Schedule NEC Form 1040 NR Sp Tax on Income Not Effectively Connected with a U S Trade or Business Spanish Version 2023

What is the Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version

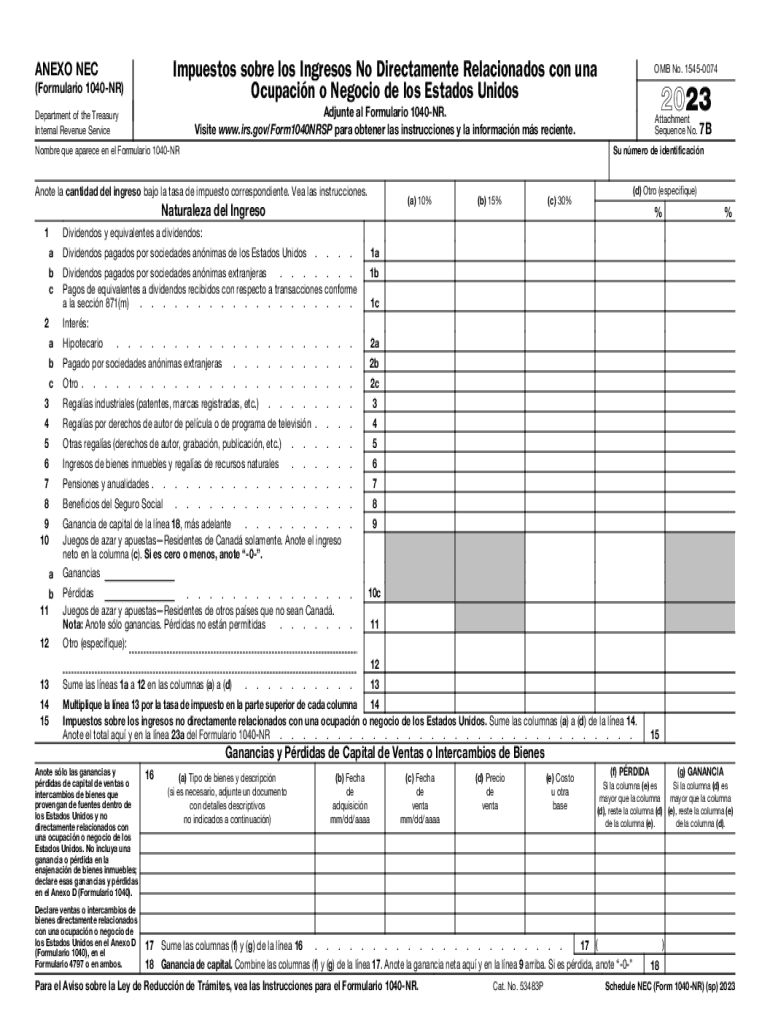

The Schedule NEC Form 1040 NR sp is a specific tax form designed for non-resident aliens who earn income that is not effectively connected with a U.S. trade or business. This form is particularly relevant for individuals who may have income from sources such as dividends, interest, or royalties. The Spanish version of this form ensures accessibility for Spanish-speaking taxpayers, allowing them to accurately report their income and comply with U.S. tax regulations.

How to obtain the Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version

To obtain the Schedule NEC Form 1040 NR sp, individuals can visit the official IRS website or contact the IRS directly for assistance. The form is available in a downloadable PDF format, which can be printed and filled out manually. Additionally, taxpayers may find the form at various tax preparation offices that cater to non-resident aliens, ensuring they have the necessary resources to complete their tax obligations.

Steps to complete the Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version

Completing the Schedule NEC Form 1040 NR sp involves several key steps:

- Gather all relevant financial documents, including income statements and tax identification numbers.

- Fill out personal information, such as name, address, and taxpayer identification number.

- Report all income that is not effectively connected with a U.S. trade or business in the appropriate sections of the form.

- Calculate the tax owed based on the income reported, following the guidelines provided in the form instructions.

- Review the completed form for accuracy before submission.

Key elements of the Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version

The Schedule NEC Form 1040 NR sp includes several key elements that are essential for accurate reporting:

- Identification Information: This section requires the taxpayer's name, address, and taxpayer identification number.

- Income Reporting: Taxpayers must report specific types of income, such as dividends and interest, that are not connected to a U.S. trade or business.

- Tax Calculation: The form provides a method for calculating the tax owed based on reported income.

- Signature: The taxpayer must sign and date the form to certify that the information provided is accurate.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule NEC Form 1040 NR sp. These guidelines outline the types of income that must be reported, the applicable tax rates, and any deductions that may be claimed. Taxpayers should refer to the IRS instructions accompanying the form for detailed information on compliance and reporting requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule NEC Form 1040 NR sp typically align with the general tax filing deadlines for non-resident aliens. It is crucial for taxpayers to be aware of these dates to avoid penalties. Generally, the deadline for filing is April 15, unless an extension is requested. Taxpayers should verify specific dates each tax year, as they may vary.

Quick guide on how to complete schedule nec form 1040 nr sp tax on income not effectively connected with a u s trade or business spanish version

Complete Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version with ease

- Find Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule nec form 1040 nr sp tax on income not effectively connected with a u s trade or business spanish version

Create this form in 5 minutes!

How to create an eSignature for the schedule nec form 1040 nr sp tax on income not effectively connected with a u s trade or business spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version?

Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version is a tax form used by non-resident aliens to report income that is not effectively connected with a U.S. trade or business. This version is specially designed for Spanish-speaking taxpayers, ensuring compliance with IRS requirements while accommodating language needs.

-

How can airSlate SignNow assist me with filling out Schedule NEC Form 1040 NR sp?

airSlate SignNow provides an intuitive platform that can help streamline the process of filling out Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version. You can easily input your information, and with our eSigning feature, you can send documents for signatures quickly and securely.

-

Is there a cost associated with using airSlate SignNow for Schedule NEC Form 1040 NR sp?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. While prices may vary depending on the features you choose, our platform remains a cost-effective solution compared to other document eSigning services, especially for tasks like managing Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow offers a range of features including customizable templates, secure eSignature capabilities, and a user-friendly interface. These features are essential for efficiently handling documents like Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version, making the entire process seamless and effective.

-

Can I integrate airSlate SignNow with other applications I use?

Absolutely! airSlate SignNow offers integrations with various applications such as Google Drive, Dropbox, and CRM systems. This allows you to easily import and export documents related to Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version, enhancing your workflow.

-

How secure is my information when using airSlate SignNow?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption and compliance measures to protect sensitive information, including details found in Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version. You can trust that your data remains confidential and secure.

-

What benefits does airSlate SignNow offer for managing tax documents?

Using airSlate SignNow for managing tax documents like Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version has its benefits. It enhances efficiency by reducing processing time, simplifies eSignature collection, and ensures compliance with tax regulations. This means less hassle and more time focused on your business.

Get more for Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version

- Ndooi 1104 rev2011 form

- Nevada peo registration form

- Ndep 0 report date incident date incident state of nevada ndep nv form

- Employee leasing company peo registration application form

- Form 580 state of ohio agent notification form for unincorported nonprofit association

- City of delaware contractor registration form

- Ohio secretary of state certificate of limited partnership cancellation limited partnership cancellation amendment form

- Form 563

Find out other Schedule NEC Form 1040 NR sp Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure