Form 760C Underpayment of Virginia Estimated Tax by Individuals, Estates, and Trusts 2023

What is the Form 760C Underpayment Of Virginia Estimated Tax By Individuals, Estates, And Trusts

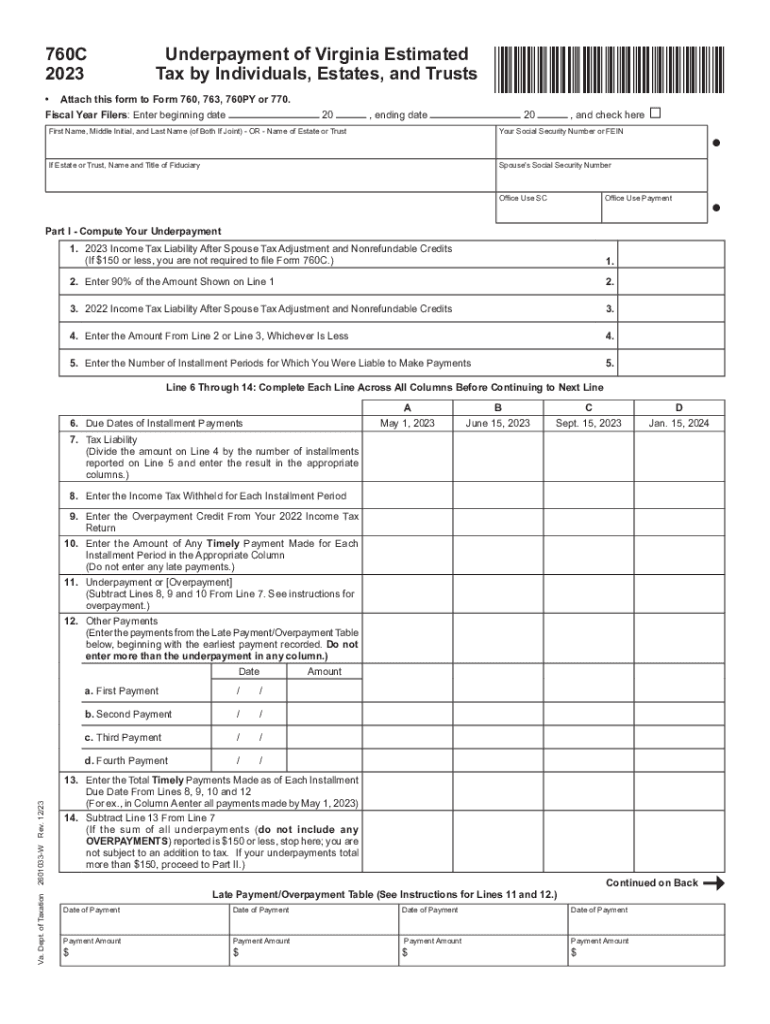

The Form 760C is a tax form used in Virginia for reporting underpayment of estimated tax by individuals, estates, and trusts. This form is specifically designed for taxpayers who did not pay enough estimated tax throughout the year and may owe additional tax. It helps ensure compliance with Virginia's tax laws by allowing taxpayers to calculate any penalties and interest due on the underpayment. Understanding this form is crucial for maintaining accurate tax records and avoiding unnecessary penalties.

How to obtain the Form 760C Underpayment Of Virginia Estimated Tax By Individuals, Estates, And Trusts

Taxpayers can obtain the Form 760C from the Virginia Department of Taxation’s official website or by visiting local tax offices. The form is available in both digital and print formats, allowing for easy access and completion. Additionally, tax professionals may provide this form as part of their services, ensuring that individuals and entities have the necessary documentation for their tax filings.

Steps to complete the Form 760C Underpayment Of Virginia Estimated Tax By Individuals, Estates, And Trusts

Completing the Form 760C involves several key steps:

- Gather all relevant financial information, including income and tax payments made throughout the year.

- Calculate the total estimated tax owed based on your income and applicable tax rates.

- Determine the amount of tax that has already been paid to identify any underpayment.

- Complete the form by filling in the necessary details, including personal information and calculations.

- Review the form for accuracy before submission to avoid delays or penalties.

Key elements of the Form 760C Underpayment Of Virginia Estimated Tax By Individuals, Estates, And Trusts

Key elements of the Form 760C include:

- Taxpayer Information: Personal details of the individual or entity filing the form.

- Income Details: Information regarding total income earned during the tax year.

- Payments Made: A record of estimated tax payments already submitted.

- Calculation of Underpayment: A section to compute any penalties based on the underpayment amount.

Filing Deadlines / Important Dates

Filing deadlines for the Form 760C are typically aligned with Virginia's tax deadlines. Taxpayers should be aware of the following important dates:

- The deadline for filing the form is usually the same as the state tax return due date, which is typically May 1 for individual taxpayers.

- Taxpayers should also keep in mind any applicable extensions that may affect the filing deadline.

Penalties for Non-Compliance

Failure to file the Form 760C when required can result in penalties imposed by the Virginia Department of Taxation. These penalties may include:

- Late Filing Penalty: A percentage of the unpaid tax amount for each month the form is late.

- Interest Charges: Accrued interest on the underpayment amount until it is paid in full.

Quick guide on how to complete form 760c underpayment of virginia estimated tax by individuals estates and trusts

Complete Form 760C Underpayment Of Virginia Estimated Tax By Individuals, Estates, And Trusts effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Form 760C Underpayment Of Virginia Estimated Tax By Individuals, Estates, And Trusts on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign Form 760C Underpayment Of Virginia Estimated Tax By Individuals, Estates, And Trusts seamlessly

- Locate Form 760C Underpayment Of Virginia Estimated Tax By Individuals, Estates, And Trusts and click on Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that function.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 760C Underpayment Of Virginia Estimated Tax By Individuals, Estates, And Trusts and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 760c underpayment of virginia estimated tax by individuals estates and trusts

Create this form in 5 minutes!

How to create an eSignature for the form 760c underpayment of virginia estimated tax by individuals estates and trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 760c and how can it benefit my business?

Form 760c is a crucial tax document used for calculating corporate income taxes in Virginia. Utilizing airSlate SignNow to manage this form can streamline your signing process, making it more efficient and less prone to errors. By adopting our eSigning solution, your business can ensure timely submissions and compliance with tax regulations.

-

How does airSlate SignNow simplify the process of completing form 760c?

airSlate SignNow offers a user-friendly platform that allows you to easily fill out and send form 760c for electronic signatures. The intuitive interface simplifies document management, allowing your team to collaborate in real-time. Plus, automated reminders help ensure that deadlines for submission are met.

-

Is there a cost associated with using airSlate SignNow for form 760c?

Yes, there is a pricing structure for using airSlate SignNow services, including the handling of form 760c. We offer various subscription plans that cater to different business sizes and needs, ensuring that you can find an economical solution. Detailed pricing can be found on our website.

-

What features does airSlate SignNow offer specifically for form 760c?

With airSlate SignNow, you can enjoy features such as customizable templates for form 760c, secure cloud storage, and audit trails for tracking document status. These features enhance not only security but also ensure that all necessary documentation is completed accurately.

-

Can I integrate airSlate SignNow with other software for managing form 760c?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications, such as CRM systems, to simplify data entry for form 760c. This allows you to automate workflows and improve efficiency across different platforms for your business.

-

How secure is my information when using airSlate SignNow for form 760c?

Security is a priority at airSlate SignNow. We utilize advanced encryption protocols to protect all data, including form 760c. Our compliance with industry standards ensures that your sensitive information remains confidential and secure throughout the signing process.

-

Are there any mobile options for working with form 760c using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage form 760c on the go. Whether you are in the office or away, you can complete, send, and sign documents directly from your smartphone or tablet to keep your business running smoothly.

Get more for Form 760C Underpayment Of Virginia Estimated Tax By Individuals, Estates, And Trusts

- Notice of removal of human corpse wi form

- Material risk notice form oregongov oregon

- Ashtabula county 4h foundation scholarship form

- Redding police department rpdct form

- Fillable concrete safety manager experience verification form rev 314

- Dog license application town of lockport ny form

- Doe student verification form

- Y1 form

Find out other Form 760C Underpayment Of Virginia Estimated Tax By Individuals, Estates, And Trusts

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later