Sol Lic NonProfit 07 Form

What is the Sol Lic NonProfit 07

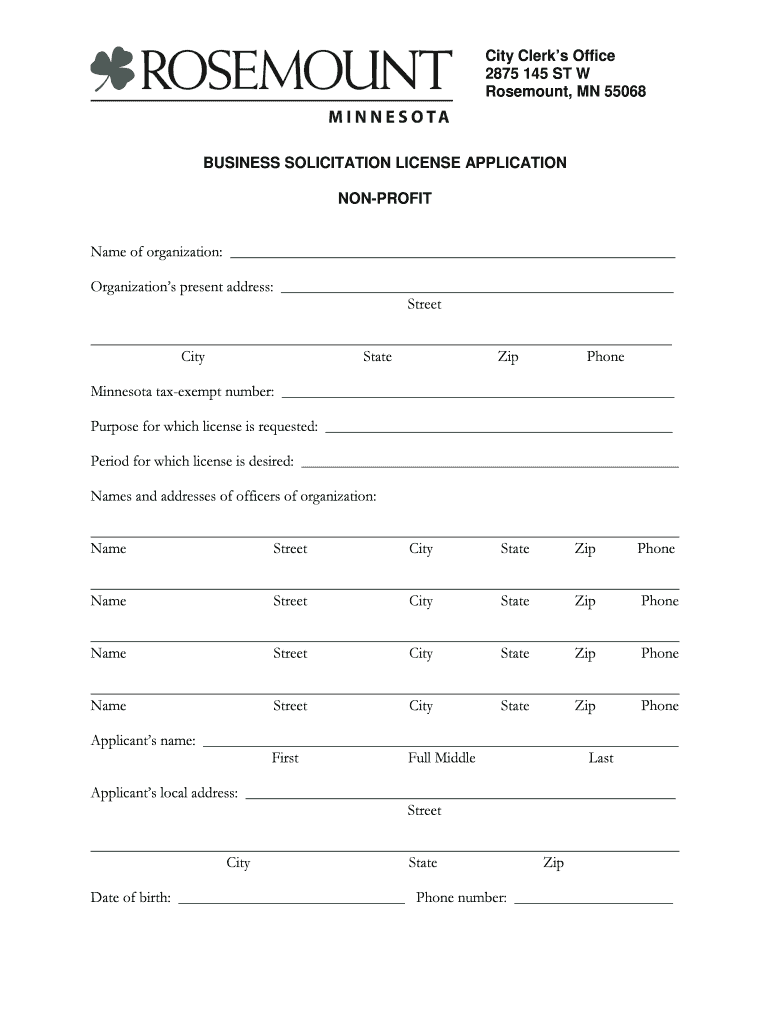

The Sol Lic NonProfit 07 is a specific form used by nonprofit organizations in the United States to apply for certain licenses or permits necessary for their operations. This form is essential for nonprofits seeking to comply with state and federal regulations, ensuring they can legally conduct their activities. It typically includes information about the organization’s mission, structure, and financial practices, which helps regulatory bodies assess the nonprofit's eligibility for tax-exempt status and other benefits.

How to use the Sol Lic NonProfit 07

Using the Sol Lic NonProfit 07 involves several steps to ensure accurate completion and submission. First, gather all necessary information about your nonprofit, including its mission statement, organizational structure, and financial details. Next, fill out the form carefully, ensuring all sections are completed. It is crucial to review the form for accuracy and completeness before submission. Once finalized, submit the form according to the specified guidelines, which may include online, mail, or in-person options, depending on your state’s requirements.

Steps to complete the Sol Lic NonProfit 07

Completing the Sol Lic NonProfit 07 requires a systematic approach:

- Gather necessary documentation, including your nonprofit's bylaws and articles of incorporation.

- Provide detailed information about the organization, including its purpose, activities, and governance.

- Ensure all financial information is accurate, including projected budgets and funding sources.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate state agency or department.

Legal use of the Sol Lic NonProfit 07

The Sol Lic NonProfit 07 is legally binding and must be filled out truthfully and accurately. Misrepresentation or failure to disclose relevant information can lead to penalties, including the denial of the application or revocation of nonprofit status. It is essential for organizations to understand the legal implications of the information provided on this form, as it plays a critical role in their operational legitimacy and compliance with state and federal laws.

Eligibility Criteria

To be eligible for the Sol Lic NonProfit 07, organizations must meet specific criteria set forth by state regulations. Generally, this includes being organized for charitable, educational, religious, or scientific purposes. The organization must also operate primarily for the benefit of the public and not for profit. Additionally, applicants may need to demonstrate that they have a governing board and a clear mission statement outlining their objectives.

Form Submission Methods

The Sol Lic NonProfit 07 can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the state’s official website, which may provide a streamlined process.

- Mailing the completed form to the appropriate state agency, ensuring it is sent via a traceable method.

- In-person submission at designated state offices, which may allow for immediate feedback or assistance.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the Sol Lic NonProfit 07, particularly concerning tax-exempt status. Organizations must ensure compliance with IRS regulations to maintain their nonprofit status. This includes adhering to reporting requirements and ensuring that the organization’s activities align with its stated mission. Understanding these guidelines is essential for any nonprofit to operate legally and effectively within the U.S. regulatory framework.

Quick guide on how to complete sol lic nonprofit 07

Effortlessly Prepare Sol Lic NonProfit 07 on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers a superb environmentally-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and store it securely online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any hold-ups. Handle Sol Lic NonProfit 07 across any platform using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign Sol Lic NonProfit 07 with minimal effort

- Obtain Sol Lic NonProfit 07 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as an authentic wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method for submitting your form: via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Sol Lic NonProfit 07 and promote clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sol lic nonprofit 07

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Sol Lic NonProfit 07 and how does it relate to airSlate SignNow?

Sol Lic NonProfit 07 is a certification that allows non-profit organizations to access discounted pricing on essential tools like airSlate SignNow. By utilizing this license, non-profits can streamline their document management processes while ensuring compliance and affordability.

-

What features does airSlate SignNow offer under Sol Lic NonProfit 07?

With Sol Lic NonProfit 07, airSlate SignNow provides features such as custom templates, unlimited eSigning, and robust security options. These features are designed to enhance the efficiency of document workflows for non-profits, ensuring they can focus on their mission.

-

How does the pricing structure work for Sol Lic NonProfit 07?

The pricing for Sol Lic NonProfit 07 is structured to offer signNow discounts to qualifying non-profit organizations. This ensures that budgeting for essential services like airSlate SignNow remains manageable while maximizing operational efficiency.

-

What benefits can non-profits expect when using Sol Lic NonProfit 07 with airSlate SignNow?

By using Sol Lic NonProfit 07 with airSlate SignNow, non-profits can expect improved workflow efficiency, cost savings, and compliance with legal requirements. This allows organizations to allocate more resources toward their core missions and enhance their impact.

-

Can I integrate airSlate SignNow with other tools if I have Sol Lic NonProfit 07?

Yes, airSlate SignNow seamlessly integrates with various tools and software platforms even under the Sol Lic NonProfit 07 license. This flexibility allows non-profits to maintain their existing processes while enhancing their document management capabilities.

-

Is there customer support available for users of Sol Lic NonProfit 07?

Absolutely! Users of Sol Lic NonProfit 07 have access to dedicated customer support through airSlate SignNow. This support includes assistance with setup, troubleshooting, and maximizing the benefits of the platform.

-

How does airSlate SignNow ensure the security of documents for Sol Lic NonProfit 07 users?

airSlate SignNow employs industry-leading security measures, such as data encryption and compliance with relevant standards, to protect documents for Sol Lic NonProfit 07 users. This ensures that sensitive information remains secure while using the platform.

Get more for Sol Lic NonProfit 07

- Control number tx 039 78 form

- What are some intent to lien letter samplesreferencecom form

- Does the contractor with no contract have the right to form

- Im a construction subcontractor who did not get paid by form

- Am i entitled to request a copy of all invoices and form

- Under texas law chapter 87 civil practice and remedies code form

- Witness grantors hands this the day of 20 490221081 form

- Wife and husband and wife form

Find out other Sol Lic NonProfit 07

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer