DOR Sales & Use Tax E File Transmission 2023-2026

Understanding the DOR Sales & Use Tax E-File Transmission

The DOR Sales & Use Tax E-File Transmission is a digital method for businesses to file their sales and use tax returns with the Department of Revenue (DOR). This system simplifies the filing process, allowing users to submit their tax returns electronically rather than using traditional paper forms. By utilizing this method, businesses can ensure timely submissions and reduce the risk of errors associated with manual entries.

Steps to Complete the DOR Sales & Use Tax E-File Transmission

Completing the DOR Sales & Use Tax E-File Transmission involves several key steps:

- Gather necessary documentation, including sales records and purchase invoices.

- Access the DOR e-filing portal through your secure account.

- Input the required tax information accurately, ensuring all fields are completed.

- Review the entered data for any discrepancies or errors.

- Submit the completed form electronically and retain confirmation for your records.

Legal Use of the DOR Sales & Use Tax E-File Transmission

The DOR Sales & Use Tax E-File Transmission is legally recognized as a valid method for filing tax returns in the United States. Businesses must ensure compliance with state regulations and guidelines when using this electronic filing system. Proper use of this method can help avoid penalties associated with late or incorrect filings.

Filing Deadlines and Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the DOR Sales & Use Tax E-File Transmission. Typically, returns are due on a quarterly or monthly basis, depending on the volume of sales. Missing these deadlines can result in penalties and interest charges. Always check the DOR website for the most current deadlines to ensure compliance.

Required Documents for E-File Transmission

Before initiating the DOR Sales & Use Tax E-File Transmission, businesses should prepare the following documents:

- Sales records detailing all taxable sales.

- Purchase invoices for items subject to use tax.

- Previous tax returns for reference.

- Any supporting documentation required by the state.

Examples of Using the DOR Sales & Use Tax E-File Transmission

Businesses of various types can benefit from the DOR Sales & Use Tax E-File Transmission. For instance, a retail store can quickly file its sales tax return after compiling its sales data. Similarly, an online service provider can report its use tax on software purchases. These examples illustrate how diverse businesses can streamline their tax filing processes through electronic submission.

Quick guide on how to complete dor sales ampamp use tax e file transmission

Complete DOR Sales & Use Tax E File Transmission seamlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage DOR Sales & Use Tax E File Transmission on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign DOR Sales & Use Tax E File Transmission effortlessly

- Locate DOR Sales & Use Tax E File Transmission and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which requires seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign DOR Sales & Use Tax E File Transmission to ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dor sales ampamp use tax e file transmission

Create this form in 5 minutes!

How to create an eSignature for the dor sales ampamp use tax e file transmission

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

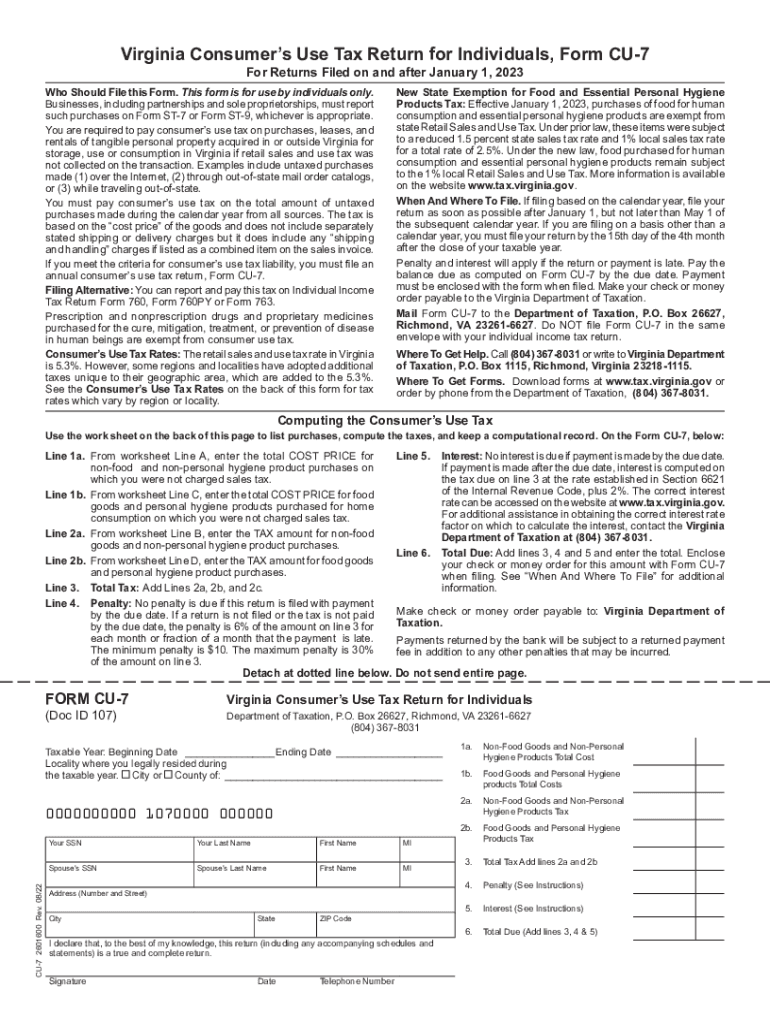

What is cu 7, and how does it relate to airSlate SignNow?

Cu 7 is a powerful feature within airSlate SignNow that streamlines the document signing process. By utilizing cu 7, users can enhance their workflow efficiency and reduce the time spent on document management and signatures.

-

How does airSlate SignNow's cu 7 improve productivity?

With cu 7, businesses can quickly send and receive signed documents without delays. This feature allows for real-time collaboration, ensuring everyone involved can access and sign documents from any device, boosting overall productivity.

-

What are the pricing options for airSlate SignNow with cu 7?

airSlate SignNow offers competitive pricing plans that include access to cu 7 features. These plans are designed to cater to businesses of all sizes, making it a cost-effective solution for document signing needs.

-

Are there any integrations available for airSlate SignNow’s cu 7?

Yes, airSlate SignNow supports various integrations that enhance the functionality of cu 7. You can easily connect it to popular apps like Google Drive, Salesforce, and Microsoft Office, creating a seamless workflow.

-

What benefits does cu 7 provide for small businesses?

Cu 7 offers small businesses an efficient way to manage documents and reduce administrative overhead. By simplifying the eSigning process, it helps save time and resources, allowing businesses to focus on growth and customer service.

-

Is cu 7 user-friendly for non-technical users?

Absolutely! Cu 7 is designed to be intuitive, making it easy for users of all technical abilities to navigate. The user-friendly interface minimizes the learning curve, allowing teams to start using the tool effectively right away.

-

Can I access cu 7 from my mobile device?

Yes, airSlate SignNow with cu 7 is fully optimized for mobile devices. You can send, sign, and manage documents directly from your smartphone or tablet, ensuring you stay productive on the go.

Get more for DOR Sales & Use Tax E File Transmission

- Qcc 100 form 129943

- Blank will forms printable

- Sgp class roster notification of completion division of form

- Attachment for sportsperson westchester county clerk form

- Affidavit of sole heirship new york form

- New york state adoption forms drl 111

- Power of attorney new york statutory short form sell or

- Nysbathe revocable trust revisited form

Find out other DOR Sales & Use Tax E File Transmission

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document