California Form 3809 Targeted Tax Area Deduction and Credit Summary 2022-2026

Overview of the California Form 3809 Targeted Tax Area Deduction and Credit

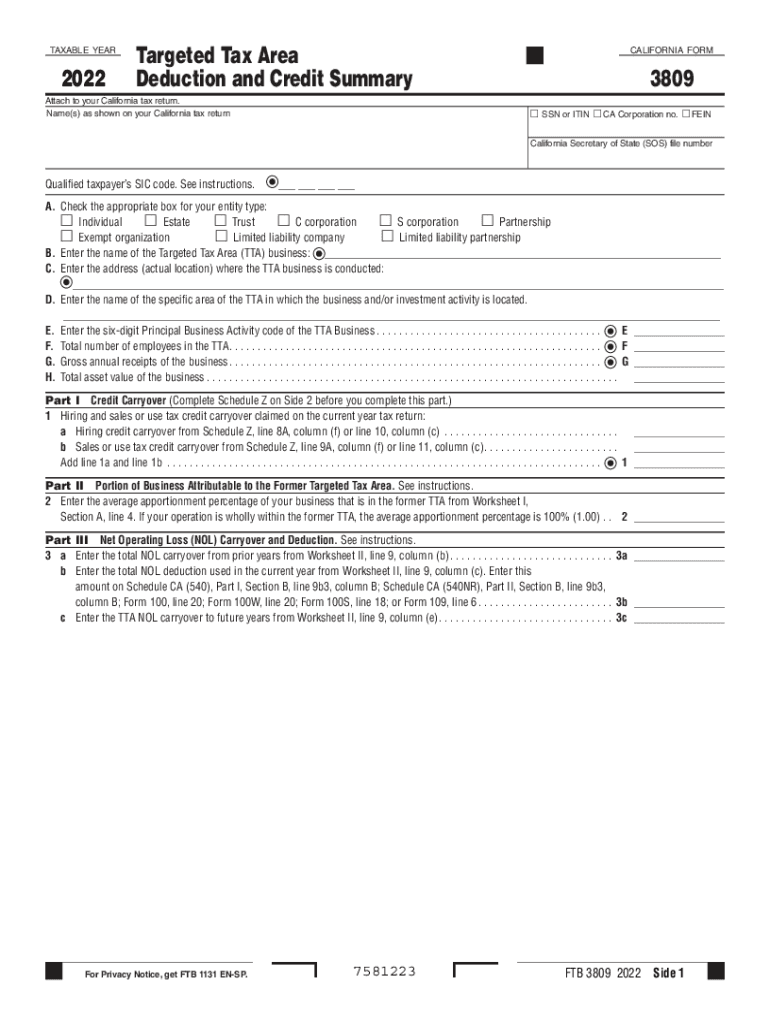

The California Form 3809 is designed to provide taxpayers with a deduction and credit for businesses operating in designated targeted tax areas. This form allows eligible taxpayers to claim benefits that can significantly reduce their state tax liability. The targeted tax areas are identified by the California Franchise Tax Board and aim to encourage economic development in specific regions. Understanding the purpose and benefits of this form is crucial for maximizing potential tax savings.

Steps to Complete the California Form 3809

Completing the California Form 3809 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including financial statements and proof of business operations within the targeted area. Next, fill out the form by providing details about your business, including its location, the nature of operations, and the specific deductions or credits being claimed. It is essential to double-check all entries for accuracy before submission. Finally, submit the completed form to the California Franchise Tax Board by the specified deadline.

Eligibility Criteria for the California Form 3809

To qualify for the benefits provided by the California Form 3809, businesses must meet specific eligibility criteria. Generally, the business must be located within a designated targeted tax area and actively engaged in qualified business activities. Additionally, the business must comply with all local, state, and federal regulations. It is important to review the specific requirements outlined by the California Franchise Tax Board to ensure eligibility before applying for the deductions and credits.

Filing Deadlines for the California Form 3809

Timely filing of the California Form 3809 is essential to avoid penalties and ensure that you receive your deductions and credits. The form must be submitted by the tax filing deadline, which typically aligns with the standard state tax return due date. For most businesses, this is usually April 15 of the following year. However, if you are on an extended filing schedule, be sure to adhere to the extended deadlines as applicable. Staying informed about these dates can help you plan your tax strategy effectively.

Required Documents for the California Form 3809

When completing the California Form 3809, certain documents are required to substantiate your claims. These may include financial records, proof of business location, and documentation demonstrating compliance with the eligibility criteria. Additionally, any supporting materials that detail the nature of your business operations within the targeted tax area should be included. Ensuring that all required documents are prepared and submitted with the form can facilitate a smoother review process by the California Franchise Tax Board.

Legal Use of the California Form 3809

The California Form 3809 must be used in accordance with state laws and regulations governing tax deductions and credits. Misuse of the form, such as falsifying information or claiming benefits without meeting eligibility criteria, can result in significant penalties. It is important for taxpayers to understand their legal obligations when using this form and to maintain accurate records to support their claims. Consulting with a tax professional can provide guidance on the proper use of the form and ensure compliance with legal requirements.

Quick guide on how to complete california form 3809 targeted tax area deduction and credit summary

Complete California Form 3809 Targeted Tax Area Deduction And Credit Summary effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage California Form 3809 Targeted Tax Area Deduction And Credit Summary on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign California Form 3809 Targeted Tax Area Deduction And Credit Summary with ease

- Find California Form 3809 Targeted Tax Area Deduction And Credit Summary and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, laborious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Adjust and eSign California Form 3809 Targeted Tax Area Deduction And Credit Summary and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 3809 targeted tax area deduction and credit summary

Create this form in 5 minutes!

How to create an eSignature for the california form 3809 targeted tax area deduction and credit summary

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 590 form 2025 and why is it important?

The 590 form 2025 is a crucial document for tax compliance that individuals need to file with the Internal Revenue Service. It focuses on withholding exemptions and helps to ensure that the correct amount of taxes are withheld from payments. Understanding the 590 form 2025 is essential for maintaining financial accuracy and compliance.

-

How can airSlate SignNow help with filling out the 590 form 2025?

airSlate SignNow offers an intuitive platform that simplifies the process of completing the 590 form 2025. With features like templates, autofill options, and e-signatures, users can efficiently manage their documentation. This ensures that all necessary information is accurately captured, streamlining the filing process.

-

What are the pricing options for airSlate SignNow when using the 590 form 2025?

airSlate SignNow offers competitive pricing plans that cater to different business needs. Customers can choose from basic to advanced plans, which provide varying features for handling documents including the 590 form 2025. Sign up today to find a plan that best fits your requirements and budget.

-

Can I integrate airSlate SignNow with other software for 590 form 2025 workflows?

Yes, airSlate SignNow supports various integrations with popular business applications, facilitating seamless workflows for managing the 590 form 2025. This allows users to connect with tools like CRMs, email platforms, and more, ensuring a cohesive document management experience.

-

What features does airSlate SignNow offer for managing the 590 form 2025?

airSlate SignNow is equipped with powerful features designed to enhance the management of the 590 form 2025. Users can benefit from document templates, e-signatures, and cloud storage, which provide a comprehensive solution for handling important tax documents securely and efficiently.

-

Is airSlate SignNow secure for handling the 590 form 2025?

Absolutely, airSlate SignNow prioritizes security and compliance when handling documents such as the 590 form 2025. The platform uses advanced encryption techniques and meets industry security standards to ensure that your sensitive information remains protected throughout the e-signature process.

-

What are the benefits of using airSlate SignNow for the 590 form 2025 over traditional methods?

Using airSlate SignNow for the 590 form 2025 eliminates the hassles of paper documents and manual signatures. The platform offers speed, convenience, and accuracy, allowing users to complete and sign documents from anywhere, at any time. This modern approach saves businesses time and reduces errors associated with traditional methods.

Get more for California Form 3809 Targeted Tax Area Deduction And Credit Summary

Find out other California Form 3809 Targeted Tax Area Deduction And Credit Summary

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form