The H&R Block Foundation Matching Gift Program Hrblockfoundation Form

What is the H&R Block Foundation Matching Gift Program

The H&R Block Foundation Matching Gift Program is designed to enhance charitable giving by matching employee contributions to eligible nonprofits. This initiative encourages employees to support their communities while maximizing the impact of their donations. The program reflects H&R Block's commitment to social responsibility and community engagement, allowing employees to participate actively in philanthropic efforts.

How to use the H&R Block Foundation Matching Gift Program

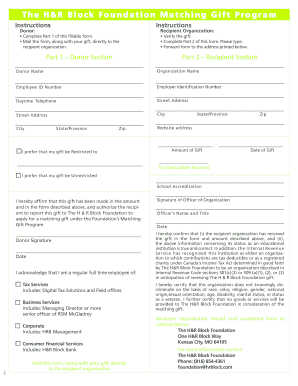

To utilize the H&R Block Foundation Matching Gift Program, employees must first make a donation to an eligible nonprofit organization. After contributing, employees can submit a matching gift request through the designated online portal. This process typically involves providing proof of the donation, such as a receipt, and filling out a simple form that includes details about the nonprofit and the donation amount. Once submitted, the foundation reviews the request and processes the matching gift accordingly.

Eligibility Criteria

Eligibility for the H&R Block Foundation Matching Gift Program is generally limited to full-time employees of H&R Block who have made contributions to qualified nonprofit organizations. Nonprofits must be recognized as tax-exempt under Section 501(c)(3) of the Internal Revenue Code. Additionally, the program may have specific guidelines regarding the minimum and maximum amounts eligible for matching, as well as restrictions on certain types of organizations, such as those that promote political activities or religious purposes.

Steps to complete the H&R Block Foundation Matching Gift Program

Completing the H&R Block Foundation Matching Gift Program involves several straightforward steps:

- Make a donation to an eligible nonprofit organization.

- Obtain a receipt or proof of your donation.

- Access the online matching gift portal provided by H&R Block.

- Fill out the matching gift request form, including details of your donation and the nonprofit.

- Submit your request along with the required documentation.

- Wait for confirmation of your matching gift from the foundation.

Key elements of the H&R Block Foundation Matching Gift Program

Several key elements define the H&R Block Foundation Matching Gift Program:

- Matching Ratio: The program typically matches employee donations at a specific ratio, often dollar-for-dollar, up to a certain limit.

- Eligible Organizations: Only donations made to IRS-recognized 501(c)(3) organizations qualify for matching.

- Submission Deadlines: Employees must submit their matching gift requests within a designated timeframe after making their donations.

- Annual Limits: There may be an annual cap on the total amount that can be matched per employee.

Examples of using the H&R Block Foundation Matching Gift Program

Employees can leverage the H&R Block Foundation Matching Gift Program in various ways. For instance, if an employee donates $100 to a local food bank, the foundation may match that contribution, effectively doubling the impact to $200. Another example is an employee who contributes to a scholarship fund; the matching gift can enhance educational opportunities for students. These examples illustrate how the program amplifies charitable efforts and encourages community involvement among employees.

Quick guide on how to complete the hampr block foundation matching gift program hrblockfoundation

Prepare [SKS] easily on any device

Online document management has gained traction with companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, revise, and eSign your files swiftly without unnecessary delays. Handle [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important portions of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal authority as a traditional ink signature.

- Review the information and click on the Done button to preserve your changes.

- Select your preferred method of delivering your form—via email, text message (SMS), invitation link, or download it to your computer.

Don’t worry about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to The H&R Block Foundation Matching Gift Program Hrblockfoundation

Create this form in 5 minutes!

How to create an eSignature for the the hampr block foundation matching gift program hrblockfoundation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is The H&R Block Foundation Matching Gift Program Hrblockfoundation?

The H&R Block Foundation Matching Gift Program Hrblockfoundation is an initiative that allows employees to double the impact of their charitable donations through company matching. This program encourages philanthropy by matching eligible contributions made to nonprofit organizations, effectively maximizing the support for various causes.

-

How does The H&R Block Foundation Matching Gift Program Hrblockfoundation work?

To participate in The H&R Block Foundation Matching Gift Program Hrblockfoundation, employees need to submit their donation receipts along with a matching gift request through the program portal. The H&R Block Foundation will then review the submissions and issue a matching donation to the specified nonprofit organization, enhancing the collective impact of their contributions.

-

Are there limits on contributions in The H&R Block Foundation Matching Gift Program Hrblockfoundation?

Yes, The H&R Block Foundation Matching Gift Program Hrblockfoundation typically has specific limits on matching contributions. Employees should check the program guidelines for details regarding maximum match amounts and eligible organizations to ensure their donations qualify for matching.

-

What types of organizations are eligible for The H&R Block Foundation Matching Gift Program Hrblockfoundation?

The H&R Block Foundation Matching Gift Program Hrblockfoundation generally supports a wide range of nonprofit organizations, including those focused on education, health, and community development. Employees are encouraged to verify the eligibility of their chosen organizations by consulting the program guidelines.

-

How can I find more information about The H&R Block Foundation Matching Gift Program Hrblockfoundation?

For more information about The H&R Block Foundation Matching Gift Program Hrblockfoundation, employees can visit the company's dedicated portal or contact their HR department. Comprehensive details regarding eligibility, application procedures, and FAQs are usually available on the program’s website.

-

Does The H&R Block Foundation Matching Gift Program Hrblockfoundation support employee volunteer hours?

Yes, The H&R Block Foundation Matching Gift Program Hrblockfoundation often includes opportunities to match contributions based on employee volunteer hours. Employees who volunteer for eligible nonprofits can often receive a monetary match for their time invested in community service, amplifying their charitable efforts.

-

How do I submit a matching gift request through The H&R Block Foundation Matching Gift Program Hrblockfoundation?

To submit a matching gift request through The H&R Block Foundation Matching Gift Program Hrblockfoundation, employees should log into the matching gift portal, complete the required submission forms, and upload any necessary documentation. It's important to ensure all information is accurate to facilitate timely processing.

Get more for The H&R Block Foundation Matching Gift Program Hrblockfoundation

- Mqa accreditation application form 448495578

- Letter of confirmation of interest and availability form

- Application form sassoon academy

- Form iv overtime register for workers industries

- Appendix b abandoned lock removal authorization form ehs uci

- Apopka high school transcripts form

- Msds akucell cmc food grade form

- Mv2488 387312678 form

Find out other The H&R Block Foundation Matching Gift Program Hrblockfoundation

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure