Part a Employee Part B Recipient Organization Section Form

What is the Part A Employee Part B Recipient Organization Section

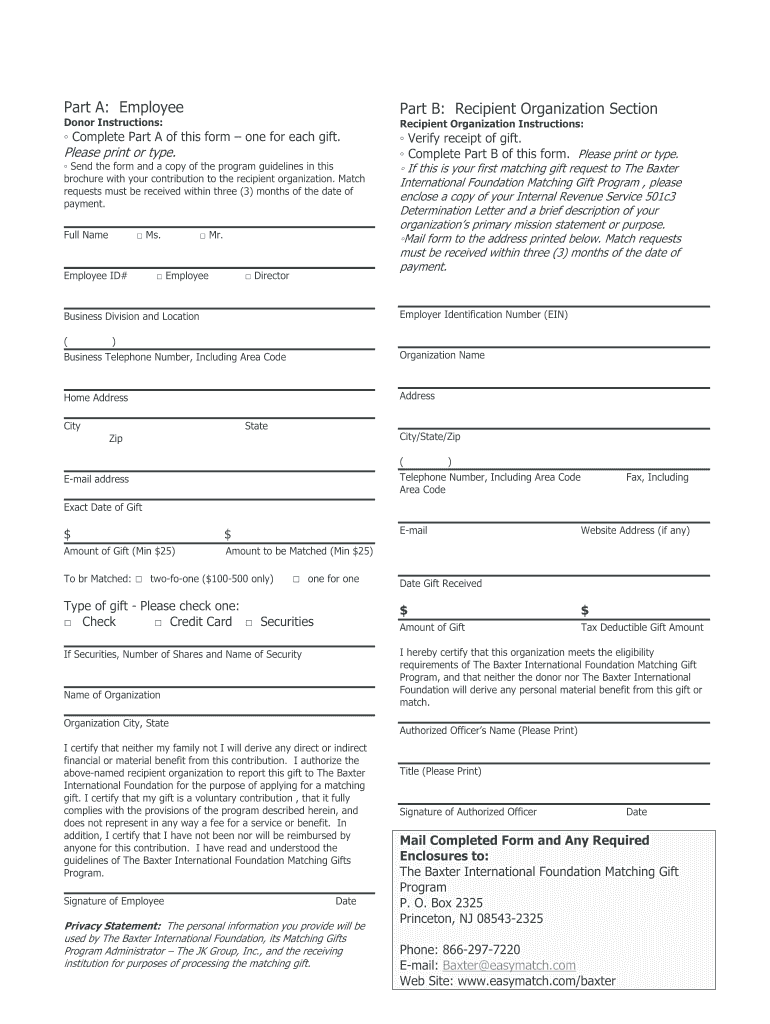

The Part A Employee Part B Recipient Organization Section is a crucial component of certain forms used in the United States, particularly in the context of employment and organizational interactions. This section is designed to capture essential information about the employee and the organization receiving services or benefits. It typically includes details such as the employee's name, identification number, and the recipient organization's name and address. Understanding this section is vital for ensuring compliance with various legal and tax obligations.

How to use the Part A Employee Part B Recipient Organization Section

To effectively use the Part A Employee Part B Recipient Organization Section, individuals must first gather all necessary information about both the employee and the recipient organization. This includes personal identification details and organizational data. Once the information is collected, it should be entered accurately into the designated fields of the form. Careful attention to detail is essential to prevent errors that could lead to processing delays or compliance issues.

Steps to complete the Part A Employee Part B Recipient Organization Section

Completing the Part A Employee Part B Recipient Organization Section involves several key steps:

- Gather all required information about the employee, including full name and identification number.

- Collect details regarding the recipient organization, such as its legal name and address.

- Carefully fill in the form, ensuring that all information is accurate and complete.

- Review the completed section for any errors or omissions.

- Submit the form according to the specified submission guidelines, whether online, by mail, or in person.

Key elements of the Part A Employee Part B Recipient Organization Section

The key elements of the Part A Employee Part B Recipient Organization Section include:

- Employee Information: This includes the employee's name, social security number, and contact details.

- Recipient Organization Details: The legal name, address, and identification number of the organization receiving the benefits or services.

- Signature Fields: Areas designated for signatures from both the employee and an authorized representative of the organization.

- Date Fields: Spaces to indicate the date of completion and submission of the form.

Legal use of the Part A Employee Part B Recipient Organization Section

The legal use of the Part A Employee Part B Recipient Organization Section is governed by various federal and state regulations. This section must be filled out accurately to ensure compliance with tax laws and employment regulations. Incorrect or incomplete information can lead to legal repercussions, including fines or penalties. It is essential for both employees and organizations to understand their responsibilities when completing this section to maintain compliance with applicable laws.

Required Documents

When completing the Part A Employee Part B Recipient Organization Section, several documents may be required to support the information provided. These may include:

- Proof of identity for the employee, such as a driver's license or social security card.

- Documentation verifying the recipient organization's legal status, such as articles of incorporation or tax identification number.

- Any previous forms or correspondence related to the employee's status or the organization's operations.

Quick guide on how to complete part a employee part b recipient organization section

Complete [SKS] effortlessly on any device

Web-based document administration has become increasingly popular with businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without interruptions. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The simplest way to modify and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and has the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to share your form, by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Part A Employee Part B Recipient Organization Section

Create this form in 5 minutes!

How to create an eSignature for the part a employee part b recipient organization section

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Part A Employee Part B Recipient Organization Section?

The Part A Employee Part B Recipient Organization Section refers to specific documentation required in various administrative processes, particularly in the healthcare sector. This section ensures proper identification and verification of employees and organizations receiving compensation or benefits. Utilizing airSlate SignNow, businesses can easily organize and manage these documents electronically.

-

How does airSlate SignNow assist with the Part A Employee Part B Recipient Organization Section?

AirSlate SignNow simplifies the process of handling the Part A Employee Part B Recipient Organization Section by enabling users to securely sign and store necessary documents online. With its effective eSigning capabilities, businesses can streamline workflows, ensuring that all required sections are accurately completed and accessible. This not only saves time but also enhances compliance.

-

What pricing plans does airSlate SignNow offer for managing Part A Employee Part B Recipient Organization Section?

AirSlate SignNow offers flexible pricing plans tailored to various business needs, including features specifically for managing the Part A Employee Part B Recipient Organization Section. These plans range from basic to advanced options, allowing users to choose according to their volume of documents and feature requirements. Visit our pricing page to find the right fit for your organization.

-

Can airSlate SignNow integrate with other tools for managing the Part A Employee Part B Recipient Organization Section?

Yes, airSlate SignNow offers seamless integrations with a variety of third-party applications that can assist in handling the Part A Employee Part B Recipient Organization Section efficiently. Whether you are using CRM systems, document management services, or other workflow tools, you can enhance your processes. Check out our integrations page for more details.

-

What are the benefits of using airSlate SignNow for the Part A Employee Part B Recipient Organization Section?

Using airSlate SignNow for the Part A Employee Part B Recipient Organization Section provides several benefits, including enhanced security, ease of access, and signNow time savings. The platform's user-friendly interface facilitates quick document preparation and eSigning. Moreover, it helps ensure compliance with legal requirements by keeping documents organized and easily retrievable.

-

Is airSlate SignNow user-friendly for document preparation related to the Part A Employee Part B Recipient Organization Section?

Absolutely! AirSlate SignNow is designed with user-friendliness in mind, enabling even those with limited technical skills to easily prepare documents related to the Part A Employee Part B Recipient Organization Section. The intuitive interface allows users to drag-and-drop fields, customize templates, and facilitate eSignatures seamlessly. Training resources are also available for further assistance.

-

How secure is airSlate SignNow when handling the Part A Employee Part B Recipient Organization Section?

AirSlate SignNow is committed to maintaining the highest security standards while handling the Part A Employee Part B Recipient Organization Section. The platform employs advanced encryption technology to protect sensitive data during transmission and storage. Additionally, comprehensive audit trails are available to track who accessed the documents and when.

Get more for Part A Employee Part B Recipient Organization Section

Find out other Part A Employee Part B Recipient Organization Section

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word