Schedule NEC Form 1040 NR SP Tax on Income Not Effectively Connected with a U S Trade or Business Spanish Version

What is the Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version

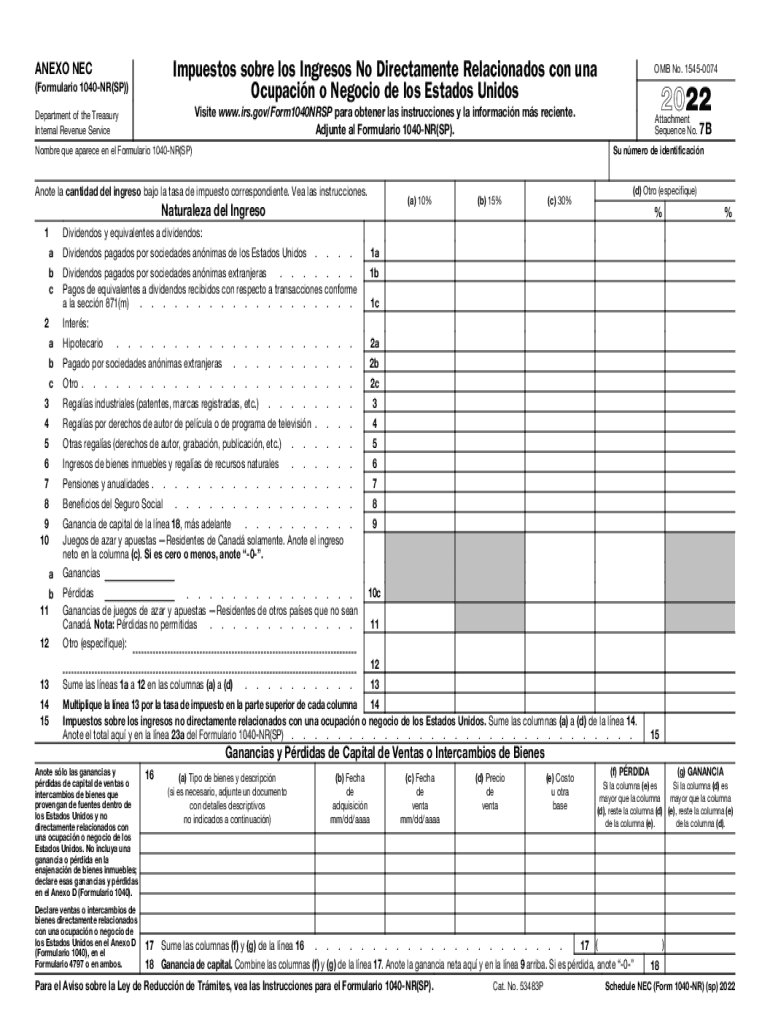

The Schedule NEC Form 1040 NR SP is a tax form specifically designed for non-resident aliens in the United States. This form is used to report income that is not effectively connected with a U.S. trade or business. The Spanish version of this form ensures that Spanish-speaking taxpayers can accurately complete their tax obligations. Understanding this form is crucial for non-resident aliens who earn income from U.S. sources that do not fall under the category of effectively connected income, such as certain types of dividends and interest.

How to use the Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version

To use the Schedule NEC Form 1040 NR SP, taxpayers must first determine if their income qualifies as not effectively connected with a U.S. trade or business. After confirming eligibility, individuals should fill out the form by providing necessary details such as their name, identification number, and the specific types of income they are reporting. It is important to follow the instructions carefully to ensure accurate reporting, which helps avoid potential issues with the IRS.

Steps to complete the Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version

Completing the Schedule NEC Form 1040 NR SP involves several key steps:

- Gather all relevant income documentation, including forms such as 1099s that report U.S. source income.

- Fill in personal information, including your name and identification number.

- Report each type of income separately, ensuring that you classify them correctly as not effectively connected.

- Calculate the appropriate tax amount based on the income reported.

- Review the completed form for accuracy before submission.

Legal use of the Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version

The Schedule NEC Form 1040 NR SP is legally required for non-resident aliens who receive income from U.S. sources that are not effectively connected with a U.S. trade or business. Filing this form accurately is essential to comply with U.S. tax laws and regulations. Failure to file or incorrectly reporting income can lead to penalties and interest charges, making it vital for taxpayers to understand their legal obligations regarding this form.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule NEC Form 1040 NR SP typically align with the general tax filing deadlines for non-resident aliens. Generally, the deadline is April 15 for income earned in the previous calendar year. However, if an extension is filed, taxpayers may have until October 15 to submit their forms. It is essential to stay informed about any changes to these deadlines to avoid late filing penalties.

Required Documents

When completing the Schedule NEC Form 1040 NR SP, taxpayers must have several documents ready:

- Form 1040 NR, which serves as the main tax return for non-resident aliens.

- Any applicable 1099 forms that report U.S. source income.

- Identification documents, such as a passport or visa, to verify non-resident status.

- Records of any tax treaty benefits that may apply.

Quick guide on how to complete schedule nec form 1040 nr sp tax on income not effectively connected with a u s trade or business spanish version 624654291

Complete Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without holdups. Handle Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version on any device utilizing airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The easiest method to modify and electronically sign Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version effortlessly

- Find Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Formulate your eSignature using the Sign feature, which takes moments and holds the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your preference. Alter and electronically sign Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule nec form 1040 nr sp tax on income not effectively connected with a u s trade or business spanish version 624654291

Create this form in 5 minutes!

How to create an eSignature for the schedule nec form 1040 nr sp tax on income not effectively connected with a u s trade or business spanish version 624654291

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version?

The Schedule NEC Form 1040 NR SP is a specific tax form for non-resident aliens reporting income not effectively connected with a U.S. trade or business. The Spanish version facilitates understanding for Spanish-speaking taxpayers, ensuring compliance with U.S. tax laws. It is crucial for accurately reporting such income to avoid penalties.

-

How does airSlate SignNow help with filing the Schedule NEC Form 1040 NR SP?

airSlate SignNow allows users to effectively fill out, sign, and send the Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version electronically. Our intuitive platform simplifies the process, enabling users to focus on the accuracy of their tax filings rather than the paperwork. You can easily track your documents through our solution.

-

Is there a cost associated with using airSlate SignNow to prepare the Schedule NEC Form 1040 NR SP?

Yes, airSlate SignNow offers a variety of subscription plans tailored to suit different business needs and budgets. Each plan includes access to all features needed to complete the Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version. You can choose the plan that fits your usage frequency and required functionalities.

-

What features are included in airSlate SignNow for managing tax documents?

airSlate SignNow includes features such as eSigning, document templates, real-time collaboration, and secure cloud storage. These tools are essential for ensuring that the Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version is completed accurately and efficiently. Moreover, you'll benefit from automated reminders and tracking for document deadlines.

-

Can I integrate airSlate SignNow with other applications for tax preparation?

Yes, airSlate SignNow offers seamless integrations with several popular tax preparation software and applications. This allows users to manage their data efficiently while working on the Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version. The integrations facilitate easy data transfer, minimizing manual entry for enhanced accuracy.

-

What are the benefits of using airSlate SignNow for non-resident tax filings?

Utilizing airSlate SignNow for non-resident tax filings, including the Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version, provides a streamlined solution. You gain access to validated document templates, straightforward eSigning, and compliance support. This reduces the risks of penalties and ensures smooth submission to the IRS.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, ensuring that all documents, including the Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version, are encrypted and stored securely. We adhere to industry standards and regulations to protect users' sensitive information. This commitment to confidentiality builds trust among our users during tax filing processes.

Get more for Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version

- Gc 399 notice of the conservatees death california courts form

- Defendants request for postponement of traffic court trial formid ri tr01 riverside courts ca

- Marin county superior court telephonic appearance form

- Hc 001 form

- Civil form ch 100 form harassment pdf online

- Tr 25 form

- Harbor newport beach faclility 4601 jamboree rd form

- Ct 9 complaint to the california attorney general regarding a form

Find out other Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple