EmployeeIndependent Contract Classification Checklist the Internal Form

Understanding the EmployeeIndependent Contract Classification Checklist

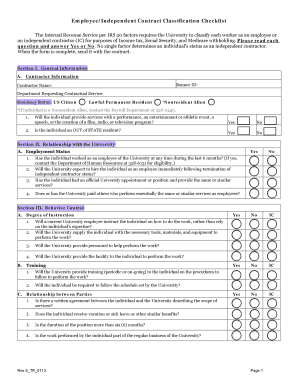

The EmployeeIndependent Contract Classification Checklist is a vital tool for businesses in the United States to determine the correct classification of workers. This checklist helps organizations identify whether a worker should be classified as an employee or an independent contractor. Misclassification can lead to significant legal and financial repercussions, making it essential for businesses to utilize this checklist accurately.

Key factors in this classification include the degree of control the employer has over the worker, the nature of the work relationship, and the worker's independence in performing tasks. Understanding these elements is crucial for compliance with federal and state labor laws.

Steps to Complete the EmployeeIndependent Contract Classification Checklist

Completing the EmployeeIndependent Contract Classification Checklist involves several steps to ensure accurate classification. First, gather all relevant information about the worker, including their job duties, hours worked, and level of supervision. Next, assess the relationship between the worker and the business by examining factors such as the degree of control, the method of payment, and whether the worker provides their own tools.

Once you have collected this information, use the checklist to evaluate each criterion systematically. Document your findings to support your classification decision. This thorough approach helps mitigate risks associated with misclassification.

Legal Considerations for Using the EmployeeIndependent Contract Classification Checklist

Employers must be aware of the legal implications of worker classification. The EmployeeIndependent Contract Classification Checklist serves as a guide to comply with both federal and state regulations. The IRS and various state agencies have specific guidelines that dictate how workers should be classified, and failure to adhere to these can result in penalties.

It's important to stay updated on any changes in laws or regulations that may affect worker classification. Consulting with a legal expert in employment law can provide additional assurance that your classification practices align with current standards.

Examples of Using the EmployeeIndependent Contract Classification Checklist

Practical examples can illustrate how to effectively use the EmployeeIndependent Contract Classification Checklist. For instance, consider a graphic designer working on a project for a marketing firm. If the designer works independently, sets their own hours, and uses their own equipment, they may qualify as an independent contractor.

Conversely, if the marketing firm dictates the designer's work hours, provides tools, and closely supervises the project, the designer is likely an employee. Each scenario emphasizes the importance of evaluating the specific circumstances surrounding the worker's role.

IRS Guidelines on Worker Classification

The IRS provides clear guidelines regarding worker classification, which are crucial for businesses using the EmployeeIndependent Contract Classification Checklist. The IRS uses a common law test that focuses on the degree of control and independence in the working relationship. Understanding these guidelines helps employers make informed decisions about worker classification.

Employers should familiarize themselves with IRS publications, such as Publication 15-A, which outlines the criteria for determining whether a worker is an employee or an independent contractor. Adhering to these guidelines can help prevent potential disputes and penalties.

Required Documents for Classification

To effectively use the EmployeeIndependent Contract Classification Checklist, certain documents may be necessary. These include contracts, job descriptions, and records of payment. Having clear documentation supports the classification decision and provides evidence in case of an audit or dispute.

Additionally, maintaining communication records with the worker can help clarify the nature of the working relationship. Proper documentation ensures that both parties understand their rights and responsibilities, fostering a transparent working environment.

Quick guide on how to complete employeeindependent contract classification checklist the internal

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Use the tools we provide to finalize your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and hit the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to EmployeeIndependent Contract Classification Checklist The Internal

Create this form in 5 minutes!

How to create an eSignature for the employeeindependent contract classification checklist the internal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EmployeeIndependent Contract Classification Checklist The Internal?

The EmployeeIndependent Contract Classification Checklist The Internal is a comprehensive tool designed to help businesses accurately classify their workers as employees or independent contractors. This checklist ensures compliance with legal standards and helps avoid misclassification risks.

-

How can the EmployeeIndependent Contract Classification Checklist The Internal benefit my business?

Utilizing the EmployeeIndependent Contract Classification Checklist The Internal can streamline your hiring process and reduce legal liabilities. By ensuring proper classification, you can enhance compliance and protect your business from potential fines and lawsuits.

-

Is the EmployeeIndependent Contract Classification Checklist The Internal easy to use?

Yes, the EmployeeIndependent Contract Classification Checklist The Internal is designed to be user-friendly. With clear guidelines and a straightforward format, businesses can easily navigate the checklist to ensure accurate worker classification.

-

What features does the EmployeeIndependent Contract Classification Checklist The Internal offer?

The EmployeeIndependent Contract Classification Checklist The Internal includes detailed criteria for classification, step-by-step instructions, and helpful tips for compliance. These features make it an essential resource for businesses looking to classify their workers correctly.

-

How much does the EmployeeIndependent Contract Classification Checklist The Internal cost?

Pricing for the EmployeeIndependent Contract Classification Checklist The Internal varies based on the package you choose. airSlate SignNow offers competitive pricing to ensure that businesses of all sizes can access this essential tool without breaking the bank.

-

Can I integrate the EmployeeIndependent Contract Classification Checklist The Internal with other tools?

Yes, the EmployeeIndependent Contract Classification Checklist The Internal can be integrated with various HR and document management systems. This integration allows for seamless workflow and enhances the overall efficiency of your business operations.

-

How does the EmployeeIndependent Contract Classification Checklist The Internal ensure compliance?

The EmployeeIndependent Contract Classification Checklist The Internal is based on current legal standards and guidelines. By following this checklist, businesses can ensure they are compliant with federal and state regulations regarding worker classification.

Get more for EmployeeIndependent Contract Classification Checklist The Internal

- Affidavit of child support payments received form

- Request for address of record request for address of record form

- Form 03en013e motion to modify child support

- 03en014e order modifying child support form

- Form 03pa001e ocss 209 acknowledgment of paternity

- 03pa211e csed 209 r rescission of affidavit acknowledging paternity is used to withdraw sworn statement of paternity form

- Form 03pa212e okdhs

- Two individuals to a limited liability company form

Find out other EmployeeIndependent Contract Classification Checklist The Internal

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure