Printable Virginia Form 760C Underpayment of Estimated Tax by Individuals, Estates, and Trusts 2020

Understanding the Virginia Form 760C

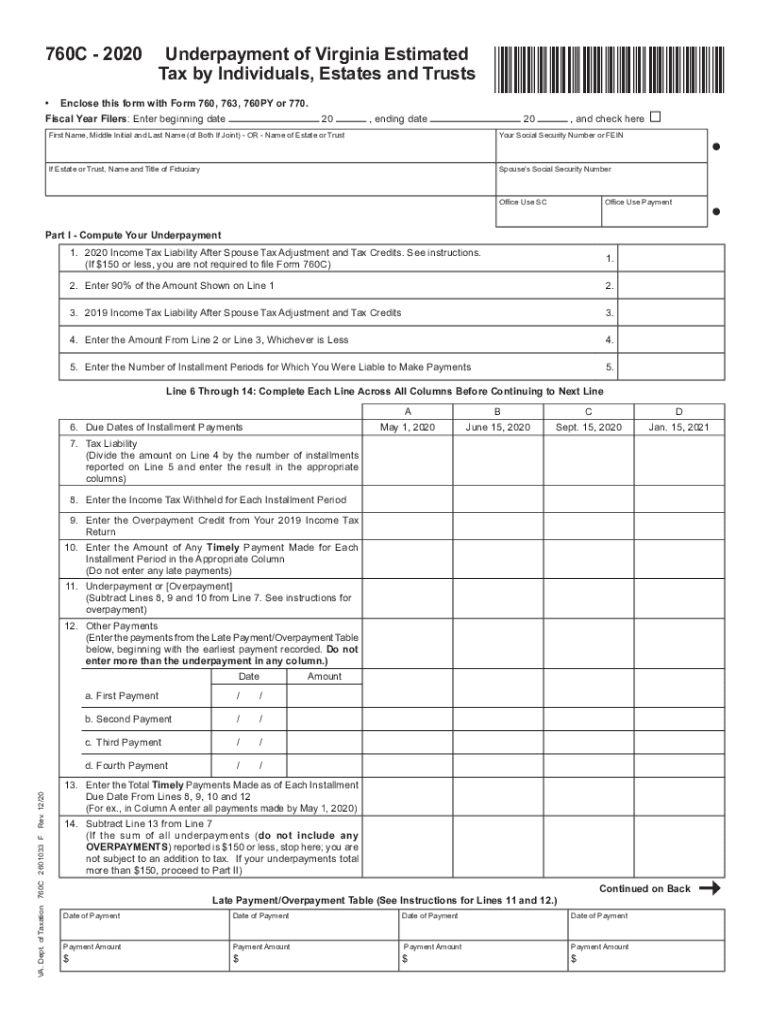

The Virginia Form 760C is designed for individuals, estates, and trusts to report underpayment of estimated tax. This form is crucial for taxpayers who may not have met their estimated tax payment obligations throughout the year. Understanding the purpose of the 760C form helps ensure compliance with Virginia tax laws and avoids potential penalties. The form specifically addresses situations where taxpayers owe additional tax due to insufficient estimated payments, making it an essential tool for accurate tax reporting.

Steps to Complete the Virginia Form 760C

Completing the Virginia Form 760C involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year to determine if you have underpaid your estimated taxes.

- Fill out the form by entering your personal information, including your name, address, and Social Security number.

- Report your estimated tax payments made during the year and compare them to your total tax liability.

- Submit the completed form either electronically or by mail, ensuring it is sent to the correct Virginia tax office.

Obtaining the Virginia Form 760C

The Virginia Form 760C can be obtained through several methods. Taxpayers can download the form directly from the Virginia Department of Taxation's website. Alternatively, physical copies may be available at local tax offices or public libraries. It is essential to ensure you are using the most current version of the form to avoid any compliance issues.

Legal Use of the Virginia Form 760C

The legal use of the Virginia Form 760C is governed by state tax laws. This form must be filed accurately to ensure compliance with Virginia's tax regulations. Failure to file or inaccuracies can result in penalties, including fines or interest on unpaid taxes. Understanding the legal implications of the form helps taxpayers fulfill their obligations and avoid potential legal issues.

Filing Deadlines for the Virginia Form 760C

Filing deadlines for the Virginia Form 760C are typically aligned with the state’s tax filing schedule. Taxpayers should be aware that the form is generally due on the same date as the annual income tax return. Keeping track of these deadlines is crucial to avoid late fees and ensure timely compliance with tax obligations.

Penalties for Non-Compliance with the Virginia Form 760C

Non-compliance with the Virginia Form 760C can lead to significant penalties. Taxpayers who fail to file the form or pay the required taxes may incur fines, interest on unpaid amounts, and potential legal action from the state. Understanding these penalties emphasizes the importance of accurate and timely filing to maintain good standing with Virginia tax authorities.

Quick guide on how to complete printable 2020 virginia form 760c underpayment of estimated tax by individuals estates and trusts

Complete Printable Virginia Form 760C Underpayment Of Estimated Tax By Individuals, Estates, And Trusts seamlessly on any device

Online document management has gained signNow traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Printable Virginia Form 760C Underpayment Of Estimated Tax By Individuals, Estates, And Trusts on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Printable Virginia Form 760C Underpayment Of Estimated Tax By Individuals, Estates, And Trusts with ease

- Locate Printable Virginia Form 760C Underpayment Of Estimated Tax By Individuals, Estates, And Trusts and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Printable Virginia Form 760C Underpayment Of Estimated Tax By Individuals, Estates, And Trusts and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 virginia form 760c underpayment of estimated tax by individuals estates and trusts

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 virginia form 760c underpayment of estimated tax by individuals estates and trusts

The best way to make an eSignature for a PDF file online

The best way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the 760c feature in airSlate SignNow?

The 760c feature in airSlate SignNow allows users to create, send, and eSign documents seamlessly. This functionality enhances workflow efficiency by simplifying the document signing process, making it ideal for businesses looking to optimize their document management.

-

How much does airSlate SignNow cost for the 760c functionality?

Pricing for airSlate SignNow's 760c functionality varies depending on the plan you choose. The solution is designed to be cost-effective, providing various pricing tiers that suit different business needs, ensuring accessibility for all users.

-

Can I integrate 760c with other applications?

Yes, airSlate SignNow's 760c feature is compatible with numerous integrations. Whether you need to connect with CRM systems or document storage services, the flexibility of 760c allows for seamless integration, enhancing your business workflows.

-

What types of documents can I send using the 760c feature?

With the 760c feature, you can send a wide variety of documents including contracts, invoices, and consent forms. This versatility is beneficial for businesses across different sectors, ensuring you can manage all your critical documents in one place.

-

Is 760c secure for handling sensitive information?

Absolutely, airSlate SignNow ensures that the 760c feature adheres to strict security protocols. With encryption and compliance with regulatory standards, you can trust that your sensitive information remains protected when using this service.

-

What are the benefits of using the 760c feature for small businesses?

Utilizing the 760c feature allows small businesses to streamline their document management processes efficiently. The ease of use and cost-effectiveness of airSlate SignNow helps these businesses save time and reduce operational costs.

-

How can I get started with the 760c functionality?

Getting started with airSlate SignNow's 760c feature is simple. You can sign up for a trial or choose a suitable pricing plan on their website, where step-by-step guides and support resources will help you make the most of this powerful feature.

Get more for Printable Virginia Form 760C Underpayment Of Estimated Tax By Individuals, Estates, And Trusts

Find out other Printable Virginia Form 760C Underpayment Of Estimated Tax By Individuals, Estates, And Trusts

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form