Service protocols.

-

Is airSlate SignNow cost-effective for filing Form 1041 Schedule K 1?

Yes, airSlate SignNow is a highly cost-effective solution for businesses needing to file Form 1041 Schedule K 1. Our pricing plans cater to various needs, ensuring you receive the best value while efficiently managing your tax document processes directly aligned with Internal Revenue Service requirements.

-

Can I integrate airSlate SignNow with accounting software to complete Form 1041 Schedule K 1?

Absolutely! airSlate SignNow easily integrates with popular accounting software, allowing you to manage all aspects of Form 1041 Schedule K 1 efficiently. This integration enables seamless data transfer, ensuring accuracy and compliance with Internal Revenue Service guidelines.

-

What benefits do I gain from using airSlate SignNow for Form 1041 Schedule K 1?

Using airSlate SignNow for your Form 1041 Schedule K 1 provides multiple benefits, including enhanced security, faster processing times, and user-friendly features. These advantages help businesses stay organized and compliant with Internal Revenue Service regulations while simplifying their tax preparation tasks.

-

How does airSlate SignNow ensure the security of Form 1041 Schedule K 1 documents?

airSlate SignNow prioritizes the security of your Form 1041 Schedule K 1 documents through advanced encryption and secure cloud storage. We adhere to strict Internal Revenue Service standards to protect sensitive data, ensuring that your tax documents remain confidential and secure.

Get more for Form 1041 Schedule K 1 Internal Revenue Service

- Restroom amp toilet facility maintenance log form

- Field trip or other activity notificat form

- Quality indicators for effective inclusive education guidebook form

- S175 permission to transfer goods between certain vessels form

- Cross curricular reading comprehension worksheets 433230470 form

- Sticker form 16099796

- Test requisition form receptivadx

- Opex ccp review form

Find out other Form 1041 Schedule K 1 Internal Revenue Service

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple